Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 23, 2015

Tankers bank on contango

Shares of tanker firms have jumped ahead of their shipping peers in recent months as the world gorges on cheap oil.

- Energy shipping firms have outperformed their general shipping peers by 12% over the last three months

- Short sellers have covered one fifth of their positions in the energy shipping sector

- Shipping firms have seen a rise in short interest in the last 12 months as international trade continues to slump

One interesting development in the wake of oil's collapsing price has been the relative resilience seen in the share prices of oil and energy shipping firms. This price stability reflects the buoyant charter rates against which ships are hired out. The rates are driven by global demand as energy importing countries seek to capitalise on the recent price dip to build strategic reserves, as seen in China which recently broke its oil importing record.

Another interesting use driving demand for tankers has been the need for storage to take advantage of the widening contango; the price difference between cash and futures markets. This has seen traders hire out tankers as floating storage as they wait for their trades to mature, helping soak up supply in the market.

Energy shares outperform

This consistent demand has seen energy shipping firms push ahead of their fellow maritime peers in the shipping sector. The 30 such firms with a market cap greater than $200m have returned an average of 14% in the three months since oil prices started to retreat in earnest.

Conversely the rest of the marine universe has only managed to return 2% over the same period of time. Rates on this side of the shipping market have been much less resilient than tanker ones, as evident by the continuing slump in the Baltic Dry index.

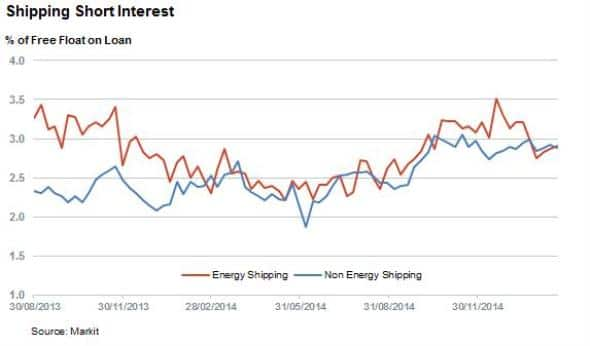

Short sellers cover energy names

The recent strong performance in energy shipping firms has not gone unnoticed by short sellers as average short interest in the sector has declined in recent months. The average share of free float out on loan among energy shipping firms has reduced by 17% in the three months since November. It is likely that short sellers originally targeted the sector as the US' increased domestic production looked set to trim the demand for tanking services.

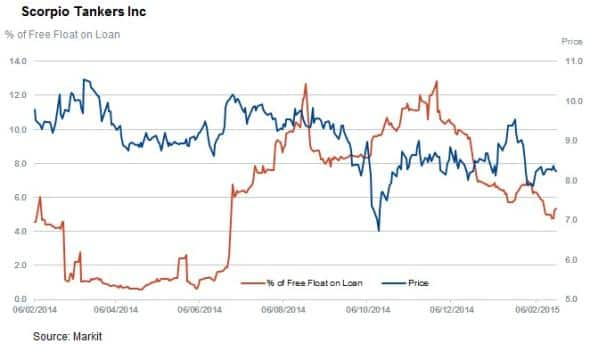

The firms driving this recent trend are Scorpio Tankers whose short interest has halved from its November highs to 5.4% of its free float and Euronav which has seen short sellers cover three quarters of their positions over the last three months.

US listed Nordic American Tanker and Ardmore have also seen significant short covering in the last month, with shorts covering over 2% of the companies' shares since the recent sectors highs in December.

Rest of shipping less bullish

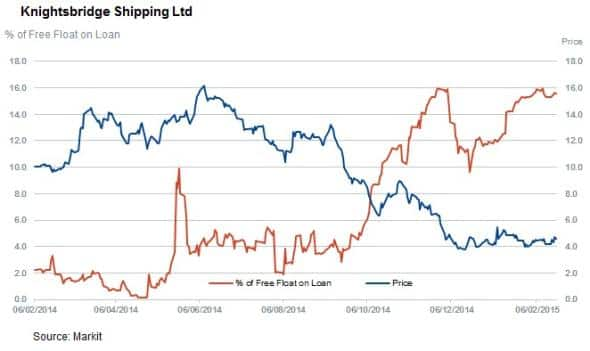

Short sellers have also taken note of the continuing slump in shipping rates as short interest in the rest of the shipping universe has increased to hit a recent high over the last three months. Average demand to borrow now stands at just under 3% of free float in the sector, up from less than 2% in June 2014.

One firm exemplifying this trend is Knightsbridge Shipping which now has a recent high of 10% of its free float out on loan as its shares hover at recent lows.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-Equities-Tankers-bank-on-contango.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-Equities-Tankers-bank-on-contango.html&text=Tankers+bank+on+contango","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-Equities-Tankers-bank-on-contango.html","enabled":true},{"name":"email","url":"?subject=Tankers bank on contango&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-Equities-Tankers-bank-on-contango.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tankers+bank+on+contango http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-Equities-Tankers-bank-on-contango.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}