Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2016

New PMI survey data signal welcome steadying of ASEAN manufacturing

IHS Markit expects the Asia Pacific region (excluding Japan) to enjoy the strongest economic growth of all regions over the next decade, within which a key role will be played by the Association of Southeast Asian Nations (ASEAN) countries. The newly launched Nikkei ASEAN PMI, compiled by IHS Markit, will therefore provide an important source of timely information on this high-profile region.

IHS Markit economic growth forecasts

Source: IHS Markit.

Manufacturing stabilises

The ASEAN Manufacturing PMI" (Purchasing Managers' Index") is produced by IHS Markit on behalf of Nikkei and is based on original survey data collected from around 2,100 manufacturing firms. National data are included for Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Taken together, these countries account for an estimated 98% of ASEAN manufacturing activity.

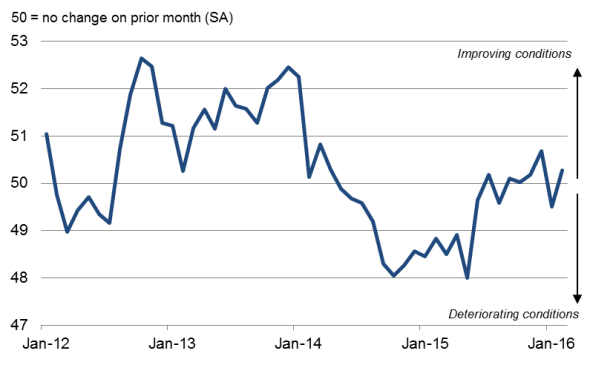

Nikkei ASEAN Manufacturing PMI

Sources: Nikkei, IHS Markit.

At 50.3 in August, up from July's 49.5, the PMI signalled a fractional improvement in operating conditions after a slight deterioration in July. Importantly, the latest reading was the second-highest since late-2014, falling just shy of June's recent peak, and represents a significant improvement on the decline signalled throughout much of last year.

The principal factor supporting the headline index was a rise in new order intakes. Rebounding from last month's decline, incoming new business rose at the second-fastest pace in 23 months, helped by a welcome stabilisation of export orders. The surveys have shown ASEAN exports to have been in almost continual decline for more than two years, largely reflecting slower economic growth in major export markets such as China, Japan, the US and Europe.

Despite signs of business conditions stabilising, producers across the region cut employment for a second successive month, with the rate of decline hitting the fastest since last December though remaining very modest. The drop in employment nevertheless reflects widespread cost consciousness and a desire to boost productivity in the face of sluggish demand.

Philippines heads ASEAN growth ranking

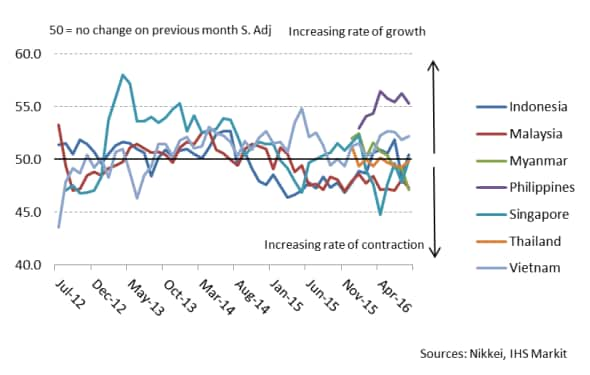

The steadying of business conditions was by no means broad-based, however. Strong growth continued to be recorded in the Philippines, as has been the case throughout the year to date, with a more modest but still robust pace of expansion seen in Vietnam. Both countries saw exports playing a key role in stimulating growth. Indonesia meanwhile saw a marginal return to growth after posting a decline in July.

Nikkei National Manufacturing PMI

Singapore also saw a steadying of business conditions, ending a six-month period of decline, despite reporting an ongoing steep downturn in export trade.

In contrast, Malaysia, Thailand and Myanmar all saw business conditions deteriorate in August, with the latter seeing the steepest decline.

At the mercy of global demand

The new PMI data therefore paint a picture of a region that is showing signs of reviving after the soft patch seen in 2015, though with a varied performance by country as a result of weak global demand so far in 2016. With the global PMI indicating still subdued worldwide GDP growth in July, ASEAN manufacturers still need to see global demand pick up in the second half of 2016 before production growth is likely to accelerate meaningfully.

Further information

The Nikkei ASEAN PMI data, and the national constituents, are published by IHS Markit on the first working day of every month and can be obtained by contacting economics@ihsmarkit.com.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-New-PMI-survey-data-signal-welcome-steadying-of-ASEAN-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-New-PMI-survey-data-signal-welcome-steadying-of-ASEAN-manufacturing.html&text=New+PMI+survey+data+signal+welcome+steadying+of+ASEAN+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-New-PMI-survey-data-signal-welcome-steadying-of-ASEAN-manufacturing.html","enabled":true},{"name":"email","url":"?subject=New PMI survey data signal welcome steadying of ASEAN manufacturing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-New-PMI-survey-data-signal-welcome-steadying-of-ASEAN-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+PMI+survey+data+signal+welcome+steadying+of+ASEAN+manufacturing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-New-PMI-survey-data-signal-welcome-steadying-of-ASEAN-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}