Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 26, 2015

Opposing Euro/US policy and the UK conundrum

UK Gilts yield have largely tracked their US peers over the last three years, but recent dovish tones from UK policy makers has seen that trend decouple.

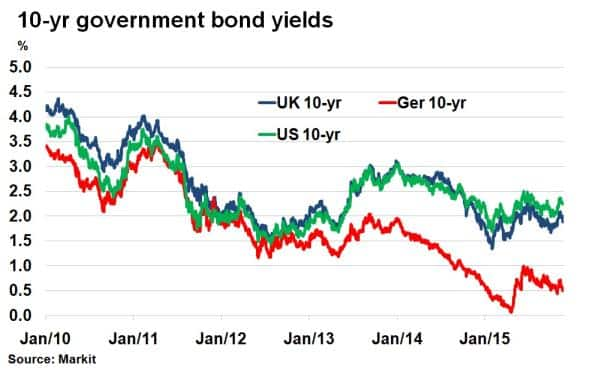

- UK and US 10-yr benchmark government bond yields decoupled from bunds in 2012

- The basis between UK and US 10-yr notes at recent lows after dovish tones form BoE

- ETF investors have sold out of Gilts despite prospect of continuing low interest rates

Post 2008, the UK along with the US has led the economic recovery in the developed world. Having set aggressive monetary policy to stimulate growth earlier than peers, both economies have seen unemployment tumble and GDP growth pickup over recent years. While deflationary pressures remain a worry, they are expected to be transient, leaving the door open for both the US and UK to lead the normalisation in monetary policy.

The close relationship between the UK and the US is evident in 10-yr government bond yields. According to Markit's bond pricing service, the yield difference between the two rates has stayed within a 0.7% absolute range over the past 5 years. In contrast German 10-yr Bund yields, which have also held a close relationship, veered off in 2012 as inflation and GDP expectations tumbled in the wake of European debt crisis, with investors pricing in the need for aggressive monetary policy from the Europeans. This divergence in monetary expectations put yields in the eurozone and the UK/US on diverging paths.

UK dilemma

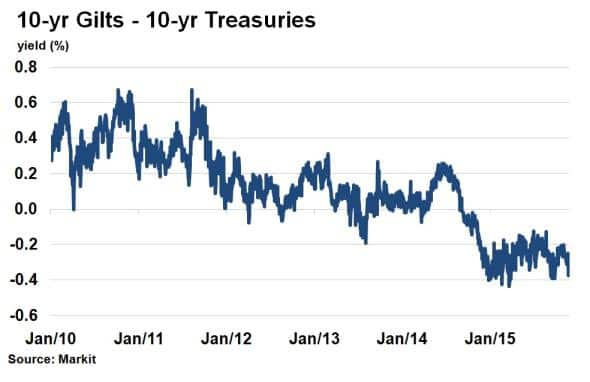

But while the UK has closely followed in the US's footpath, the yield difference between the government bonds of the two nations has been diverging recently.

UK gilt 10-yr bonds have been yielding less than US counterparts since August last year, and have continued the downward momentum suggesting that the UK is starting to lag its US peer who look set to hike interest rates in December. The yield difference reached -37bps as of November 20th, a nine month wide.

In fact, BoE Governor Mark Carney stated in his address to MP's this week that interest rates are set to remain low for some time. While global macroeconomic shocks like the one seen over the summer have no doubt played a part in this decision, continued Eurozone monetary easing will play a bigger part in the eventual decision to raise UK benchmark rates. The Eurozone is responsible for around 40% of the UK's exports and a raise in the UK rates will see the pound strengthen which in turn could see UK exporters lose their competitive edge with continental competitors.

The dilemma faced by rate setters was also made evident earlier this month when Carney stated that he was looking at ways to make it harder for UK banks to extend credit in order to cool the rapidly heating UK housing market. This would usually be achieved with a rate rise.

The US economy on the other hand is much more closed and much less exposed to such factors so its policy makers have less foreign exchange risk to worry about.

Investor flows

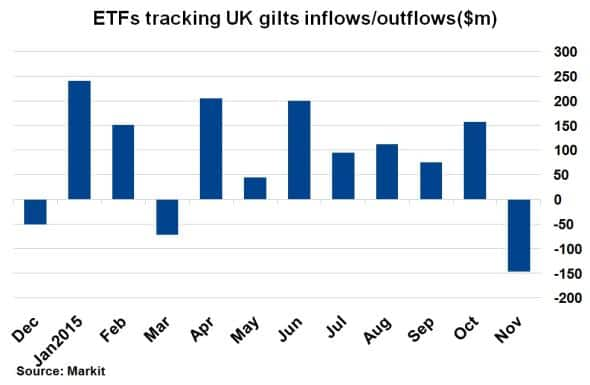

Despite the rhetoric coming from the BoE, ETF investors have fled UK government bonds recently. As rate raises loom, bond yields are expected to rise, suppressing bond prices and subsequently returns. ETFs tracking UK government bond indices have seen $146m of net outflows this month, the highest amount in 2015. This is despite the fact that gilts now offer an attractive yield when compared to the rest of the region's sovereign bonds and the prospects of the rate rise looks to be off the table for the near term.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-Credit-Opposing-Euro-US-policy-and-the-UK-conundrum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-Credit-Opposing-Euro-US-policy-and-the-UK-conundrum.html&text=Opposing+Euro%2fUS+policy+and+the+UK+conundrum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-Credit-Opposing-Euro-US-policy-and-the-UK-conundrum.html","enabled":true},{"name":"email","url":"?subject=Opposing Euro/US policy and the UK conundrum&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-Credit-Opposing-Euro-US-policy-and-the-UK-conundrum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Opposing+Euro%2fUS+policy+and+the+UK+conundrum http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112015-Credit-Opposing-Euro-US-policy-and-the-UK-conundrum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}