Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 26, 2016

US GDP revised higher but first quarter economic growth risks escalate

News that the US economy showed signs of stalling in February has been swiftly followed by a confirmation of weak economic growth late last year. The recent clutch of disappointing data raises worries that the US economy is slowing sharply, wrong-footing policy makers who decided to hike interest rates for the first time in almost a decade late last year.

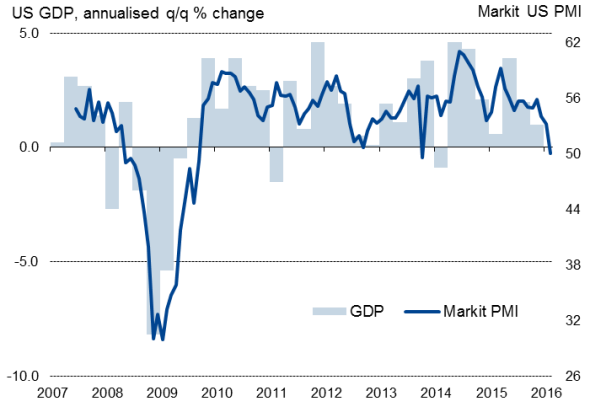

Official data showed that the US economy grew at an annualised rate of 1.0% in the final three months of last year, up from a previously estimated 0.7% expansion and above economists' expectations but down sharply from 2.0% in the third quarter and 3.9% in the second quarter.

US GDP and the Markit PMI

Sources: Commerce Department, Markit.

Unfortunately, the cause of the upward revision bodes ill for the first quarter. The GDP number was revised higher in part due to a bigger than previously thought contribution from inventories, something which often happens due to weaker than expected demand, meaning inventories could act as a drag in the first quarter as excess stock levels are wound down again.

Final sales, which strip out inventories, rose at an annualised rate of 1.2%, down from 2.7% in the third quarter and 3.9% in the second. Consumer spending growth, a key driver of the US upturn, was meanwhile revised down to 2.0% compared with a prior estimate of 2.2%.

The trend in the economy looks to be deteriorating further in the first quarter. Markit's flash PMI fell sharply in both manufacturing and services in February, pointing to a stagnation of the economy. Forward looking indicators such as business optimism and order books suggests business activity could fall in March.

Companies cite a number of worries that are dragging on customer spending and causing businesses to become more risk averse. These include worries about the forthcoming election, financial market volatility, the global economic environment and the possibility of higher interest rates.

However, while higher interest rates are seen as a concern among businesses, if the weak flow of data continues it looks like the Fed will need to revise their guidance on further rate hikes, putting policy on hold until the economic environment starts to hopefully improve again.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-Economics-US-GDP-revised-higher-but-first-quarter-economic-growth-risks-escalate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-Economics-US-GDP-revised-higher-but-first-quarter-economic-growth-risks-escalate.html&text=US+GDP+revised+higher+but+first+quarter+economic+growth+risks+escalate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-Economics-US-GDP-revised-higher-but-first-quarter-economic-growth-risks-escalate.html","enabled":true},{"name":"email","url":"?subject=US GDP revised higher but first quarter economic growth risks escalate&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-Economics-US-GDP-revised-higher-but-first-quarter-economic-growth-risks-escalate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+GDP+revised+higher+but+first+quarter+economic+growth+risks+escalate http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-Economics-US-GDP-revised-higher-but-first-quarter-economic-growth-risks-escalate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}