Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 26, 2016

Week Ahead Economic Overview

Markets will be on tenterhooks during a week which concludes with the publication of US non-farm payrolls, which will give all-important clues for Fed policymaking. Before the US labour market update, the week sees the release of February PMI figures, providing data watchers and policymakers with an insight into the health of all major global economies. In the eurozone, updated labour market, retail sales and inflation figures will also be provided. Finally, fourth quarter GDP data for struggling Brazil completes the key releases.

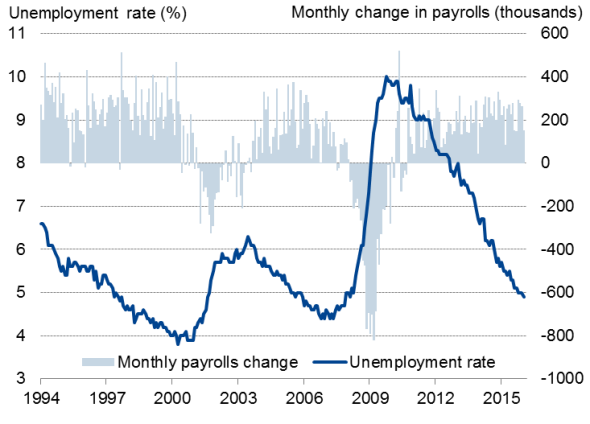

A positive update on US non-farm payrolls will be sought to re-instil some much needed confidence back into the US economy, after recent Flash PMI data signalled a heightened risk of economic downturn. Labour market data for January were mixed, as the unemployment rate dropped to 4.9%, its lowest level since February 2008, but non-farm payrolls disappointed with a 151,000 increase. Weaker than anticipated job market numbers and US PMI data from Markit and the ISM could knock back the Federal Reserve's decision to lift bank rates into late 2016.

Markit's UK PMI data for February will be of particular interest to policymakers next week, especially with debate towards a possible 'Brexit' gaining stronger momentum and the Bank of England sounding more cautious about the economy. Sterling depreciated to near seven-year lows after markets questioned the robustness of the UK economy without the support of the EU. However, it's not all doom and gloom for the UK, GDP grew 0.5% in the final quarter of last year and the PMI data for January showed a pick-up in speed, albeit with a health warning about future growth, as optimism slipped to a three year low. February's PMI data will provide an important gauge of first quarter GDP growth.

Eurozone inflation figures published on Monday will be carefully scrutinized by the ECB, who will be looking for signs of stronger demand in the region. However this looks unlikely, after Flash PMI data reported the sharpest rate of output price deflation for one year. Despite January's annual inflation rate rising to an eight-month high of 0.3%, it was revised down from the initial 0.4% estimate and still way off the targeted 2%. Next month's ECB meeting is already expected to see the announcement of increased economic stimulus, and further weak inflation, retail sales and labour market trends will raise expectations of aggressive ECB action.

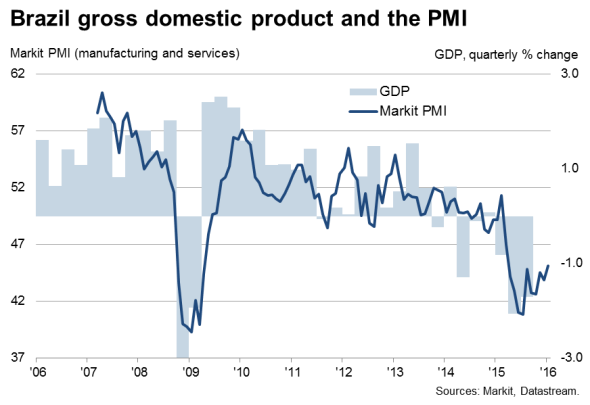

Brazil will also be in the news, for all the wrong reasons. The commodity-focused country has endured a torrid time of late: not only is its economy in the midst of a deepening recession, as signalled by PMI data, but its sovereign debt was recently downgraded to 'junk' status by credit rating agency Moody. Given weak PMI readings, the update on fourth quarter GDP is anticipated to bring further miserable news to policymakers next week.

US non-farm payrolls and unemployment rate

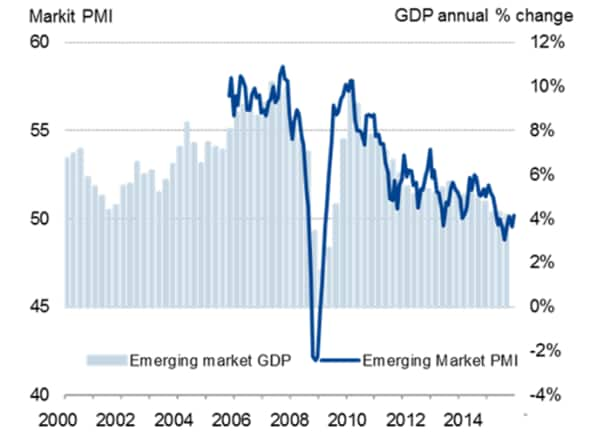

Emerging Market GDP and PMI

Developed World GDP and PMI

Monday 29 February

In Australia, a number of key releases are issued including new home sales data, MI inflation gauge and corporate profit numbers.

Preliminary industrial output data for Japan are made available alongside latest retail sales figures.

India's federal budget is announced.

Meanwhile, Flash inflation numbers for the Eurozone are released.

Germany announces latest retail sales data alongside import price figures.

Preliminary Italian CPI numbers are published.

Spain releases an update on its current account balance as well as its business confidence index.

The final fourth quarter GDP number for Greece is released alongside latest retail sales numbers and producer prices.

The Bank of England publishes mortgage approval data.

Tuesday 1 March

In Japan, an update on unemployment data is provided.

China releases its CB leading economic index.

February's final PMI data are released by Markit for a number of economies around the world.

Meanwhile, South Africa and Canada provide updated fourth quarter GDP numbers.

An announcement on Eurozone unemployment will be provided, including a breakdown for Germany and Italy.

Wednesday 2 March

Fourth quarter GDP figures are out in Australia.

Updated producer prices for the Eurozone are provided.

In Brazil, an interest rate decision will be made by the central bank while a variety of inflation figures are published.

Thursday 3 March

Markit releases worldwide services and whole economy PMI results.

Central Bank of India meets to discuss monetary policy.

In South Africa, the SACCI Business Confidence Index is released.

Latest eurozone retail sales figures will be published.

Unemployment figures for France are announced.

Meanwhile, an update on Brazilian GDP for the fourth quarter will be provided.

Revised productivity numbers, export sales data and factory order figures are released in the US.

Friday 4 March

Australian retail sales are published in the early hours.

India releases latest bank lending and foreign reserves data.

CPI numbers in Russia are issued.

In Italy, final fourth quarter GDP numbers are published.

An announcement on Brazilian industrial output numbers will be issued.

Finally, the US Department of Labor updates its unemployment rate along with the release of latest non-farm payrolls data.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}