Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 24, 2015

Rebound in durable goods orders fails to dispel economy worries in the US

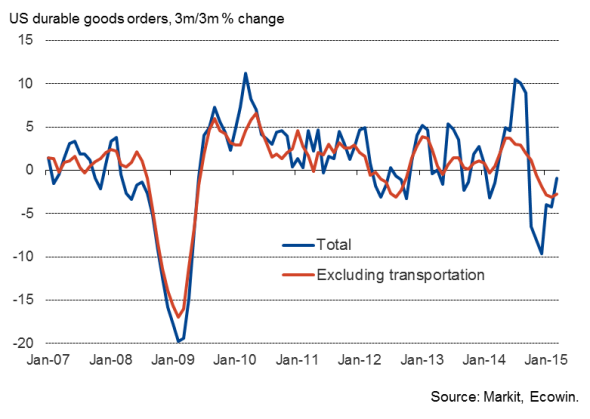

A sharp rebound in orders for long-lasting manufactured products raises expectations of US interest rates rising this year. However, dig a little deeper into the data and signs of lingering weakness in business investment add to the case for any decision on tightening policy to be delayed until later in the year when the health of the economy in the second quarter becomes clearer.

Waning rate of order book decline

Durable goods orders rose 4.0% in March, recovering from a 1.4% decline in February. Over the first quarter as a whole, orders are down 1.0%, but that compares favourably with the worryingly-steep 9.6% decline seen in the final quarter of last year.

If transportation goods are excluded, orders were down for a sixth successive month, but at 0.2% the latest drop was the smallest seen over this period, pointing to an easing in the downward trend and raising hopes that the order book trend will move positive in the summer months.

Lingering concerns

However, policymakers will remain concerned on two fronts.

First, orders excluding transportation are still down 2.8% over the first quarter as a whole, pointing to an ongoing malaise in business investment spending, which in turn highlights the economy's continued dependence on consumer spending. Note that although orders for capital goods (i.e. business equipment and machinery) rose 4.8% in March, they were down 0.5% once defence and aircraft orders were stripped out

Second, the data follow manufacturing PMI data which showed the goods-producing sector suffering a downturn in export orders in April, which will add to worries that the strong dollar is hitting demand for US-made goods in export markets, while also leading to import substitution at home.

The survey and durable goods orders both therefore suggest that, although tide is turning from the weakness seen in the manufacturing economy at the start of the year, the underlying trend in demand remains weak. Concerns over the dollar's appreciation and weak business investment will therefore continue to haunt policymakers and most likely lead to calls for rate hikes to be pushed back to later in the year at the earliest.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Rebound-in-durable-goods-orders-fails-to-dispel-economy-worries-in-the-US.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Rebound-in-durable-goods-orders-fails-to-dispel-economy-worries-in-the-US.html&text=Rebound+in+durable+goods+orders+fails+to+dispel+economy+worries+in+the+US","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Rebound-in-durable-goods-orders-fails-to-dispel-economy-worries-in-the-US.html","enabled":true},{"name":"email","url":"?subject=Rebound in durable goods orders fails to dispel economy worries in the US&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Rebound-in-durable-goods-orders-fails-to-dispel-economy-worries-in-the-US.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rebound+in+durable+goods+orders+fails+to+dispel+economy+worries+in+the+US http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Rebound-in-durable-goods-orders-fails-to-dispel-economy-worries-in-the-US.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}