Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 26, 2015

UK retail sales growth buoyed by falling prices

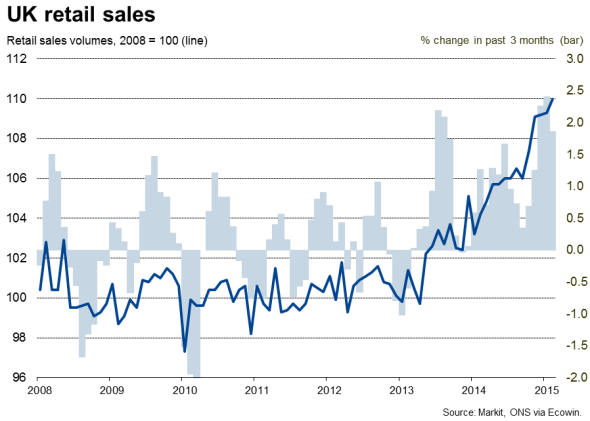

The UK's economic upturn continued to show strong momentum in February, with retail sales growth rebounding strongly, according to the Office for National Statistics. Sales increased 0.7% during the month, up 5.7% on last year. An originally estimated 0.3% fall in January was also revised up to show a 0.1% rise.

So far this year, sales are running 1.0% above the fourth quarter, adding to evidence that the economy is enjoying another quarter of reasonably robust growth. Gross domestic product looks set to rise by 0.6% in the first quarter.

Sales buoyed by falling prices

Part of the growth surge was due to increased spending on furniture, thought to have been a reflection of the housing market upturn.

However, the broader upturn in consumer spending, and in fact therefore the wider economic upturn, is sitting on somewhat shaky foundations. Consumer spending has once again become the main driver of economic growth, and is in turn being fuelled by what is likely to be a temporary downturn in inflation.

With store prices falling 3.6% on a year ago in February, the biggest decline since 1997, households are taking advantage of falling prices.

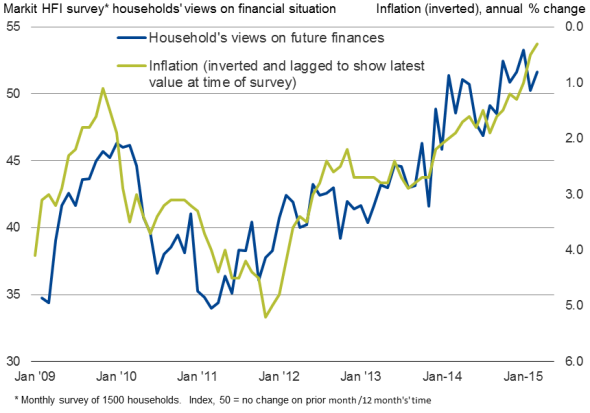

How lower inflation has boosted household optimism

Sources: Markit, ONS

Low inflation is also having the effect of boosting real incomes to the greatest extent for seven years. With inflation having dropped to zero, the 1.6% increase in pay seen in the three months to February was the largest real-terms increase in regular employee earnings since January 2008. However, after going negative in the spring, inflation looks set to start rising again by the end of the year, meaning we need to see pay growth picking up to ensure the upturn remains intact.

At the moment, however, there are worryingly scant signs of rising pay pressures. Real-terms pay growth could therefore start to deteriorate again, especially as zero or negative inflation potentially leads to lower pay reviews, which could put downward pressure on spending.

Until we see convincing signs of wage growth picking up, the Bank of England will most likely err on the side of caution even in the face of robust economic growth and consumer spending, keeping interest rates at record lows. Given the current weakness of pay growth, it's becoming increasingly likely that interest rates will stay on hold for the rest of the year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-uk-retail-sales-growth-buoyed-by-falling-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-uk-retail-sales-growth-buoyed-by-falling-prices.html&text=UK+retail+sales+growth+buoyed+by+falling+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-uk-retail-sales-growth-buoyed-by-falling-prices.html","enabled":true},{"name":"email","url":"?subject=UK retail sales growth buoyed by falling prices&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-uk-retail-sales-growth-buoyed-by-falling-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retail+sales+growth+buoyed+by+falling+prices http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-uk-retail-sales-growth-buoyed-by-falling-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}