Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 25, 2016

Bearish sentiment descending on Deutschland

Participating in a broader European recovery since February, German blue chip stocks have faced a deluge of weaker economic data, indicating Europe's manufacturing hub is not quite firing on all cylinders.

- Since January, $3bn of funds have been pulled out of ETFs exposed to Germany

- German new export orders grow as PMI data indicates further deflation in local prices

- Increase in robotic factory automation sales lifts Kuka as shorts cover a fifth of positions

ETF investors have withdrawn funds and short interest levels remain largely unaffected across Germany's DAX index despite a 20% rally in stock prices.

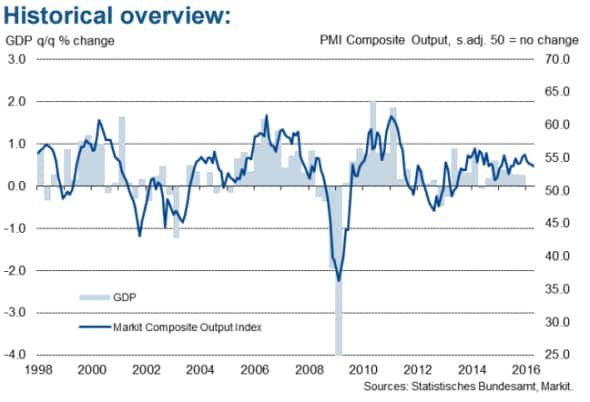

The ECB continues to struggle to ignite economic growth across Europe with the region 'stuck in a slow growth rut,'according to Market PMI data released last week. The Markit Flash Eurozone PMI dipped in April, reaching a two month low while registering moderate growth in manufacturing and services.

German manufacturers continue to struggle with output growth slowing further at the beginning of the second quarter of 2016. Growth in output according to Markit PMI data had improved compared to January levels however, input costs continued to fall as a result of raw material costs and exchange rate factors.

This could explain the more positive PMI signals coming from German exporters, with the strongest rise in new export orders recorded thus far this year and specific mention of growth emanating from China, Southern Europe and the US.

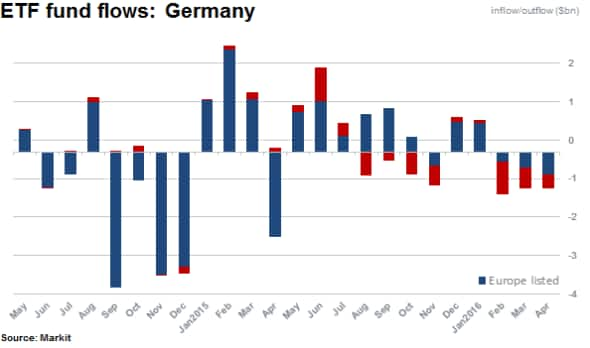

In the meantime however, local and foreign investors have withdrawn funds from German exposed ETFs with $2.1bn of net outflows recorded this year. Three consecutive months of outflows have been recorded totalling almost $3bn, the largest since December 2014.

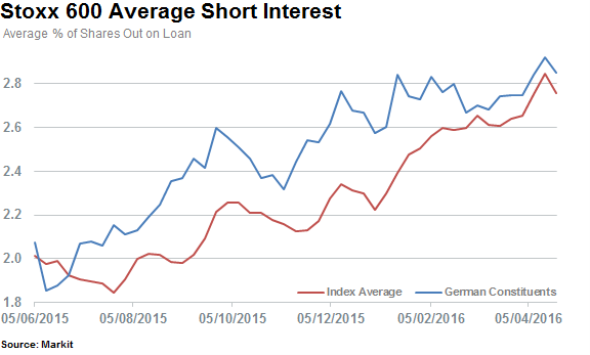

Shorts seem to be largely unconvinced by the recent rally in German blue chips with the DAX rising an impressive 19% from February lows. However, looking at the average short interest across the Stoxx 600, this seems to be a wider trend in Europe.

