Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 25, 2014

US economy grows faster than first thought in third quarter

The US economy grew faster than previously thought in the third quarter. Gross domestic product grew at an annualised rate of 3.9% in the three months to September, revised up from the initial estimate of 3.5%, according to updated data from the Commerce Department.

Both business and consumer spending were revised higher. Business investment growth was upgraded from 5.5% to a brisk 7.1%, while growth of consumer spending was revised up from 1.8% to 2.2%.

Growth surge attracts investors

The 3.9% pace of expansion followed growth of 4.6% in the second quarter, meaning the US has undergone its strongest growth phase for 11 years. Such buoyant growth will inevitably raise expectations that the Fed could soon start to raise interest rates, possibly in the first half of 2015.

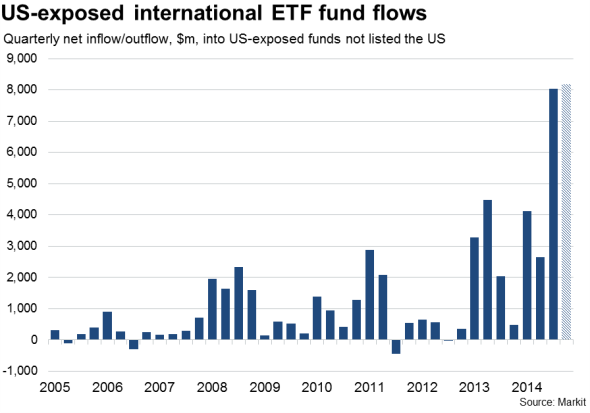

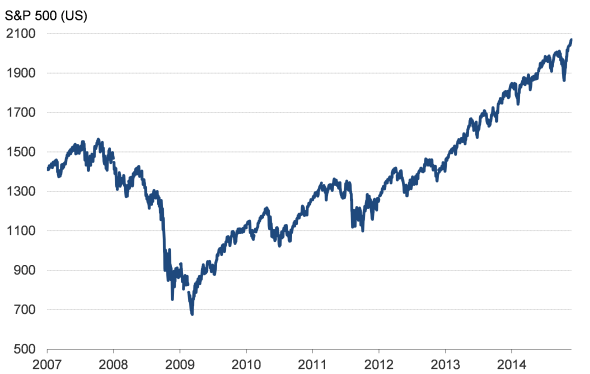

The prospect of higher interest rates has not deterred investors. Equity prices have risen to an all-time high according to the S&P 500. Inflows into foreign-listed exchange-traded funds (ETFs) exposed to the US are meanwhile set to see a record inflow in the fourth quarter, building on what was already a record inflow by some margin in the third quarter. These inflows point to a steep rise in non-US investors seeking exposure to the US.

Business mood darkens

However, the policy outlook is by no means clear cut. There are signs that the pace of economic growth and job creation could moderate in the final quarter of the year, and possibly to a greater extent than many are currently anticipating.

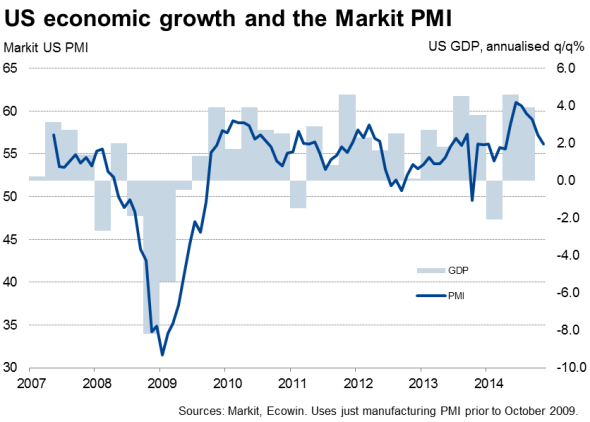

Markit's PMI surveys, which have accurately anticipated GDP data in recent years, signalled a fifth successive monthly slowing in the pace of economic growth in November to the weakest since April. The survey data translate into annualised GDP growth of 2.5% at best in the fourth quarter.

On one hand, 2.5% is still a respectable pace of expansion which should continue to fuel strong rates of job creation. However, the worry is that further downside risks to growth are clearly possible in the light of recent severe winter weather in parts of the country.

Inventories were also revised higher in the third quarter, suggesting some payback might be seen in the fourth quarter, further subduing economic growth.

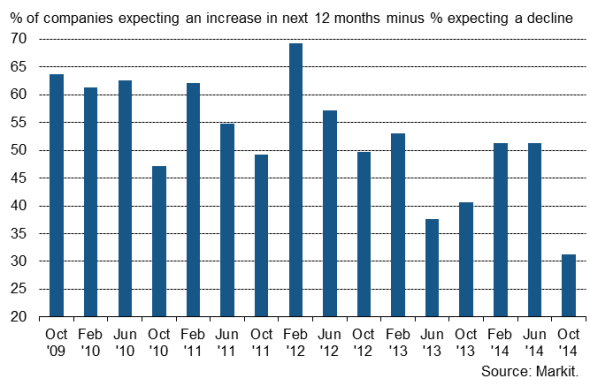

Furthermore, the mood in the corporate sector has started to sour. Business expectations about the year ahead are running at the lowest seen since 2009, according to Markit's Global Business Outlook Survey (published this week).Hiring and investment intentions have also slipped to post-recession lows as US companies worry in particular about the global economic climate.

With central banks in the eurozone and Japan taking further action to boost economic growth, worries about the global economic outlook are perhaps overly gloomy. However, companies will want to see firm evidence of the global economy picking up from its recent malaise before the ebullient mood seen on Wall Street in recent weeks is replicated on Main Street.

Markit US Business Outlook Survey

Equity prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Economics-US-economy-grows-faster-than-first-thought-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Economics-US-economy-grows-faster-than-first-thought-in-third-quarter.html&text=US+economy+grows+faster+than+first+thought+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Economics-US-economy-grows-faster-than-first-thought-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=US economy grows faster than first thought in third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Economics-US-economy-grows-faster-than-first-thought-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy+grows+faster+than+first+thought+in+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Economics-US-economy-grows-faster-than-first-thought-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}