Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 27, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Short sellers cover a fifth of positions in Sanchez Energy as oil price rallies

- Mcdermott International's short interest climbs by 85% in 2015 to date

- Shipping companies feature in top short sales globally as the Baltic Dry index crashes below 1980s crisis levels

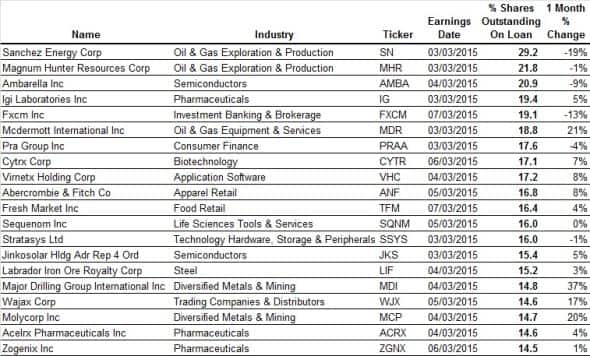

North America

Independent oil explorer and producer Sanchez Energy group is most shorted ahead of earnings this week in North America with 29% of shares out on loan. The developer of unconventional oil and natural gas resources has seen short sellers cover positions; shares out on loan have declined by 19% in recent weeks from highs of 36% at the beginning of February 2015.

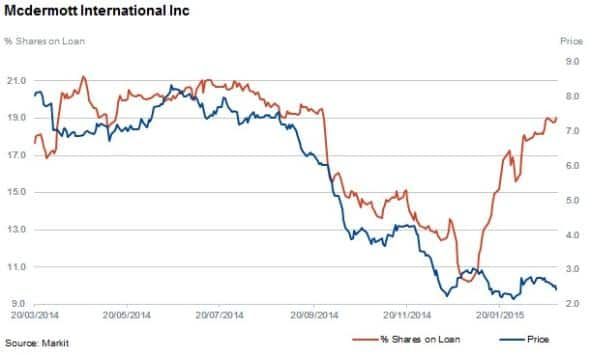

Mcdermott International, an offshore oil and gas infrastructure provider has seen its shares plummet alongside the falling oil price and short sellers have lined up in recent weeks betting against the company's prospects ahead of earnings. Shares out on loan have risen by 85% this year to date reaching 21%.

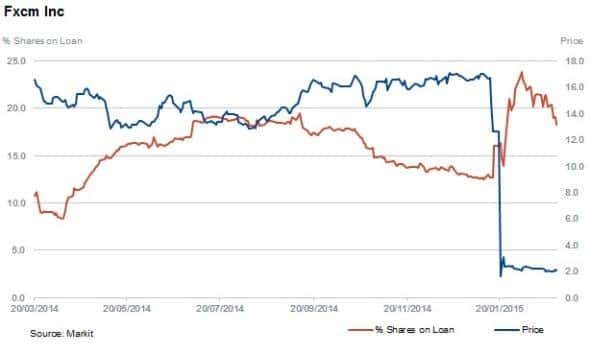

Retail forex brokers suffered in January 2015 when the Swiss Central Bank removed its currency cap. Fxcm and its clients suffered and the company took a $300mn cash injection to avoid breaching capital requirements. The stock has seen some light covering in recent weeks post the share price collapse with shares out on loan currently standing at 18%.

Western Europe

Seeing significant growth in short interest in the last month in Western Europe is Germany's largest private sector real estate company, Deutsche Annington Immobilien (ANN). Shares out on loan have increased by 22% in the last month to reach 12%. Recently listed, and now second largest landlord in continental Europe, has seen its stock rise by 72% in the last 52 weeks and recently announced the acquisition of GAGFAH; increasing its portfolio to 350,000 residential units worth an approximate €11.4bn.

Demark based independent shipping company Dampskibsselskabet Nordern has 6% of shares out on loan. There are mixed expectations across energy shipping and dry bulk haulage sectors, with shipping rates falling amid lower oil prices. The firm has seen shares fall over the last 12 months while short sellers continue to hold positions.

Standard Chartered recently conducted a board room clear out and hired renowned chief executive, Bill Winters. There has been a 136% increase in shares out on loan since the beginning of the year to reach 3.1%.

Sportswear conglomerate Adidas has seen a gradual increase in the level of shorting activity throughout the year. Shares out on loan have reached 5.8%, a 260% increase from 1.6% in March 2014. Markit Dividend Forecasting expects a cut in the dividend from €1.50 as weak golf related sales in 2014, exposure to Russia and a weaker eurozone is expected to have impacted earnings.

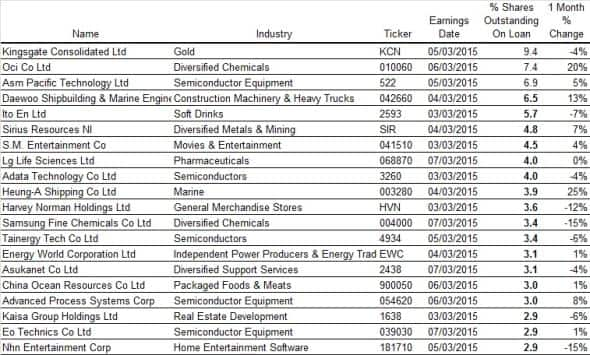

Asia Pacific

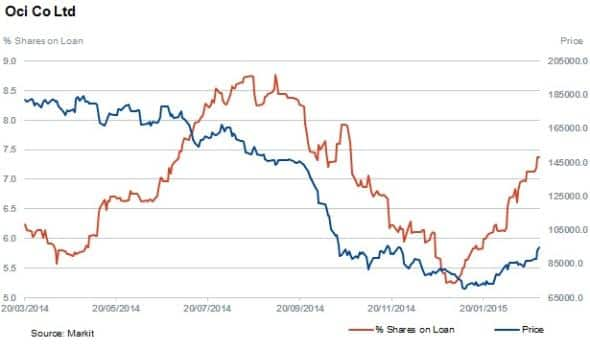

Second most shorted ahead of earnings this week in APAC is Oci Co Ltd. The Seoul based company manufactures a variety of chemical products including polysilicon, the primary raw material used in solar PV panels. Shares out on loan have shot up by 20% in the last month to 7.4%.

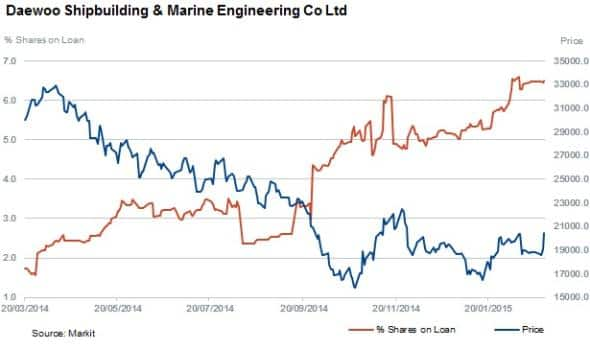

Two shipping shares in APAC are seeing significant increases in short interest, confirming that shipping firms globally are under pressure. Daewoo shipbuilding and Marine Engines shares out on loan has increased by 13% to 6.5%. Heung-A Shipping shares out on loan have increased by 25% to 3.9%.

Bulk shipping rates have continued to fall in 2015 and while Daewoo has seen short sellers increase positions as shares plummet, Heung-A shares have yet to react as shares out on loan continue to edge higher.

Relte Stephen Schutte, Analyst at Markit

Posted 27 February 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}