Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 25, 2015

June US flash PMI data signal marked slowdown in economic growth

Survey data signalling robust second quarter economic growth, strong employment gains and rising inflation add to pressure on the Fed to hike interest rates. But a slowdown in the pace of expansion in June may give the Fed a further pause for thought before hiking interest rates.

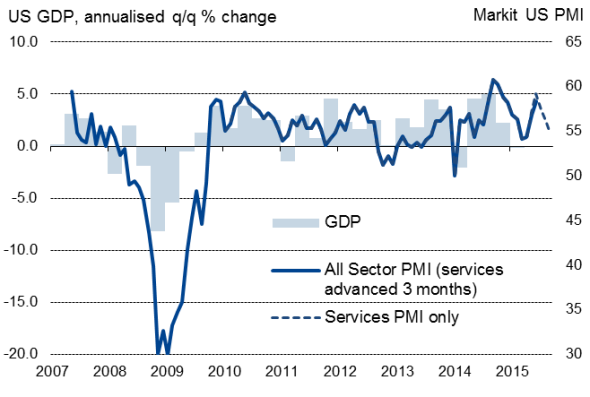

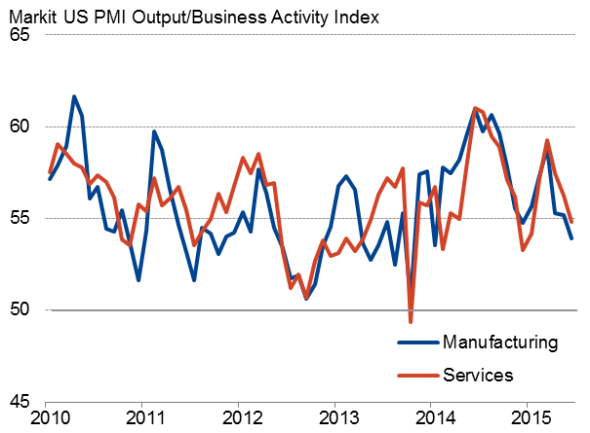

The Markit Flash Composite PMI™ fell from 56.0 in May to 54.6 in June. Although remaining above 50 to signal ongoing growth, the survey data point to a further easing in the rate expansion from March’s peak.

June saw the slowest growth of factory output for close to a year-and-a-half, linked to a strong dollar, accompanied by the smallest rise in service sector activity since January.

The survey data imply that, with the exceptions of the weather-related slowdowns at the turn of this year and early last year and the 2013 government shutdown, June saw the weakest pace of economic growth since May 2013.

Economic growth

Third quarter slowdown?

While the surveys point to the economy growing at an annualised rate of around 3% in the second quarter there has clearly been a loss of momentum in recent months. With June also seeing one of the smallest increases in new orders recorded over the past two years, the surveys suggest that GDP growth could slow appreciably in the third quarter.

This slowing in part reflects a return to normal after the economy rebounded from weather-disruptions seen at start to the year, but company survey responses also point to the strong dollar damaging export competitiveness and dampening income from abroad.

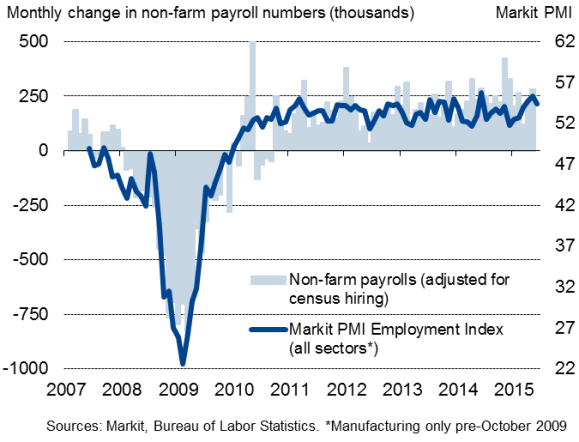

Robust job creation

Some reassurance was provided by the surveys pointing to employment rising strongly again in June, consistent with another 200,000-plus rise in non-farm payrolls.

Employment

The weighted employment index from the two surveys dipped to a three-month low, having hit a near post-crisis high in May, but is nevertheless still signalling a 220,000 payroll rise for June after a 252,000 increase indicated for the prior month (lower than the current official estimate of 280,000)[1]. However, it seems inevitable that hiring is likely to cool in coming months in response to the weaker order book growth.

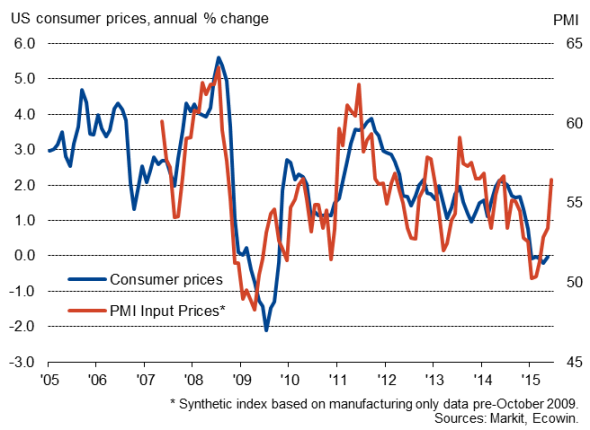

Rising prices

June also saw resurgent price pressures. Average input costs rose at the fastest rate for a year, and average prices charged for goods and services showed the largest monthly increase since last September.

Prices

Companies attributed much of the upturn in inflationary pressures to higher oil and energy prices, although also often reported stronger wage growth. The rise in the PMI price indicators is consistent with annual consumer price inflation moving higher in coming months. Headline inflation was zero in May, having been negative in both March and April.

Fed on hold?

The big question will therefore be whether the current strength of the labour market, robust second quarter economic growth and revival of price pressures are sufficient to cause policymakers to hike rates, or whether these signs of the economy losing momentum may buy more time before any policy decisions are made.

Markit Flash PMI surveys

[1] These estimates are based on a regression analysis which uses the composite PMI employment index as the sole explanatory variable of the non-farm payroll numbers adjusted for census hiring. The regression exhibits an adjusted r-squared of 0.89.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-June-US-flash-PMI-data-signal-marked-slowdown-in-economic-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-June-US-flash-PMI-data-signal-marked-slowdown-in-economic-growth.html&text=June+US+flash+PMI+data+signal+marked+slowdown+in+economic+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-June-US-flash-PMI-data-signal-marked-slowdown-in-economic-growth.html","enabled":true},{"name":"email","url":"?subject=June US flash PMI data signal marked slowdown in economic growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-June-US-flash-PMI-data-signal-marked-slowdown-in-economic-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=June+US+flash+PMI+data+signal+marked+slowdown+in+economic+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-June-US-flash-PMI-data-signal-marked-slowdown-in-economic-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}