Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 27, 2016

2015 vintage year for Asian securities lending

As the world turned to Hong Kong to take of view on a slowing China, 2015 proved to be a banner year for Asia's securities lending market.

- Revenues from securities lending activity in Asia were up 21% yoy to a record $672m

- Hong Kong and South Korea were the region's strongest markets in terms of revenue increase

- Shares trading special represent over 80% of the region's stock lending revenues

Last year's volatile Chinese markets offered ample opportunities for Asian short sellers to short shares directly exposed to the country's economic headwinds as well as shares that came under pressure from the country's slowing demand for commodities. Stock borrowing activity in the region surged to multi-year highs with every major market seeing an increase in demand.

The total revenue generated last year by the Asian securities lending industry reflects these dynamics as revenue surged. The industry generated $672m from lending out stocks in 2015 marking a 20% increase above the previous year's tally. This marks the best year on record beating 2012's record of $643m.

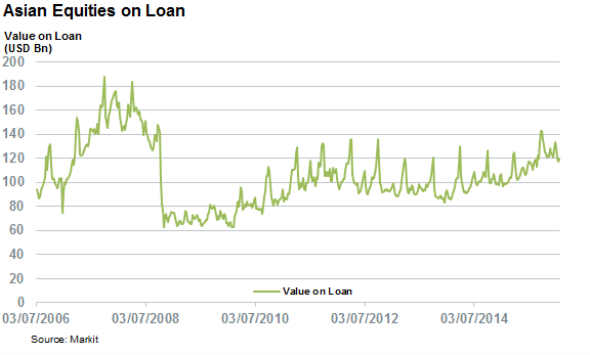

This bumper number was driven mainly by an increase in the value on loan. The average daily value of shares on loan on any given day, at $115bn, represented a 15% increase on the previous year. This signified the largest average daily balance since 2008 when $130bn shares were out on loan on any given day.

Hong Kong and South Korea drive returns

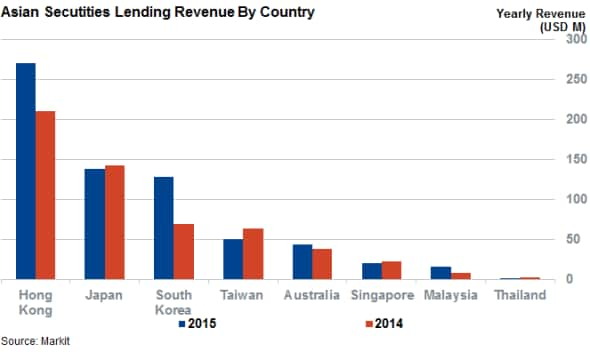

The main drivers of revenue were South Korea and Hong Kong as both markets produced the biggest year on year increase.. While both countries managed to grow their yearly revenues by over $60m last year, the accomplishment is most impressive for South Korea as it represents a doubling of its aggregate annual revenue.

Honk Kong managed to consolidate its position as the most abundant revenue-generating Asian country for the securities lending industry. Its share of the region's total revenue grew to 40% from 38% in 2014. Japan's contribution to the region's securities lending revenue was down by $5m year over year. Its share of Asia's revenue fell by 5% to 21%. Taiwan was another country that failed to match the region's bumper year as its total revenue fell by $12m compared with 2014..

Specials drive revenue

Specials, which are shares trading at more than 150bps, continued to be a key revenue driver. Specials generated over 80% of the region's revenues despite only making up 21% of the balance on any given day.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-Equities-2015-vintage-year-for-Asian-securities-lending.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-Equities-2015-vintage-year-for-Asian-securities-lending.html&text=2015+vintage+year+for+Asian+securities+lending","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-Equities-2015-vintage-year-for-Asian-securities-lending.html","enabled":true},{"name":"email","url":"?subject=2015 vintage year for Asian securities lending&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-Equities-2015-vintage-year-for-Asian-securities-lending.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2015+vintage+year+for+Asian+securities+lending http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012016-Equities-2015-vintage-year-for-Asian-securities-lending.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}