Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 24, 2017

Oil volatility fails to rouse short sellers

Short sellers are still largely steering clear of energy stocks despite the resurgence in oil price volatility.

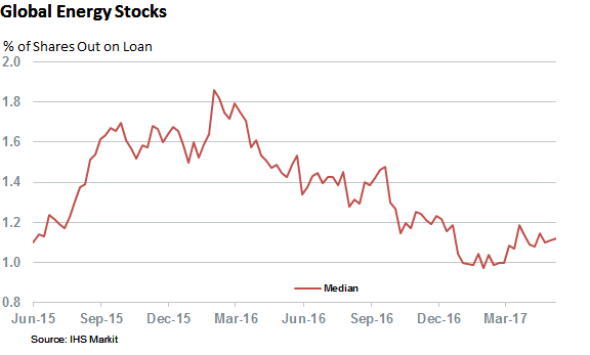

- Median short interest across global energy stocks near two year lows

- Corporate actions driving a larger portion of energy short selling

- Service and equipment providers most heavily shorted part end of the sector

Oil price volatility came back to life this month when as bumper US production numbers, ongoing questions about the future state of OPEC supply cuts and other technical factors, briefly sent the price of spot Brent crude barrel below the $47 mark for the first time since November of last year. This selloff brought back memories of last year's wild swings which sent energy stocks to multi year lows whilst driving short interest in the sector ever higher. While the former has occurred to some extent, as evidenced by the fact that the largest energy sector ETF, the Energy Select Sector SPDR Fund (XLE), extended its year to date underperformance against the S&P 500 past the 15% mark; short sellers are so far staying on the sidelines during this period of volatility. The last month has seen global energy shares register only a 3% increase in the sector's average % of shares outstanding on loan.

Average shorting activity across all global energy firms has ticked up somewhat from the recent lows set over January; bearish bets are still way off the levels registered during the height of last years' volatility. In fact the current average short interest across these 700 plus energy firms whose shares are freely available in the securities lending market, 3.3% of shares outstanding, is still a quarter lower than that seen in February of last year; when oil prices hit their lows.

Median average demand to borrow energy shares, which gives a better indication of how broad the shorting activity is distributed across the sector is even lower at 1.1% of shares outstanding which is just about the lowest level in over two years.

The varying spread between these two gauges of bearish sentiment in the energy space indicates that short sellers are taking a much more precise approach to shorting the sector which is a departure from the broad brush employed during the worse of last year's selloff. This coincides with the narrative on the ground as well capitalized firms, with profitable operations, rebound strongly while industry laggards, some of whom have large debt overhangs, struggle to regain momentum.

Corporate action driving demand to borrow

The current high conviction short plays are also more likely to be targeted for reasons other than purely directional short selling. Corporate actions such as warrants issuance, debt for equity exchanges and convertible bond issuance have made several stocks targets of arbitrage traders looking to take advantage of pricing anomalies thrown off by corporate actions.

One such firm is Premier Oil, the second most shorted global oil firm at the moment. Premier recently announced a debt restructuring which saw it issue warrants representing 90 million shares. Investors have hedged their warrant exposure by shorting premier share to borrow premier shares has jumped more than ten-folds in the last six months to the current 30% of shares outstanding. Ironically this large short interest should be viewed as a vote of confidence in investors' long term view of the firm as it indicates approval of its debt restructuring.

Not all good news

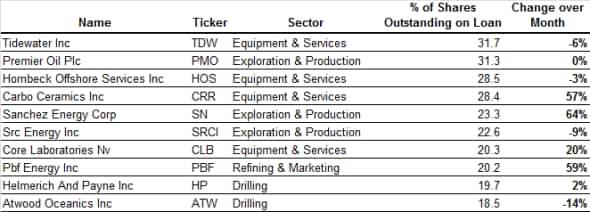

Not every energy stock is out of the woods yet however as plenty of energy stocks still see more than their fair share of shorting activity. As previously mentioned, the current crop of high conviction shorts is mostly composed of the sector's laggards as the 10 most shorted energy names currently have seen their shares fall by 50% on average which is over three time the fall registered by previously mentioned XLE ETF.

A deeper dive into the current crop of top energy stocks finds a disproportionate number of services firms among these ranks. These firms tend to be viewed by investors as latter cycle plays which perform best when the sector is in a free spending mood; something which is still elusive in the current rally.

Tidewater, the most shorted energy firm at the moment, fits into both categories as slump has taken the offshore ship operator's shares down by 97% over the last two years. This leaves precious little meat on the short trade as Tidewater's market cap is currently hovering around $35m.

Exploration firms, such as Sanchez and Scr Energy, which have 23 and 22% of their shares out on loan respectively, make up the majority of the remaining firms among the latest snapshot of the 10 most shorted energy names.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Equities-Oil-volatility-fails-to-rouse-short-sellers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Equities-Oil-volatility-fails-to-rouse-short-sellers.html&text=Oil+volatility+fails+to+rouse+short+sellers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Equities-Oil-volatility-fails-to-rouse-short-sellers.html","enabled":true},{"name":"email","url":"?subject=Oil volatility fails to rouse short sellers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Equities-Oil-volatility-fails-to-rouse-short-sellers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+volatility+fails+to+rouse+short+sellers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Equities-Oil-volatility-fails-to-rouse-short-sellers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}