Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 25, 2015

Dell's credit improves post LBO

Two years on from being taken private in a $24.9bn deal, computer maker Dell could be on the cusp of regaining its investment grade credit rating.

Dell's CDS spread is now lower than the day before the buyout became public

Six year Dell bonds are now trading 56bps tighter than its BB rated bonds category

Yet its bonds yield are still 2.05% wider than the lowest rated investment grade category

In October 2013, Dell's founder and CEO Michael Dell completed a $24.9bn leveraged buyout (LBO) with PE firm Silver Lake Management.

The move was intended to invigorate Dell's declining PC sales as competition in the Far East put pressure on margins and consumer tastes shifted to tablets smartphones.

Since then Dell has steadily been making competitive gains, enjoying accelerated growth in new markets such as India, while also paying down existing debt.

Credit spreads tighten

News of the buyout caused a sharp rise in the cost to insure against Dell as 5-yr CDS spreads jumped from 197bps to 345bps. This was no surprise given the buyout would add billions of dollars of debt to Dell's balance sheet, which was seen as a risky move by credit market participants. The spread continued to trade in the 300-400bps range until the buyout was complete.

Spreads have since been in steady decline in recognition of the company's improved performance and debt repayments. They recently reached three year lows of 145bps, well below the level before the LBO become public.

Path to investment grade

Dell's senior unsecured debt was cut from BBB to BB (junk) status by rating agency S&P just before the LBO was completed, and has since remained in the category.

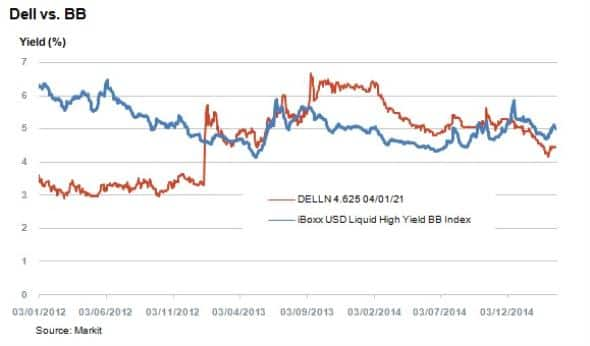

Mimicking its CDS spreads, cash investors also displayed signs of increased investor confidence as yields on Dell bonds steadily declined and continue to do so.

The path back to investment grade is evident when comparing the yields on BB rated bonds with Dell's bonds. Yields on the Dell 4.625% 2021 bond are above the iBoxx USD Liquid High Yield BB Index and have been since 2013. They reached 147bps in October that year, which was no surprise given the heightened credit risk at the time. This trend reversed in December last year and today BB rated bonds yield 4.91%, whereas equivalent Dell bonds yield 4.41% with a 56bps spread basis.

But it is worth noting that Dell does have some way to go before being considered investment grade if investors are looking at yields on company's bonds. The iBoxx $ Corporates BBB, the lowest rung of investment grade, still yields 2.05% extra versus an equivalent Dell bond (7.1% 2028). This suggests that Dell still has some way to go before closing the gap between investment grade and junk bond status.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-credit-dell-s-credit-improves-post-lbo.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-credit-dell-s-credit-improves-post-lbo.html&text=Dell%27s+credit+improves+post+LBO","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-credit-dell-s-credit-improves-post-lbo.html","enabled":true},{"name":"email","url":"?subject=Dell's credit improves post LBO&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-credit-dell-s-credit-improves-post-lbo.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dell%27s+credit+improves+post+LBO http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-credit-dell-s-credit-improves-post-lbo.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}