Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 24, 2015

Japan flash manufacturing PMI hits 20-month high in November

Japanese goods producers are on course for their best quarter since the start of 2014. The Nikkei Manufacturing PMI hit a 20-month high of 52.8 in November, according to the preliminary 'flash' reading. The PMI readings for the fourth quarter so far are the highest since the first quarter of 2014, suggesting the sector is making a positive contribution to economic growth.

The improved survey data suggest that the goods-producing sector is experiencing a turnaround in business conditions compared to the weak picture seen throughout much of the year to date, with output and employment both growing at increased rates amid faster export sales and robust domestic demand.

Here are five key charts from the November flash PMI survey:

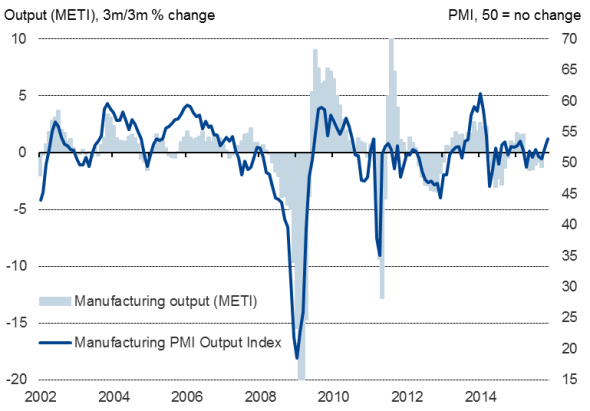

1.Factory output growth at 20-month high

The survey's output index rose to a 20-month high, signalling the fastest expansion of factory production volumes since March of last year. The survey therefore points to a revival of factory growth in the fourth quarter after the lull seen over the summer.

2.Upturn helped by export order growth

Export orders continued to recover after suffering the largest fall for two-and-a-half years back in September. November saw the largest rise since June, building on the improvement seen in October. The upturn in sales was linked to both a pick up in demand from key export markets, including the US and China, alongside the depreciation of the yen since mid-October.

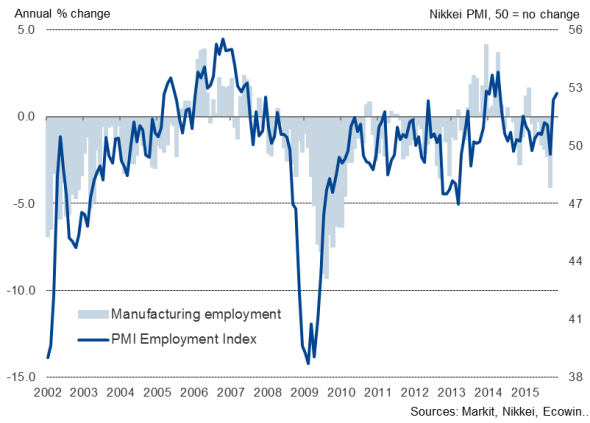

3. Job creation continues to revive

The upturn in exports contributed to a further robust rise in overall orders, with total new work showing one of the largest monthly gains seen over the past year-and-a-half. The improvement in the order book situation contrasts with declining inflows of new work seen earlier in the year and has prompted firms to review their staffing strategies, with job-shedding in September now having turned to net job creation. November in fact saw the largest monthly gain in factory employment since April of last year.

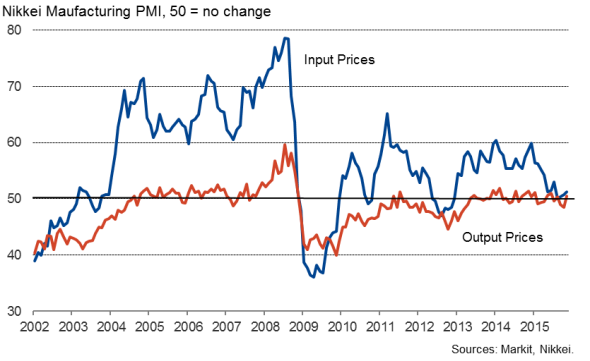

4. Output prices rise (albeit only marginally)

Average selling prices rose for the first time in three months, albeit only marginally. Selling price inflation remains only modest due mainly to the combination of intense competition and low global commodity prices. Input costs rose at a slightly increased rate, though one that remained modest and well below that seen earlier in the year, largely reflecting lower prices paid for oil and energy.

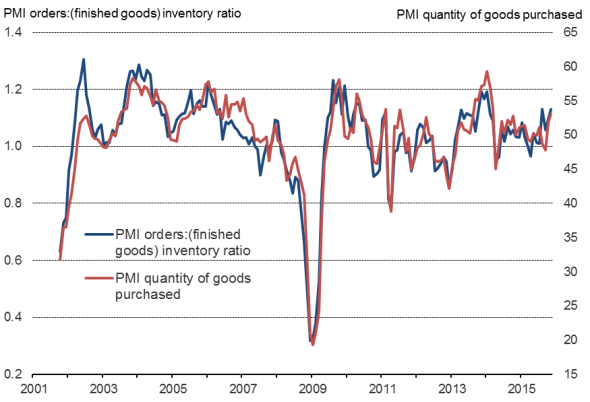

5. Positive outlook for goods production

Forward indicators of factory output paint an encouraging picture. The ratio of new orders to finished goods stock hit one of the highest levels seen since early last year, while the amount of inputs bought by manufacturers for use in production showed the largest monthly increase since March 2014.

Upturns in these forward-looking indicators not only tend to foretell an expansion of output but also suggest companies will be inclined to take on additional staff, thus adding to hopes that the current growth phase is looking increasingly sustainable.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Economics-Japan-flash-manufacturing-PMI-hits-20-month-high-in-November.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Economics-Japan-flash-manufacturing-PMI-hits-20-month-high-in-November.html&text=Japan+flash+manufacturing+PMI+hits+20-month+high+in+November","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Economics-Japan-flash-manufacturing-PMI-hits-20-month-high-in-November.html","enabled":true},{"name":"email","url":"?subject=Japan flash manufacturing PMI hits 20-month high in November&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Economics-Japan-flash-manufacturing-PMI-hits-20-month-high-in-November.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+manufacturing+PMI+hits+20-month+high+in+November http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Economics-Japan-flash-manufacturing-PMI-hits-20-month-high-in-November.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}