Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 25, 2016

Solid UK GDP expansion masks worrying signs of unbalanced growth

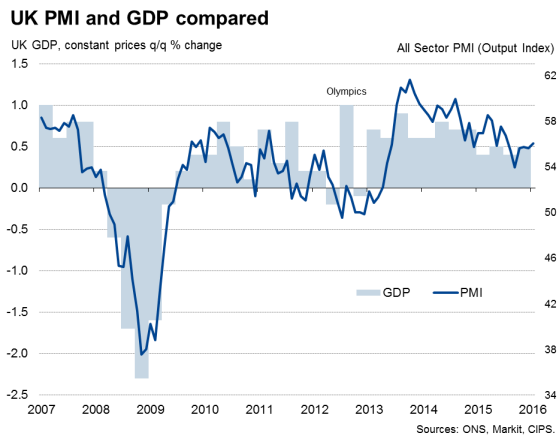

UK economic growth in the final quarter of last year was confirmed at 0.5%, according to the ONS's second estimate of gross domestic product. However, the numbers also reveal an economy overly-reliant on household spending and show a worrying slide in business investment amid heighted uncertainty about the outlook, which raises doubts about the sustainability of the upturn.

Unbalanced growth

Construction and industrial production numbers were both revised lower to 0.4% and 0.5% declines respectively, with a flat manufacturing sector, but the revisions were not large enough to downgrade the overall economic growth rate. Clearly the service sector remains the main growth driver, having expanded 0.7% (unrevised) in the final three months of last year.

Households played an important role in boosting the economy, aided by rising pay. Household expenditure and compensation of employees both rose by 0.7%. The big concern was a 2.1% fall in business investment, which points to increased risk aversion amid heightened economic uncertainty; something that the business surveys have also been signalling and which looks to have worsened so far this year.

While further robust growth is currently being signalled for the start of the first quarter, warning lights are flashing about the extent to which the pace could weaken in coming months due to fragile business confidence. The PMI surveys in fact indicated a slight acceleration of business activity growth in January, but also showed one of the smallest gains in employment for over two years as hiring slowed in response to a deteriorating order book pipeline and increased caution about the outlook.

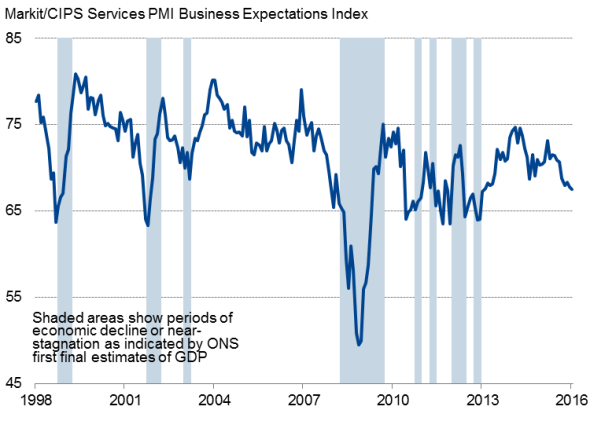

Perhaps most worrying was the fall in a key PMI gauge of business optimism to a three-year low as increasing numbers of firms grew anxious about the outlook, something which one would expect to have intensified in February given the increased uncertainty surrounding 'Brexit' over the past week.

UK business confidence & periods of economic weakness

We will know more about how 'Brexit' worries have affected the business mood with next week's PMI numbers and the upcoming release of Markit's February Business Outlook survey results, but we note that this index had already fallen in January to a level that is historically consistent with GDP either contracting or near stagnation (see chart).

The data therefore paint a picture of an unbalanced economy that is once again reliant on consumer spending to drive growth as business shows increased signs of risk aversion. Growth is being supported by firms increasing the wages paid to workers alongside low inflation, which is clearly good for household incomes in the short term. But for a sustainable recovery, which involves improvements in productivity and profits, we also need to see business investment revive, something which will only happen when business confidence lifts higher again.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-economics-solid-uk-gdp-expansion-masks-worrying-signs-of-unbalanced-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-economics-solid-uk-gdp-expansion-masks-worrying-signs-of-unbalanced-growth.html&text=Solid+UK+GDP+expansion+masks+worrying+signs+of+unbalanced+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-economics-solid-uk-gdp-expansion-masks-worrying-signs-of-unbalanced-growth.html","enabled":true},{"name":"email","url":"?subject=Solid UK GDP expansion masks worrying signs of unbalanced growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-economics-solid-uk-gdp-expansion-masks-worrying-signs-of-unbalanced-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Solid+UK+GDP+expansion+masks+worrying+signs+of+unbalanced+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-economics-solid-uk-gdp-expansion-masks-worrying-signs-of-unbalanced-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}