Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 24, 2015

Shorts target Taiwanese technology

As Asian market turmoil spreads globally, manufacturers in Taiwan have come under pressure with short sellers targeting technology stocks and investors pulling funds from Taiwan exposed ETFs.

- Short sellers target technology as demand slows and competition for market share heats up

- Acer is the most short sold stock in Taiwan, while technology sector short interest up 10%

- Taiwan ETFs see two months of strong outflows, curbing a record breaking year of inflows

PMI points to Taiwan weakness

PMI data released by Markit in early August indicated that the Taiwanese manufacturing sector had experienced a further deterioration of operating conditions throughout July. Production levels, new orders and purchasing activity all fell sharply, with new export work declining by the fastest rate seen in almost three years.

This trend also shows no signs of slowing given China's recent yuan devaluation. This step could make Taiwanese exports less competitive against those of the largest exporter in the region, China.

ETFs feel the weakness

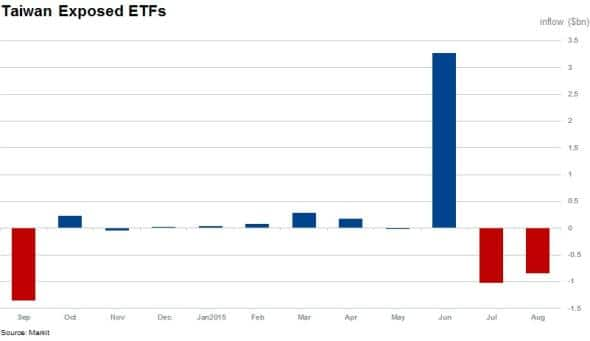

Weak PMI data is accompanied by ETP data that indicates ETF investors started to pull funds out of Taiwanese exposed funds early in July. However despite the recent outflows in July and August, and thanks to a very strong monthly inflow during June, the year is still on track to record the largest annual inflow into Taiwan ETFs.

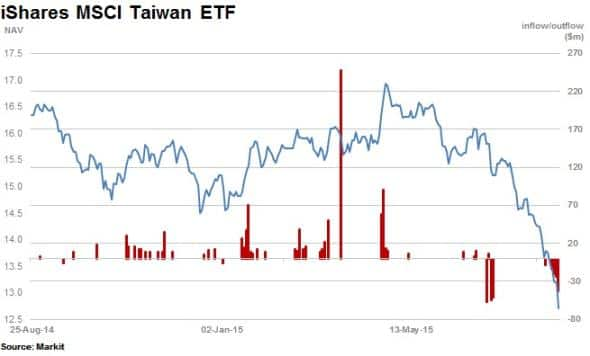

The iShares MSCI Taiwan ETF (EWT) with $3.14bn in AUM is the largest ETF tracking Taiwanese equities, representing 42% of current ETF AUM exposed to the region. The fund has seen almost $270m of outflows occur since the beginning of July, 8.5% of current AUM. Its NAV has fallen by a staggering 22.3% since the beginning of July.

Most shorted in Taiwan

Taiwan's recent struggles have also spurred on short sellers which have been circling around Taiwan's export driven technology shares since the start of the third quarter.

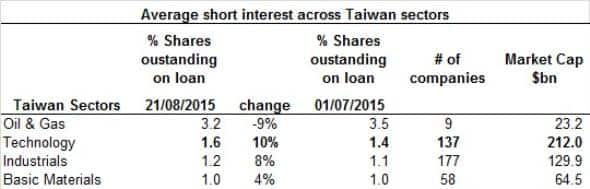

The three largest most short sold stocks in the region are technology firms, with the sector's average short interest rising by 10% since the beginning of July. While technology is only the second most shorted sector, it has ten times the market cap of the most shorted oil & gas sector.

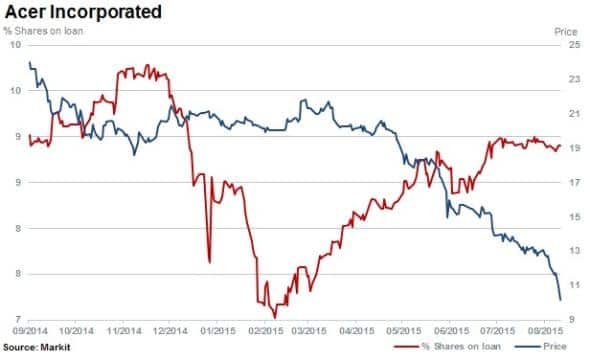

The most shorted in Taiwan currently is hardware manufacturer Acer who has once again been targeted.

