Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 25, 2015

Asian short selling jumps to three year high

Demand to borrow Asian stocks surged in the wake of the recent market volatility. While short sellers have since pulled back slightly, the current demand to borrow shares across the region is still up by a fifth since the start of the year.

- Short interest across Asia is up by 18% year to date, reaching 2.7% of free float

- Consumer sectors have made Australia the most shorted country in the region

- But Japanese short selling has been relatively flat since the start of the year

The impact of the recent Chinese-driven market volatility has seen short sellers increase their positions across the globe. Asia, which has been at the centre of the recent macroeconomic issues, has been no exception.

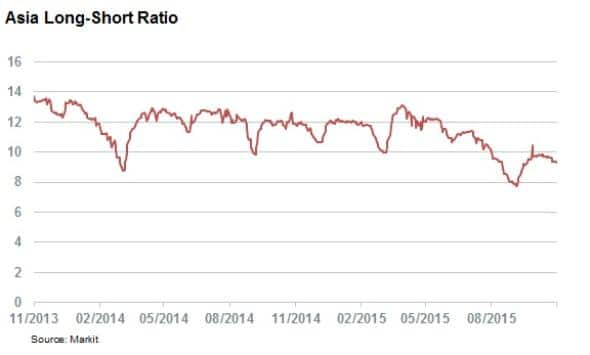

The Asian market's long-short ratio, a measure of the value of long positions sitting in lending programs to short positions, fell to a three year low during the worst of the recent volatility in late September. Over this low there were eight dollars of long positions to cover every short position, down from 12 at the start of the year. While the trend has fallen back somewhat in the last few weeks, the long-short ratio still indicates that the overall demand to sell the region's shares is very much at an elevated state.

Free float on loan surges

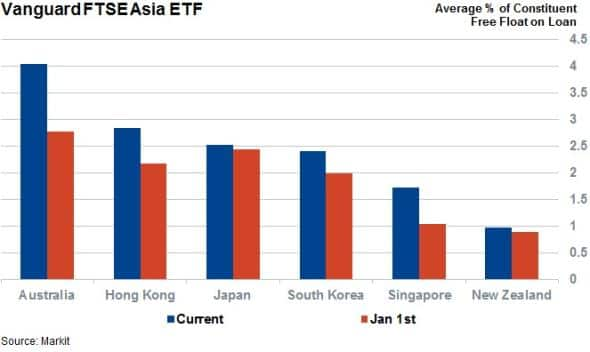

This elevated demand to sell short across the region is also reflected in the average free float out on loan across the constituents of the Vanguard FTSE Pacific ETF, the largest pan-Asian ETF by AUM. The fund's current 1000 constituents now have an average of 2.7% of their free float out on loan, which is 18% higher than at the start of the year. That number had been bound in the 2-2.3% range for the 18 month leading up to this summer's volatility.

While this propensity to sell short has been universal across the region, as seen by the fact that all six constituent countries tracked by the ETF have seen an increase in demand to borrow since the start of the year, the recent volatility has seen some countries more heavily targeted than others.

Leading this trend is Australia, where the 146 of ETF constituents have seen a 46% increase in average demand to borrow. This is over twice that seen in the rest of the region and increases the country's lead as the most shorted country in Asia.

Interestingly, the firms leading the increase in Australian short selling are more closely linked to the country's consumer sector rather than the downtrodden energy and commodities sectors. These sectors are very much a "second derivative" play as the Australian consumers trim back on spending in the wake of cutbacks in the commodities sector.

The two firms exemplifying this trend are Metcash and Flight Centre.

Japan bucks the trend

One country that has been relatively immune from the recent trend is Japan as the Japanese constituents of the Asia ETF have only seen a marginal increase in demand to borrow over the last 11 months with 2.5% of their free float out on loan. The relative reticence of short sellers in the country makes sense given the recent willingness of Japanese policy makers to kick-start growth through quantitative easing, which has a propensity to benefit equity prices.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112015-equities-asian-short-selling-jumps-to-three-year-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112015-equities-asian-short-selling-jumps-to-three-year-high.html&text=Asian+short+selling+jumps+to+three+year+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112015-equities-asian-short-selling-jumps-to-three-year-high.html","enabled":true},{"name":"email","url":"?subject=Asian short selling jumps to three year high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112015-equities-asian-short-selling-jumps-to-three-year-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+short+selling+jumps+to+three+year+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112015-equities-asian-short-selling-jumps-to-three-year-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}