Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 27, 2015

Greek credit troubles so far contained

The credit market’s response has been relatively restrained as radical left party Syriza wins election and promises an end to austerity.

- Corporate credit was the most affected by the recent election with banks widening significantly

- Contagion to peripheral Eurozone countries limited

- Greek bonds are torn between possible election fallout and the recent ECB action and are currently trading with a lower yield than at the start of the year

Economic and political commentators across the globe have focused on Greece as voters took to the polls in what was one of the most hotly anticipated elections of recent years. The victory of left wing Syriza brings a new era of uncertainty to the Greek economy, and European investors.

Depositors flee banks

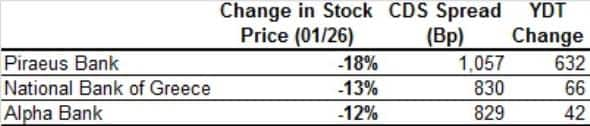

Stock markets in Athens experienced huge declines and volatility after Syriza’s bigger than expected win, halting Europe’s ECB driven rally. Banks in particular were hit hard, with three of Greece’s systemic banks posting one day declines of over 10%, as depositors fled to safer eurozone banks to protect themselves from any potential Grexit instability.

Credit markets signalled heightened risk as 5 year CDS spreads widened to highs not seen since 2013, but much of this default risk has already been priced in since the beginning of January. All three banks trade upfront, an indicator of distress in the CDS market. Piraeus Bank has been trading the highest at 18.93 points upfront, although on very thin liquidity.

Sovereign Credit sees no contagion

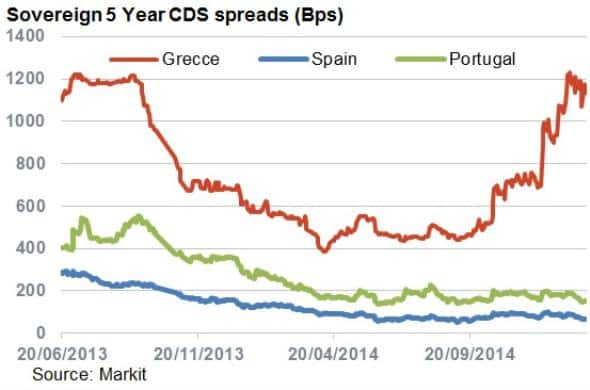

Peripheral Sovereign CDS spreads widened on the back of the election news, with Italian and Portuguese spreads hitting intraday levels of 102bps and 167bps, before settling flat for the day at 88bps and 151bps respectively.

This was a possible reaction to the better than expected winning margin for the Syriza, an example of mixed emotions in the market. The win also raises the prospects of anti-austerity parties in the eurozone gaining traction, particularly in other austerity hit countries such as Spain. Credit markets don’t look to have been pricing this in.

Much of the credit risk was assumed for Greece over the last few months, and the country remains an outlier against its peripheral eurozone peers such as Spain.

Bonds stay flat but risks remain

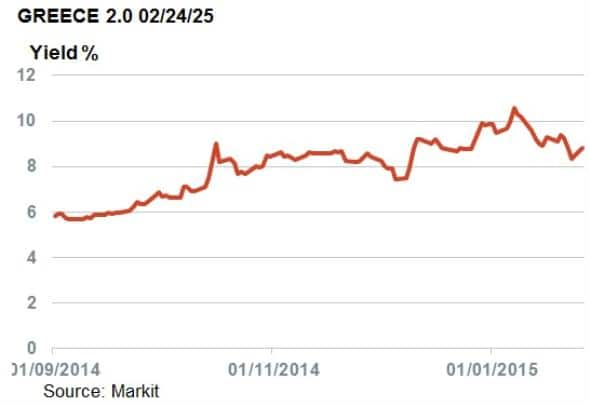

Bond markets reacted sharply to the Syriza win, with bunds rallying before losing ground in on Monday afternoon as market reaction subdued. The 10 year bund (0.5% 2025) hit an intraday low yield of 0.355%, the lowest recorded yield ever, before ending the day up 4bps.

The Greek 10 year bond (2% 2025) ended the Monday trading with a yeild 8.84%, 50bps higher than close last Friday, but below the 10% levels seen earlier this January. The relief provided at the end of last week by the ECB’s QE decision to was short lived as yields crept back up. Yields remain flat on Tuesday morning, a sign of further calm.

Overall bond markets reacted relatively flat to the news. But the broader market indicates that Greece remains a delicate and uncertain proposition for investors, and not just in the short term.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Credit-Greek-credit-troubles-so-far-contained.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Credit-Greek-credit-troubles-so-far-contained.html&text=Greek+credit+troubles+so+far+contained","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Credit-Greek-credit-troubles-so-far-contained.html","enabled":true},{"name":"email","url":"?subject=Greek credit troubles so far contained&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Credit-Greek-credit-troubles-so-far-contained.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+credit+troubles+so+far+contained http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Credit-Greek-credit-troubles-so-far-contained.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}