Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 27, 2016

Uncertainty sees market load up on government bonds

The market's volatile start to the year has seen investors turn to the safety of government bonds in the US and Europe while corporate bond ETFs, both investment grade and high yield, have seen outflows.

- " and $ investment grade corporate bonds returns negative as spreads jump to 2012 levels

- Government bond ETFs have seen $10bn of inflows ytd, with US investors most eager to buy

- Investment grade bonds initially immune to selloff, but the trend has reversed in last two weeks

Continuing worries about the impact of ongoing economic volatility has seen the bond market on both sides of the Atlantic move into full risk off mode over the last fortnight.

The risk perceptions in corporate bonds, as gauged by the benchmark spread in euro and dollar investment grade bonds, had held steady near the levels seen at the start of the year as late as January 10th, but fears around the health of the global economy have seen that measure of market uncertainty surge to levels not seen since 2012.

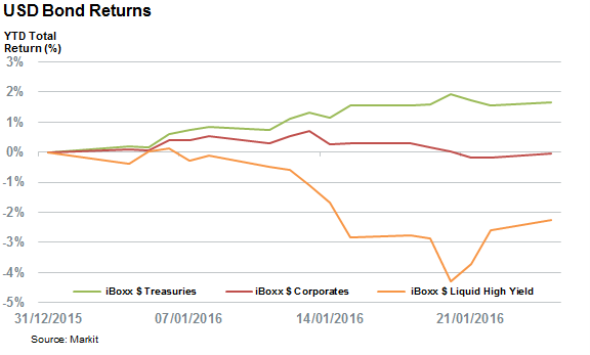

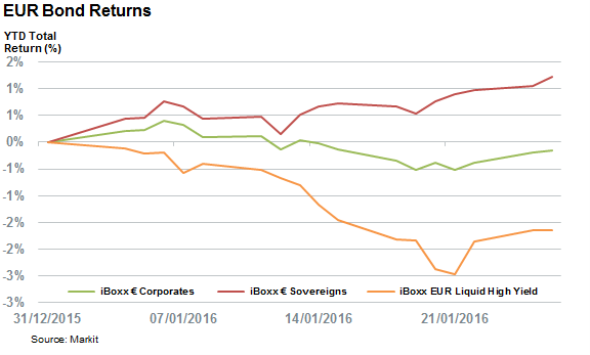

The market's sudden demand for better compensation to hold corporate bonds is filtering through to returns with both euro and US dollar denominated asset classes now in the red for the year. These headwinds contrast with a surging demand for safer government bonds as investors load up on the asset class in anticipation of more accommodative monetary policies from central bankers.

This divergence means that the Markit iBoxx $ Corporates index is now tailing its government peer, the iBoxx $ Treasuries by 1.7% ytd. This trend also holds in Europe with the iBoxx " Corporates lagging the iBoxx " Sovereign peer by 1.4% on a total return basis.

Investors rush to government bonds

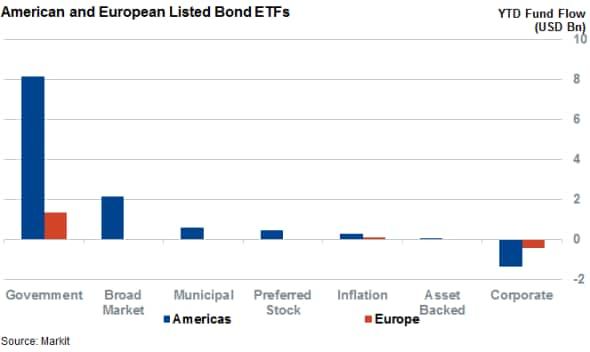

Fund flows in and out of bond ETFs have shown a similar trend in the last couple of weeks as investors sold out of corporate bond funds in order to load up on government bond funds.

According to Markit's ETP service, Sovereign bond funds listed in Europe and America have seen around $10bn of inflows so far in January which puts the asset class on track for its best monthly inflow since February 2014. American investors have proven to be the most eager to ride this trend as the 88 government bond funds listed in the region have taken the lion's share of inflows after attracting $8.5bn of new assets. This represents a significant 13% of the $62bn managed by these funds since the start of the year.

Corporate funds have been on the opposing side of the risk off trend with European funds on both sides of the Atlantic seeing their ytd fund flow tallies turn negative to the tune of $1.7bn.

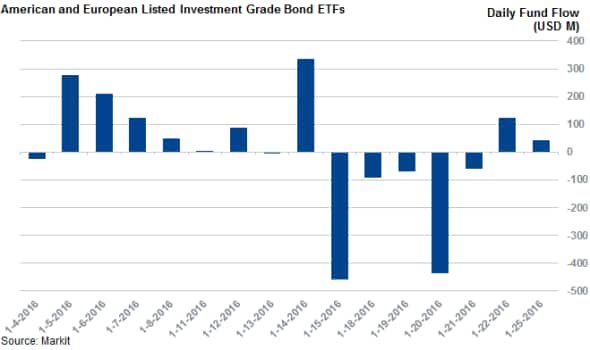

While underperforming high yield bonds have driven that trend, it appears that the investors have increasingly been shunning investment grade bonds in the last two weeks as the asset class has seen $950m of outflows since January 14th. This has nearly erased the $1.06bn of inflows seen by the asset class in the first two weeks of the year just prior to the surge in spreads and ensuing headwinds.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-credit-uncertainty-sees-market-load-up-on-government-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-credit-uncertainty-sees-market-load-up-on-government-bonds.html&text=Uncertainty+sees+market+load+up+on+government+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-credit-uncertainty-sees-market-load-up-on-government-bonds.html","enabled":true},{"name":"email","url":"?subject=Uncertainty sees market load up on government bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-credit-uncertainty-sees-market-load-up-on-government-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Uncertainty+sees+market+load+up+on+government+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-credit-uncertainty-sees-market-load-up-on-government-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}