Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 24, 2014

Third place for Abe's three arrows

We review ETF flows and investor reaction to the island nation's recent political and fiscal movements to fend off deflation, recession and drive growth.

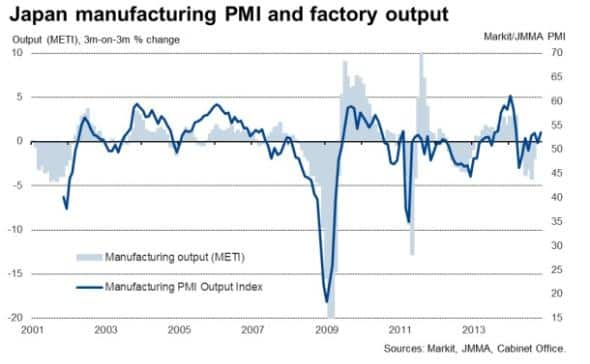

- Markit PMI data indicates a strong fourth quarter for the manufacturing sector

- Foreign investors have flocked to Japanese ETFs that are hedged against the Yen

- Local ETF investors pull $4.7bn in Q4 - the worst outflow in five years

Arrows still flying"

As the US's third iteration of quantitative easing officially ended, almost simultaneously across the pacific, the Japanese increased their stimulus measures to fight deflation with a three 'arrowed' fiscal policy experiment. All measures are intended to fend off deflation and drive sustainable economic growth for Japan, now the third largest national economy in the world behind China and the US.

Another arrow which equity investors have been banking on is a change in the proportion of assets allocated to equities by the country's influential pension funds. This played out in the last few weeks when the Government Pension Investment Fund (GPIF), the country's largest pension fund, announced on October 31st that it would trim its bond allocations from 60% to 35% and increase its target in equities from 12% to 25%.This news sent the Nikkei 225 to seven year highs and perhaps explains drawdowns in ETFs by local investors.

The GPIF targets add to the BoJ's expansionary movements where bond purchases have increased to 80tn Yen from 60-70tn.

There are signs that growth maybe trickling through and perhaps Abenomics is working. Markit's economic data indicates that the region may be indeed turning a corner as it registered the largest increase in factory production since March this year, partly buoyed by an increase in exports.

There are 226 exchange traded products (ETPs) that investors can use to gain exposure to Japan. As ever in the ETF world, assets are concentrated towards a few funds which have a disproportionate share of assets under management (AUM) as the ten largest ETFs represent 80% of AUM with the largest five representing 55%.

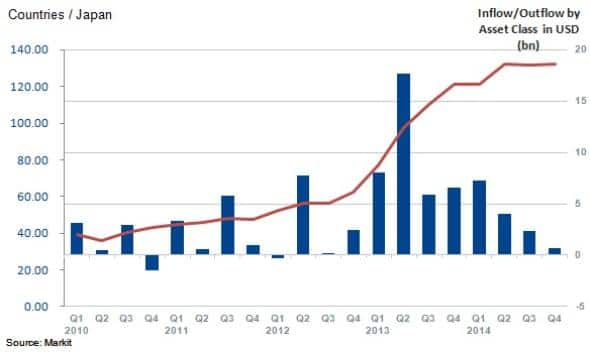

Over the last five years, AUM of exchange traded products in the region has quadrupled, from $34bn to $135bn.

Aggregate quarterly ETF inflows into Japan have been declining from a high of $17.7bn in Q2 2013 to a dismal current figure of $670m Q4 2014 to date (November 21st), but may reach $1bn by year end. AUM growth year to date is 9.1%. Overall, the majority of funds saw major inflows occur in the first quarter of the year.

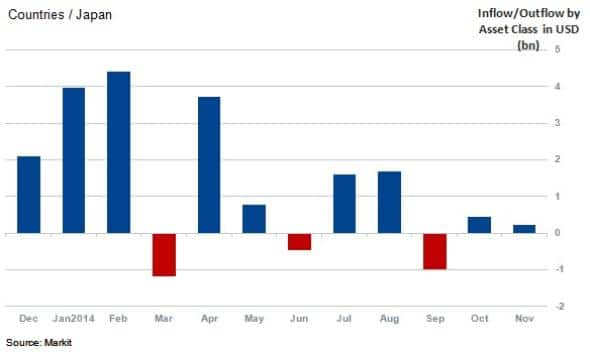

Foreign investors favouring currency hedged funds have masked the largest quarterly outflows of local funds in five years. Locally listed ETFs have witnessed approximately $3.6bn in outflows in the last quarter compared to foreign issued Japan focused ETFs which have seen inflows close to $4bn.

$1.6bn has flowed to foreign ETFS hedged against the Yen. Two hedged ETFs, which manage 12.7% of Japanese focused AUM, have seen a disproportionate share of inflows since the end of October.

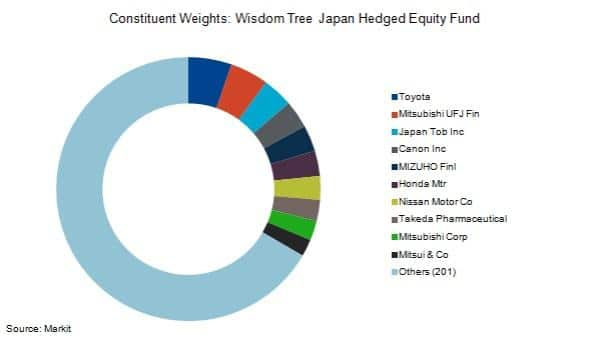

The iShares currency hedged ETF and the Wisdom Tree Japan Hedged Equity Fund provide investors with exposure to Japanese equity without exposure to the Yen. The funds are benchmarked against different indices however hold similar exposures to the largest listed companies in the region.

The Wisdom Tree fund is the larger of the two at $12.6bn in AUM representing 9.5% of Japan focused ETFs.

Although Wisdom Tree may end the year with flat AUM at $12.6bn, it has seen $3.2bn of inflows from a yearly low of $9.5bn in mid-October. Inflows over the last month have erased the steady outflows that have occurred since the middle of March 2014.

This implies that almost 30% of net ETF inflows into Japanese exposed ETFs have gone to hedged instruments indicating that foreign investors might be willing to invest in the Japanese economy and the arrows strategy might be working but they are preparing for a weaker Yen.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-Equities-Third-place-for-Abe-s-three-arrows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-Equities-Third-place-for-Abe-s-three-arrows.html&text=Third+place+for+Abe%27s+three+arrows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-Equities-Third-place-for-Abe-s-three-arrows.html","enabled":true},{"name":"email","url":"?subject=Third place for Abe's three arrows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-Equities-Third-place-for-Abe-s-three-arrows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Third+place+for+Abe%27s+three+arrows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-Equities-Third-place-for-Abe-s-three-arrows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}