Shares outstanding on loan have increased in to 8.9%. With 70% of available shares short sold, the cost to borrow remains high for the stock.

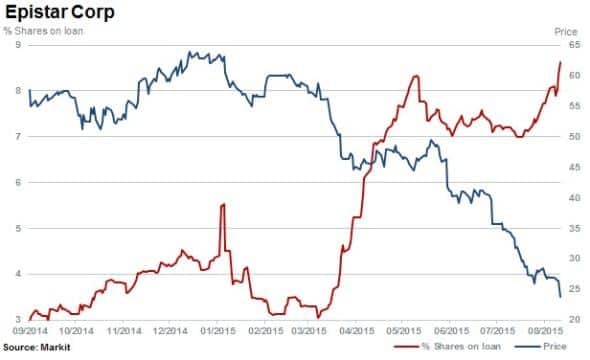

Falling into the semiconductor subsector, the second most shorted in the region is Epistar which manufactures LEDs. Shares outstanding on loan have jumped in recent weeks to 8.6%, a 52 week high.

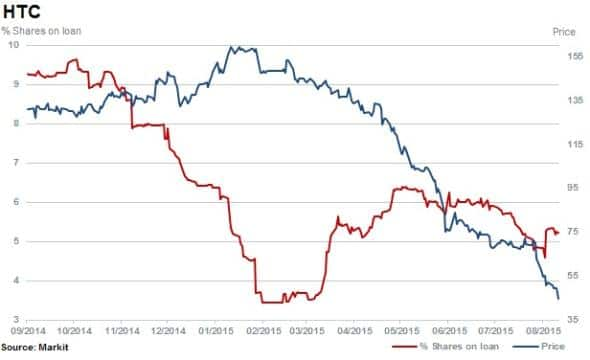

Making the top twenty most shorted in the region, handset maker HTC's stock has fallen by 71% in the last six months with short sellers covering positions by a half during the same period.

The struggling handset maker has battled against an incredibly competitive Asian market that has reached signs of saturation with signs of demand slowing down.

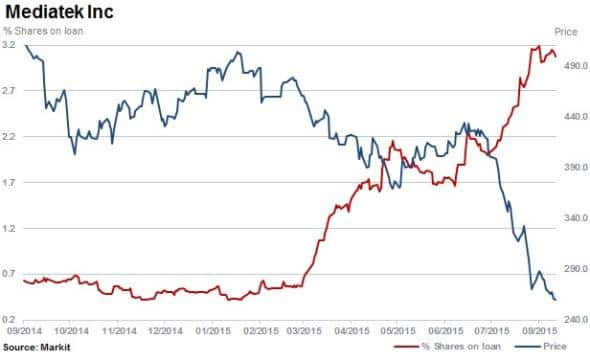

Another semiconductor name seeing heavy short interest in the last few weeks is Mediatek which is second to US rival Qualcomm in the manufacturing of semiconductors for mobile and wireless hardware applications. After three years of strong revenue and earnings growth, momentum for the firm has stalled and consensus forecasts point to stagnating sales and earning falling by a third for 2015. The majority of Mediatek chips are destined for Asian handset makers.

Short sellers utilise ETFs

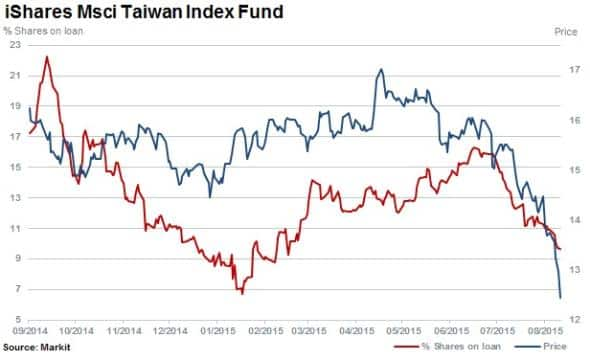

In a similar trend to that seen in China, short sellers have used the iShares MSCI ETF to efficiently short the Taiwan market.

Shares out on loan for the ETF currently stands 9.6%, declining by 22% in the last month as the ETF's NAV declined by 15% over the same period.

To find out more about Markit Securities Finance data, please contact us.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-equities-shorts-target-taiwanese-technology.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-equities-shorts-target-taiwanese-technology.html&text=Shorts+target+Taiwanese+technology","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-equities-shorts-target-taiwanese-technology.html","enabled":true},{"name":"email","url":"?subject=Shorts target Taiwanese technology&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-equities-shorts-target-taiwanese-technology.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+target+Taiwanese+technology http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-equities-shorts-target-taiwanese-technology.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}