Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 26, 2015

European banks lag US peers on dividends

US banks have bounced back from the post-crash lows, while their European peers are still struggling to return to pre-crisis payout levels.

- European banks have trailed US banks by 40% on a total return basis since 2008

- Markit Dividend Forecasting expects US banking dividends to increase by 11% in 2016

- European banks expected to post a 1% decline in payments due to regulatory headwinds

For the full report on US and European banking sector dividends, please contact us.

Charting quantitative easing

With Europe's version of quantitative easing well underway and the near term prospect of tighter monetary policy in the US, the performance of the banking sector since the crisis clearly shows the outperformance of institutions in the US versus Europe.

Using the SPDR Financial Select Sector ETF (XLF) as a proxy, the US banking sector is now back in profit on a total return basis. Despite taking seven years, the ETF is now above levels last seen prior to January 2008.

The same cannot be said for the European banking sector as the Lyxor UCITS STOXX Europe 600 Banks ETF (BNK) is still down by 50% from the levels seen at the start of 2008. While both XLF and BNK fell to similar lows during the crisis, the performance of the two funds decoupled five years ago as European banks remained stuck in a sideways trend over that period.

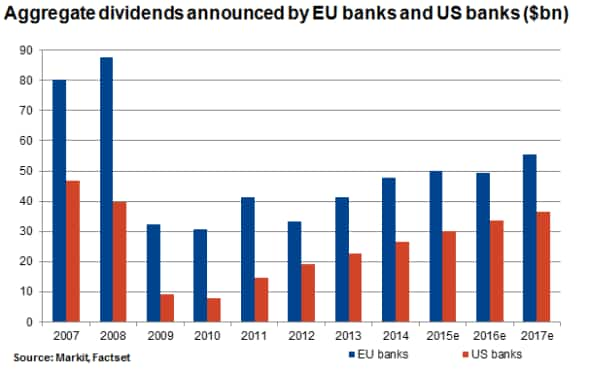

This performance divergence is also reflected in the dividends paid by the two region's banks.

US banking dividends recover

While still 36% below peak aggregate dividend levels attained in 2007, the US banking sector has recovered much more strongly than its European counterpart. 24 banks in the US are now paying higher dividends than in 2009; a feat that is only achieved by only seven of their European peers (out of the 46 biggest banks selected in each region).

Aggregate dividends announced by EUbanks and US banks ($bn)

More stringent capital ratio requirements and regulatory costs have hampered European banking dividend growth. A key difference impacting the different dividend trajectories is prior significant cuts made to US dividends during the financial crisis compared to European banks. US banks have subsequently increased dividends every year since 2011.

Wells Fargo takes top spot

Since 2007 the top three US dividend paying banks have been responsible for over 50% of sectors payments, although the firms making the top three lists have shifted over time. The current top payer is Wells Fargo, driven by the fact that the company has consistently increased its dividend payments since the crash in 2008.

Wells Fargo, Prudential Financial and Goldman Sachs have also helped boost the sector's payments as these institutions have been responsible for the largest increases in dividends since 2007.

The total has also been boosted by small and mid-sized regional banks as these institutions have more than doubled their aggregate payments 2007.

Citigroup stands on the other side of the trend as the firm's current dividend policy means that its latest announced dividend payment represents a paltry 5% of 2007 levels. Bank of America is another dividend disappointment, as the former top payer's current dividends represent just one-fifth of the 2007 levels.

Looking forward, the sector's dividend growth is expected to continue as aggregate payments are forecast to grow by 12% next year to an aggregate $33.6bn.

Europe

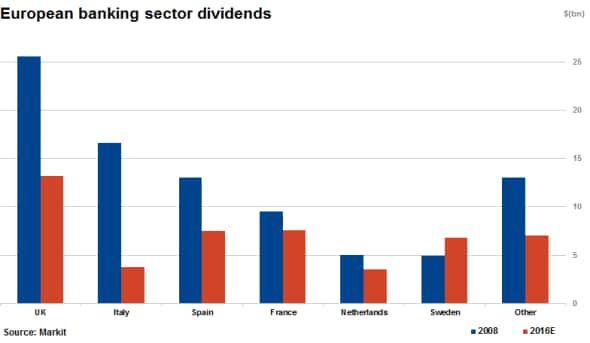

While the majority of US banks are now paying dividends above crisis levels, this feat is only forecast for just seven out of the 46 banks in Europe in 2016. This means that aggregate dividend payments are set to be 43% lower in the current fiscal year than their peak in 2008.

The outlook for European banking dividends is more mixed as the region's banks are actually forecast to cut their payments by 1% on aggregate in the coming fiscal year. Among eight banks not expected to announce any dividends in 2016 are Standard Chartered, RBS and Deutsche Bank.

On a country level, only Swedish banks have managed to boost their aggregate payments while the rest of the region's banks will make a lower payment in 2015 than the 2008 peak.

The most disappointing country in terms of bank dividends has been Italy as the country's banking dividends have collapsed from $16.6bn in 2008 to forecasted total of just $3.8bn in 2016.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-equities-european-banks-lag-us-peers-on-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-equities-european-banks-lag-us-peers-on-dividends.html&text=European+banks+lag+US+peers+on+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-equities-european-banks-lag-us-peers-on-dividends.html","enabled":true},{"name":"email","url":"?subject=European banks lag US peers on dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-equities-european-banks-lag-us-peers-on-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+banks+lag+US+peers+on+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-equities-european-banks-lag-us-peers-on-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}