Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 25, 2016

Shale oil spilling over into regional banks

Signs of pressure are emerging in North American Banks who financed the boom in shale oil. Sustained low oil prices are forcing banks to cut credit lines and make provisions which are in turn attracting short sellers.

- Regional banks attract 30% higher levels of shorting activity in 2016, led by Texas

- 10% of Texan bank Cullen/Frost sold short as energy provisions take toll ahead of earnings

- Short sold Oklahoma based Bok financial, underestimates credit losses ahead of earnings

Last week saw US credit rating firm Moody's downgrade 175 oil and mining firms as prices of crude and other commodities continued to hover at decade lows. Credit downgrades immediately impact financing costs at a time when these companies can least afford it. This resurfaces old questions around the uncertain impact of credit exposure faced by the US banking sector both directly through loans to oil firms and indirectly through slowing economic activity.

While major US banks recently disclosed the damage caused to date by their respective exposure to US Energy as they provisioned for bad loans, questions still circle over the mark-to-market standards in the wake of oil's decade low slump. This has seen short sellers circle banking institutions with regional banks leading the negative sentiment.

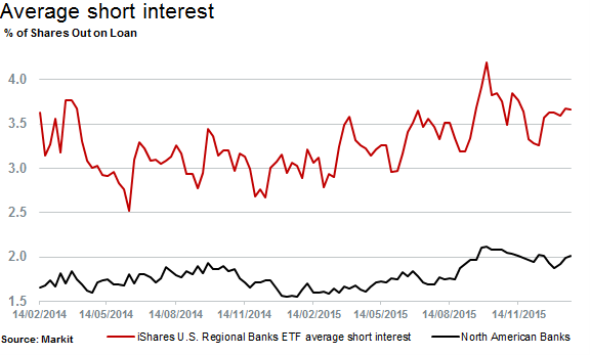

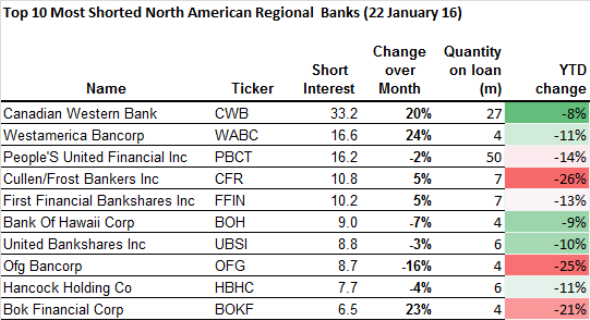

Since the beginning of 2015, average short interest across North American banks has increased by 30%, reaching 2% of shares outstanding on loan. Regional banks have led the surge forward with the firms that make up the iShares US Regional Banks ETF now seeing 3.5% of their shares out on loan, up from 2.5% in early 2015.

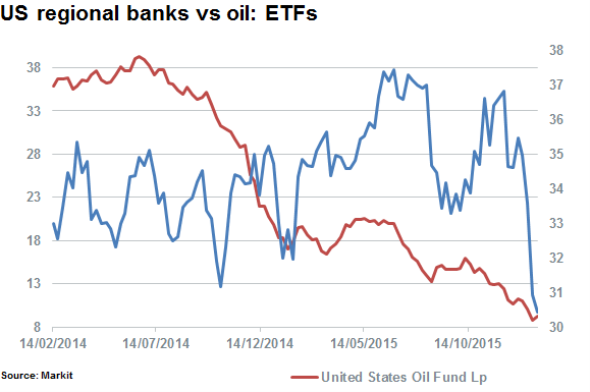

The link between these institutions and sliding oil prices is evidenced by the recent selloff in the iShares U.S Regional Banks ETF. The ETF has fallen 13% year to dateroughly in line with the US Oil Fund ETF which is down almost 16% year to date.

Shorts bank on Texan shale shorts

Texas regional banks are leading the rise seen in shorting activity. Average stock on loan across the 13 banks that are domiciled in the state over the past 12 months showed an average of 3.6% of shares outstanding on loan.

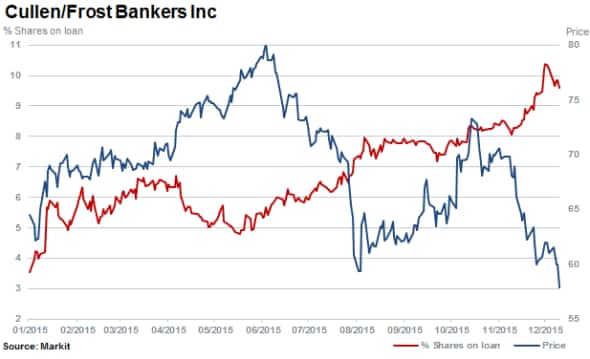

The most shorted regional Texan bank is San Antonia based Cullen/Frost. Short sellers have built up $246m in positions as the bank's shares have started to show signs of weakness. The bank recently announced 2015 loss provisions for the fourth quarter of $34m due to energy sector exposure. The firm is expected to release earnings this week.

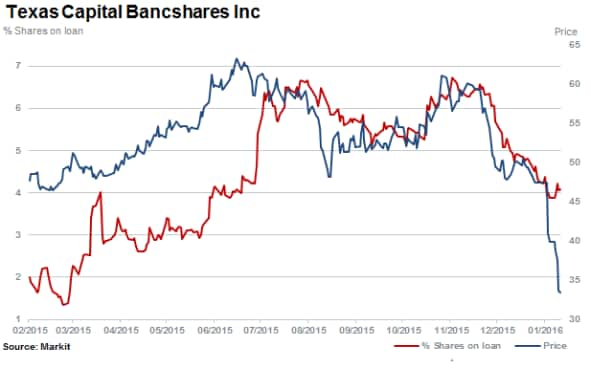

Texas Capital Bancshares which reported earnings last week has seen its stock fall 32% with earnings rising despite "significant additional provisions from the adverse credit migration primarily in the energy portfolio". Short sellers have trimmed positions in the stock lower to 4.1% of shares outstanding on loan.

Shale troubles extend outside of Texas

Oklahoma based Bok Financial cited "credit grade migration and increased impairment in our energy portfolio" when updating shareholders on their underestimation of credit losses, totalling $22.5m on January 13th 2016. Shares in Bok have dived 32% in 2016.

The recent nosedive by shares in Bok Financial has seen short sellers increase their positions, with shares outstanding on loan rising to 6.5% ahead of earnings which are expected on January 27th 2016.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-Equities-Shale-oil-spilling-over-into-regional-banks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-Equities-Shale-oil-spilling-over-into-regional-banks.html&text=Shale+oil+spilling+over+into+regional+banks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-Equities-Shale-oil-spilling-over-into-regional-banks.html","enabled":true},{"name":"email","url":"?subject=Shale oil spilling over into regional banks&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-Equities-Shale-oil-spilling-over-into-regional-banks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shale+oil+spilling+over+into+regional+banks http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-Equities-Shale-oil-spilling-over-into-regional-banks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}