Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 25, 2015

Credit subdued amid black Monday selloff

The vicious selloff in global equities over the past week has pointed towards a pending crisis, but credit markets have remained calm compared to previous periods of market unrest.

- Asian and US investment grade credit spreads hit a one and two year highs respectively

- European financials' credit held up better than broader European corporate credit market

- Markit iBoxx $ Liquid HY Index spread hit 566bps, 30bps tighter than 7-yr daily average

Equity market volatility hit four year highs yesterday as recent market jitters culminated in a global market meltdown. Global equity prices moved sharply lower and whipsawed intraday, with the Shanghai composite tumbling 8%. The session in equities drew comparisons with the crises seen in the past, although credit markets were more subdued.

Corporates nudge wider

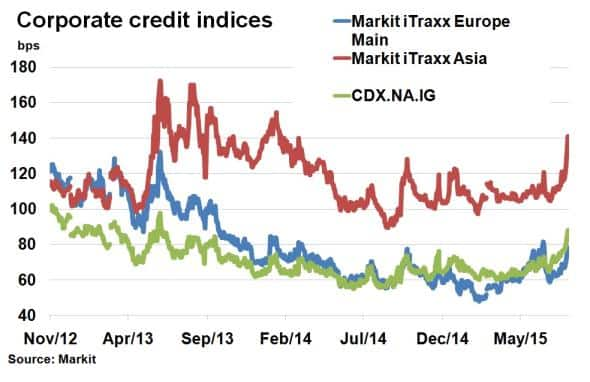

In investment grade corporate credit, the Markit iTraxx Asia Ex Japan IG index widened 10bps yesterday to reach 141bps; the highest level since March 2014. This was hardly ground breaking as the index surpassed this level on numerous occasions from mid-2013 to mid-2014, at the time of the 'taper tantrum', when Asian credit sold off. Back then, fears stemmed from what was wholly a credit problem, with minimal impact on the stock market.

It was a similar story in US investment grade, as represented by the Markit CDX.NA.IG index, which reached new two year highs yesterday before tightening this morning. Interestingly, European investment grade credit widened 4bps yesterday, but the Markit iTraxx Europe Main index was 6bps wider at the height of the Greece saga on June 7th, suggesting little panic.

Banks hold up

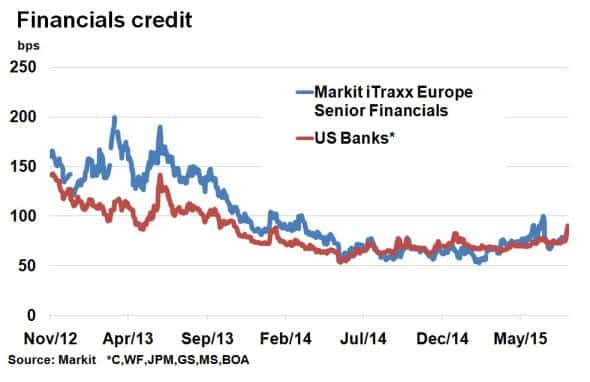

Parallels were also drawn with past crises like in 2008 when a credit bubble caused a deep recession, with the banking system the forefront.

A look at financial credit paints a more subdued story. The Markit iTraxx Europe Senior Financials index paired some of yesterday's spread widening, but yesterday's level of 90bps was still 10bps off year to date highs. The average CDS spread across the largest US banks did however reach a two year high at 90bps, but the average spread remains well below levels seen in early 2013.

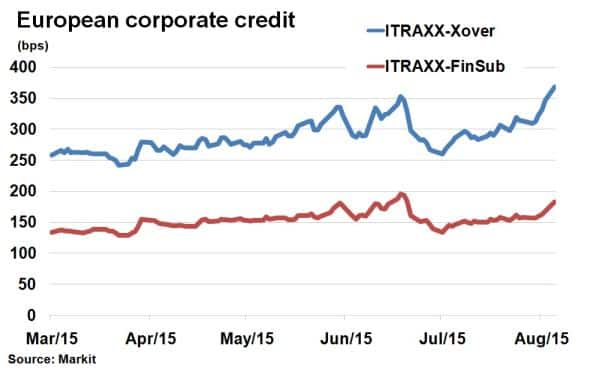

In fact, financials held up better than the broader market. The Markit iTraxx-FinSub index, which tracks the risk associated with subordinated debt in a bank's capital structure, widened 15bps yesterday to 182bps, well below the levels seen during the height of the Greece crisis. In contrast, the broader high yield credit market, as represented by the Markit ITRAXX-Xover widened 22bps to 367bps, 15bps wider than on July 7th.

High yield

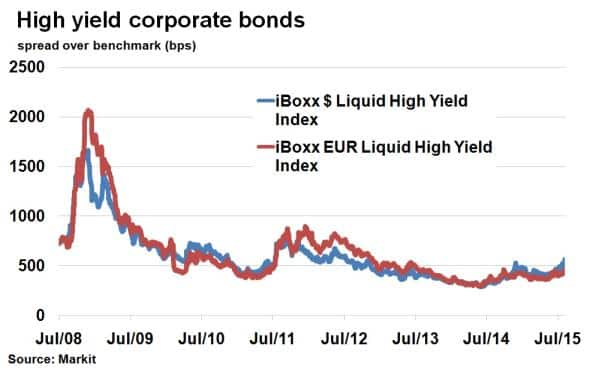

High yield bond mimicked credit, moving sharply wider. Looking at historical averages the Markit iBoxx $ Liquid High Yield Index spread hit 566bps, 30bps tighter than its seven year average. It was a similar story in European high yield with the iBoxx EUR Liquid High Yield Index spread over benchmark remaining significantly lower than the post 2008 daily average.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Credit-Credit-subdued-amid-black-Monday-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Credit-Credit-subdued-amid-black-Monday-selloff.html&text=Credit+subdued+amid+black+Monday+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Credit-Credit-subdued-amid-black-Monday-selloff.html","enabled":true},{"name":"email","url":"?subject=Credit subdued amid black Monday selloff&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Credit-Credit-subdued-amid-black-Monday-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+subdued+amid+black+Monday+selloff http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Credit-Credit-subdued-amid-black-Monday-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}