Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 26, 2017

Preliminary UK GDP estimates point to muted second quarter upturn

UK gross domestic product rose 0.3% in the three months to June, according to the preliminary estimate from the Office for National Statistics, up slightly from the 0.2% increase seen in the opening quarter of the year.

These meagre growth rates indicate that the economy has lost momentum in 2017, and will consequently fail to achieve the 1.8% expansion seen in 2016.

Weaker outlook

The second quarter growth was below the 0.4% expansion anticipated by the Bank of England, and therefore suggests we'll see the central bank revise down its forecasts for the economy next week from the 1.9% growth it has currently penciled-in. IHS Markit is currently forecasting just 1.4% growth, while the IMF has just downgraded its expectation to 1.7%.

The confirmation of the lackluster performance of the economy so far this year surely also diminishes the chance of an interest rate hike any time soon, especially as growth prospects for coming months have become increasingly skewed to the downside.

Households' views about their finances continued to deteriorate in July, according to survey data, with appetite to make major purchases, such as holidays, cars and expensive household goods, deteriorating at the steepest rate for over three-and-a-half years. Worries about squeezed incomes amid rising prices and weak wage growth therefore look set to dominate the coming months and act as a drag on consumer spending, which has played a major role in sustaining the economy's resilience over the past year.

Meanwhile, business optimism slumped to the lowest since 2011 at the end of the second quarter, linked to deepening concerns about the path to Brexit, a renewed wave of domestic political uncertainty and evidence of more subdued consumer spending.

We'll know more next week with the publication of PMI data for July, but at the moment the likelihood is that the second quarter's modest growth may represent a high-point in the economy's performance in 2017. As such, there's a not-insignificant risk that policy may even need to be loosened to help the economy if conditions deteriorate further.

Services-led growth

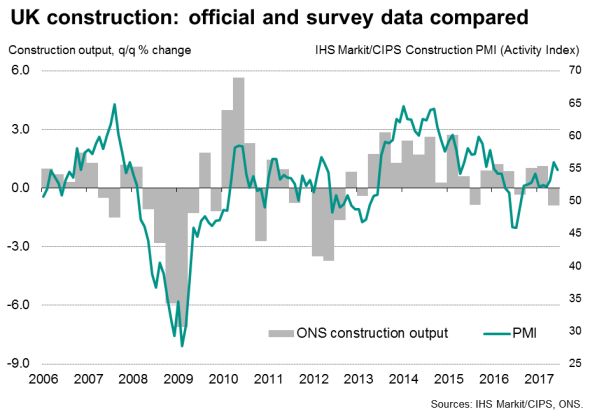

In the detail, manufacturing output shrank 0.5% compared to a 0.3% rise in the first quarter. Construction output also paid back much of the 1.1% gain seen in the first quarter, declining some 0.9%. Mining and quarrying meanwhile also saw output slump 0.9% after a 1.5% rise in the first quarter.

That left services once again propping up the economy, with output rising 0.5%, gaining momentum from the meager 0.1% increase seen in the first three months of 2017. Retail, hotels, transport and communication were the main growth drivers - some of which come as a surprise given the recent squeeze on consumers' real incomes (though also hints at either increased foreign tourism-related activity, linked to the weaker pound, or households eating into savings or taking on more debt). Business and financial services recorded a solid but unspectacular 0.4% gain in output.

The pace of expansion was weaker than indicated by recent PMI business survey data, especially for manufacturing and construction, which hints at the official data being revised slightly higher at a later date (to 0.4%). Today's initial estimate is based on only around 40% of data for the full quarter, and the construction data in particular are highly prone to substantial revision.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26072017-Economics-Preliminary-UK-GDP-estimates-point-to-muted-second-quarter-upturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26072017-Economics-Preliminary-UK-GDP-estimates-point-to-muted-second-quarter-upturn.html&text=Preliminary+UK+GDP+estimates+point+to+muted+second+quarter+upturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26072017-Economics-Preliminary-UK-GDP-estimates-point-to-muted-second-quarter-upturn.html","enabled":true},{"name":"email","url":"?subject=Preliminary UK GDP estimates point to muted second quarter upturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26072017-Economics-Preliminary-UK-GDP-estimates-point-to-muted-second-quarter-upturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Preliminary+UK+GDP+estimates+point+to+muted+second+quarter+upturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26072017-Economics-Preliminary-UK-GDP-estimates-point-to-muted-second-quarter-upturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}