Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 26, 2016

Week Ahead Economic Overview

The release of worldwide manufacturing PMI results will provide analysts around the globe with important information on economic trends midway through the third quarter, while the latest set of US non-farm payroll numbers will be closely watched by Fed policy makers. Meanwhile, inflation and unemployment figures are updated in the eurozone.

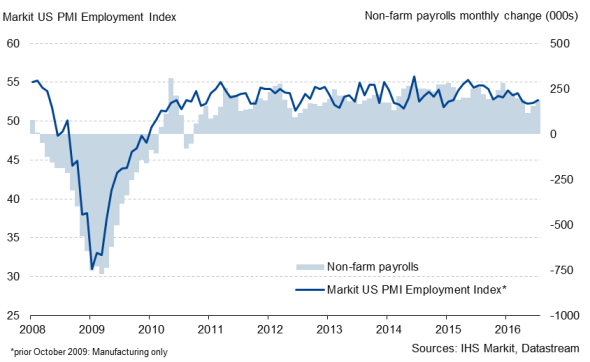

Although it is unlikely that the Fed will raise interest rates at their September meeting, a hike later in the year remains a possibility. Much depends on the data flow in coming weeks and months, with the release of non-farm payroll numbers of particular interest. The US job market smashed expectations for a second month running in July and the latest PMI results from IHS Markit point to non-farm payrolls rising by 130k in August.

US non-farm payrolls and the PMI

Although growth of business activity failed to accelerate in August, according to the US PMI results, there was some anecdotal evidence that growth is being dampened by uncertainty around the upcoming presidential election. Therefore there remains a case for the economy to pick up speed again after the election, adding to the case for a rate hike later this year. Data watchers will also keep an eye on latest consumer confidence, factory orders and mortgage data.

Over in the eurozone, Eurostat will provide updates on latest labour market and price trends. Although unemployment remained at its lowest in almost five years in June, there is still a significant regional divide, with double-digit jobless rates across the south of the euro area contrasting with low unemployment in countries such as Austria and Germany. Official figures for July are published on Wednesday.

Inflation numbers are also out during the week and, although official data signalled a 0.2% rise in consumer prices in July, latest PMI results point to a lack of inflationary pressures, with selling prices falling further. If this trend persists in coming months, and economic growth remains subdued, policymakers may well keep the door open for further stimulus later in the year. Other important releases for the currency bloc include final PMI data, which will include more national detail.

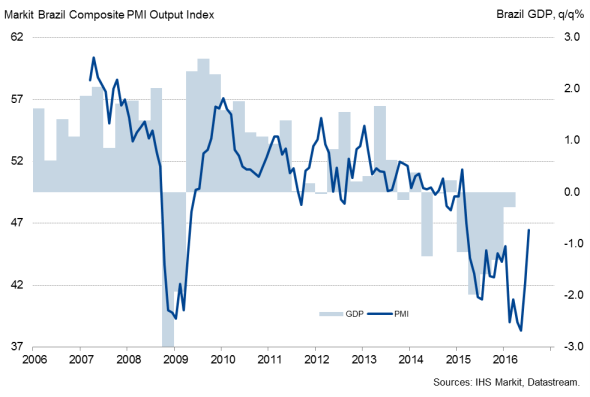

Elsewhere in the world, Brazil and India see the release of second quarter GDP numbers. It looks unlikely that the run up to the Olympics boosted growth in South America's largest country and the PMI has now posted below the neutral 50.0 mark for nearly one-and-a-half years. We therefore expect that the official data will confirm signals from the PMI and will show a further contraction of the economy in the second quarter. IHS Markit currently predicts a 3.1% decline in Brazilian GDP for 2016.

Brazil GDP and the PMI

The Reserve Bank of India left its main interest rate unchanged at its August meeting, but Governor Rajan said that "The stance of monetary policy remains accommodative." It is widely expected that the Indian economy continued to grow sharply in Q2 and the latest IHS Markit forecast predicts growth of 7.5% for 2016 as a whole.

Further insights into global economic trends in the third quarter are meanwhile provided by PMI results. In July, the global PMI reached a three-month high on the back of stronger emerging market growth. However, the underlying trend remained subdued. Of particular interest will be the first release of the new Nikkei ASEAN PMI, which includes national data from seven countries that account for roughly 98% of the region's GDP.

Monday 29 August

In Germany, import price and retail sales figures are released.

Italy sees the release of business and consumer confidence data.

Budget balance numbers are meanwhile issued in Brazil.

Updated personal income data are out in the US.

Tuesday 30 August

Household spending, retail sales and unemployment data are all updated in Japan.

Economic sentiment numbers are issued in the eurozone, while Germany and Spain see the publication of preliminary inflation figures for August.

Meanwhile retail sales numbers are released in Italy.

The Bank Austria Manufacturing PMI is out.

The Bank of England publishes mortgage data for the UK.

Jobless and inflation figures are updated in Brazil.

In Canada, current account and producer price numbers are out.

Consumer confidence numbers are issued in the US alongside the latest Case-Shiller Home Price Indices.

Wednesday 31 August

Japan sees the release of construction orders, housing starts and industrial production figures.

Second quarter GDP data and M3 money supply information are published in India.

M3 money supply data are also released in South Africa, with trade balance numbers also out.

Latest GDP figures are issued in Nigeria.

Unemployment and flash inflation numbers are published by Eurostat for the currency union.

Labour market data are released in Germany and Italy, while France updates its consumer spending and producer price figures.

In Spain, current account numbers are updated.

GfK consumer confidence and Nationwide house price data are issued in the UK.

Brazil and Canada see the release of second quarter GDP figures.

ADP national employment and mortgage data are out in the US.

Thursday 1 September

Manufacturing PMI results are published worldwide, including the new Nikkei ASEAN Manufacturing PMI.

Retail sales data and the latest AIG Manufacturing Index are released in Australia.

Brazil's Central Bank announces its latest monetary policy decision. Moreover, the country sees the publication of producer price and trade numbers.

The US sees the release of initial jobless claims and revised productivity data.

Friday 2 September

In Japan, consumer confidence numbers are updated.

Producer price figures are released in the euro area.

Final second quarter GDP data are meanwhile out in Italy.

August's UK Construction PMI is released.

Industrial production numbers are published in Brazil.

Canada sees the release of trade figures.

Non-farm payroll and factory orders data are issued in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}