German constituents in the Stoxx 600 are marginally more short sold than the broader index with the current average rising to 2.8%.. In fact German firm Wirecard is the most shorted stock across the Stoxx 600 with 24.5% of shares outstanding on loan.

Wirecard has been the target of an activist short campaign from Zatarra Research and recently featured as the most shorted stock ahead of earnings in Europe.

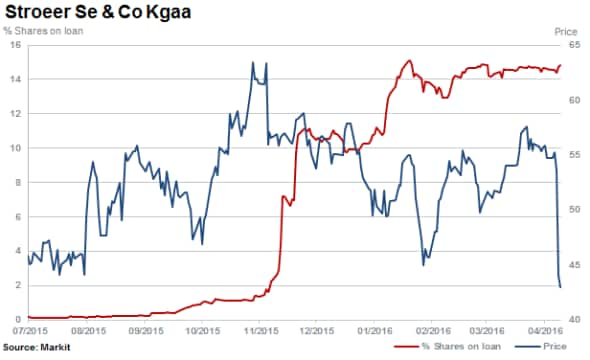

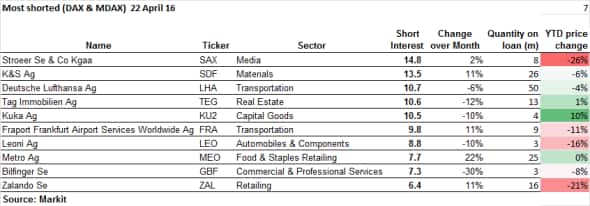

The most shorted stock currently among Germany's MDAX and DAX index constituents is Stroeer, with 14.8% of shares currently outstanding on loan.

Shares plummeted in Stroeer last week after activist short seller Muddy Waters Capital reported that the advertising firm has overstated cash flows due to its accounting of acquisitions.

The largest German 'bluechip' by market cap attracting material levels of short interest currently is retailer Metro with 7.7% of shares outstanding on loan representing over $600m in value on loan.

Short interest at Metro has surged 84% since February 25th along with the share price which has risen by a quarter after the retailer announced plans to split its business into separate food and consumer electronics businesses. Online German retailer Zolander joins Metro in the top ten most shorted stocks in Germany with 6.4% of shares outstanding on loan currently.

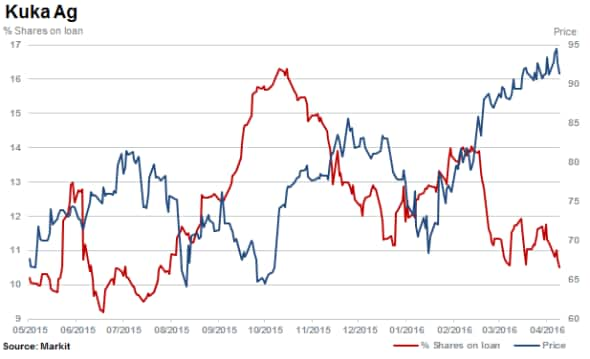

Short sellers have however, covered in the Kuka with 10.5% of shares outstanding on loan currently. Shares have rallied an impressive 34% since the end of January 2016. The provider of robotic automation equipment used on assembly lines recorded surging sales and earnings growth but shorts have covered almost a fifth of their positions.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Equities-Bearish-sentiment-descending-on-Deutschland.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Equities-Bearish-sentiment-descending-on-Deutschland.html&text=Bearish+sentiment+descending+on+Deutschland","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Equities-Bearish-sentiment-descending-on-Deutschland.html","enabled":true},{"name":"email","url":"?subject=Bearish sentiment descending on Deutschland&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Equities-Bearish-sentiment-descending-on-Deutschland.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bearish+sentiment+descending+on+Deutschland http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Equities-Bearish-sentiment-descending-on-Deutschland.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}