Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 26, 2015

Short sellers get crafty in beer

The weaker macroeconomic outlook has intensified the battle of the brewers from both ends of the market with short sellers targeting the mid-range breweries which are less diversified and not able to fend off fast growing minors and acquisitive majors.

- Short sellers have tripled their positions in brewers Carlsberg and Molson Coors

- Boston Beer currently the most short sold brewery worldwide

- Craft Brew Alliance not craft enough for the US consumer and sees sales fall

A perfect storm has brewed

Global breweries have come off the boil in the last few years dealing with saturated developed markets, waning consumer demand and feisty craft brewers taking hefty slices of market share.

Recent growth for the major brewers has come mostly through frontier markets and consolidation. Weaker than anticipated results in emerging markets however has spoiled short term prospects of the former leading to some speculation that major brewers could again turn to consolidation to return to growth.

With healthy margins and generally strong cash flows, Markit Dividend Forecasting is expecting moderate dividend growth across the major brewers albeit at a lower pace than that seen last year.

Cheaper Carlsberg under pressure

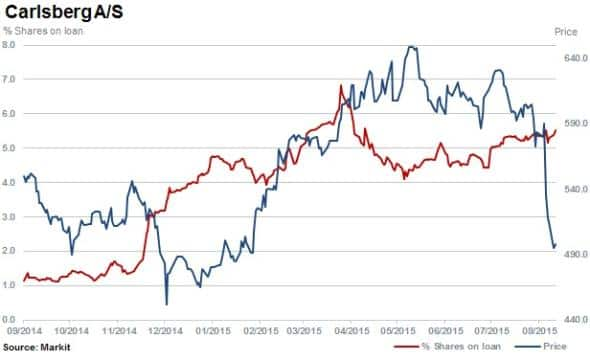

The growth pitfalls faced by the industry were evidenced recently when Danish based brewer Carlsberg fell by 21% over the last month as the brewer guided earnings lower on tepid eastern European sales and Russian sales exposure which along with a weaker euro impacted results. Better positioned premium branded competitor Heineken however was able to post reasonable growth in the region.

Short sellers look to have profited from the recent fall in Carlsberg. Short interest increased by threefold over the last year with shares outstanding on loan rising to 5.1% before the fall. Short interest currently still stands high at 5.5%. The current short interest is over three times the level seen 12 months ago.

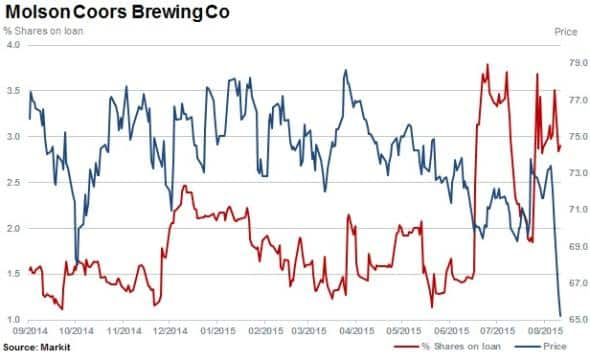

Shares in US brewer Molson Coors have drifted lower over the last 12 months with short interest doubling to 3.7% prior to a 12% drop in the share price in recent weeks. Like its Danish listed peers, short sellers have since trimmed positions to 2.9% of shares outstanding on loan.

Crafty shorts

The superior ability of larger well capitalised players to acquire and leverage successful brands of smaller breweries to drive growth should concern the larger less diversified craft brewers whose sales are beginning to stagnate.

Posting hefty annual double digit volume growth, smaller brewers like Camden Town and Brewdog have been able to carry out successful crowd funding campaigns recently to continue to fund growth.

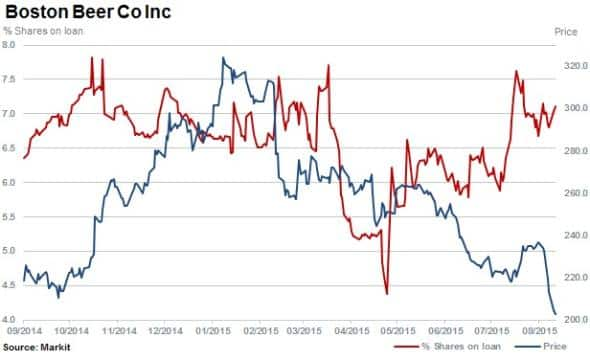

To this end, short sellers have targeted stalwart craft brewer Boston Beer with 7.1% of shares currently outstanding on loan. The Stock has had a tumultuous 12 months of trading reaching an all-time high in January 2015 and subsequently falling 37%. The stock continued to fall after the company guided for a flat outlook for 2015.

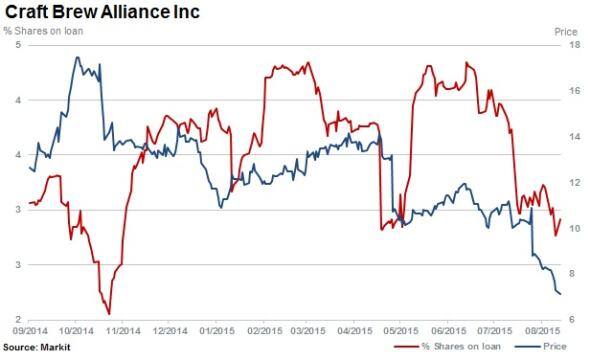

Shares in Craft Brew alliance have almost halved in the last 12 months while short sellers have profited handsomely. Short interest peaked at 4.7% of shares outstanding on loan and currently stands at 3.1%.

Boston Beer and Craft Brew are faced with a similar problem to the major brewers; small independent breweries whose production growth continues to out outpace the rest of the industry.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082015-Equities-Short-sellers-get-crafty-in-beer.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082015-Equities-Short-sellers-get-crafty-in-beer.html&text=Short+sellers+get+crafty+in+beer","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082015-Equities-Short-sellers-get-crafty-in-beer.html","enabled":true},{"name":"email","url":"?subject=Short sellers get crafty in beer&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082015-Equities-Short-sellers-get-crafty-in-beer.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+get+crafty+in+beer http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26082015-Equities-Short-sellers-get-crafty-in-beer.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}