Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 26, 2014

US growth revised up

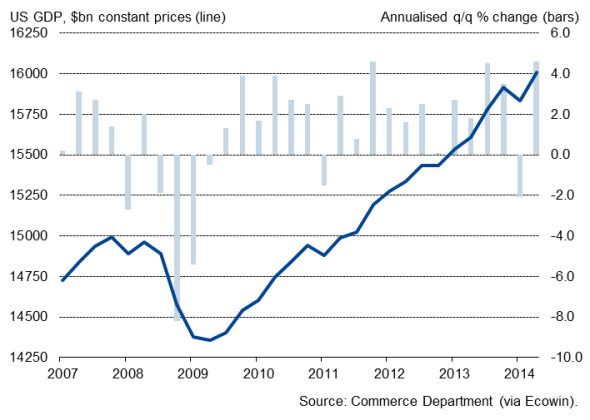

The US economy grew faster than previously thought in the second quarter, according to revised official data, expanding at the steepest rate since the fourth quarter of 2011. Gross domestic product increased at an annualised rate of 4.6% in the three months to June, up from a prior estimate of 4.2% and a welcome revival from the 2.1% decline seen in the first three months of the year. In quarterly terms, the economy grew 1.1%, having contracted 0.5% in the first quarter.

The data signal an even stronger rebound from the decline seen in the first quarter, when extreme weather battered many parts of the economy. However, the impressive gain in the second quarter looks to be far more than just a weather-related upturn, with evidence pointing to an underlying buoyant pace of economic expansion. Survey data in particular indicate that strong growth has persisted throughout the third quarter. Markit's flash PMI data for September rounded off the best quarter of business activity growth seen since the financial crisis.

A further rise in retail sales and upbeat consumer confidence data also indicate that the economy maintained strong momentum in the third quarter. Although official factory output data have been somewhat mixed and non-farm payroll growth slowed to an eight-month low in August, the overall picture, based on a model of all the available official and survey data, is of an economy growing at an annualised rate of around 3.0% in the third quarter.

GDP recovery

Broad-based upturn

In the detail of the second quarter GDP update, the upturn was driven by personal consumption, alongside stronger than previously thought upturns in exports and non-residential investment. Increases in inventories, the housing market and government spending also helped buoy the economy.

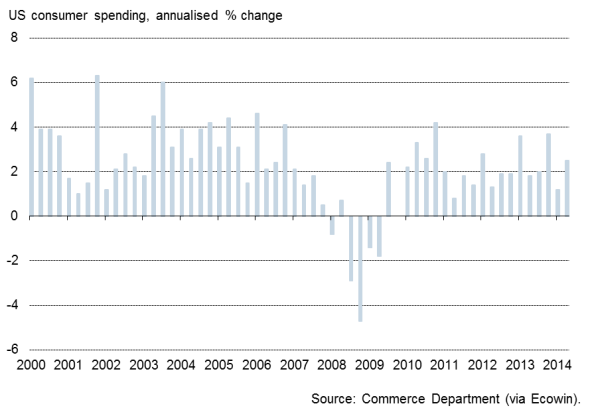

Consumer spending

Personal consumption increased at an annualised rate of 2.5%, up from 1.2% the first quarter, boosted by a 14.2% increase in spending on durable goods.

Non-residential investment surged by 9.7%, compared to 1.6% in the first three months of the year, and exports were up 11.1%, recovering from a 9.2% drop in the first quarter.

By sector, the 1.1% quarterly rise in GDP was aided by service sector output edging 0.2% higher than the first quarter, alongside a 2.8% rise in construction output and a 2.7% jump in goods production.

Policymakers split on rate outlook

On one hand, with the economy growing at this pace, it seems likely that wage growth will continue to improve. This would add further fuel to expectations that the Fed could move sooner than mid-2015 in taking the first step in raising interest rates, led by calls from Fed officials Bullard and Fisher. After all, US GDP is now 6.8% larger than its pre-crisis peak, a recovery that sits in stark contrast to the UK, where GDP has only just risen above pre-crisis levels, and the eurozone, where the economy remains 2.4% smaller than before the crisis struck.

On the other hand, even with wage growth and inflation picking up, some policymakers such as Dudley and Evans are veering towards allowing the economy to 'run hot', fearing an early hike in interest rates carries a greater risk of hurting the recovery than any damage that future inflation from loose policy could cause.

The most likely scenario therefore seems to be that rates are likely to stay on hold until mid-2015, with the Fed tolerating above-trend economic growth to help heal the labour market, but any marked upturns in the inflation outlook could mean the hawks carry a louder voice. Next week's employment report will therefore be scoured for detail on any signs of wage growth accelerating in particular.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-economics-us-growth-revised-up.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-economics-us-growth-revised-up.html&text=US+growth+revised+up","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-economics-us-growth-revised-up.html","enabled":true},{"name":"email","url":"?subject=US growth revised up&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-economics-us-growth-revised-up.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+growth+revised+up http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-economics-us-growth-revised-up.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}