Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 24, 2016

Shake down of IPOs: Class of 2015

New company issuances create frenzied buying and selling scenarios as firms enter the public sphere. In certain cases Limited stock supply is driving insatiable demand from investors who at times are as enthused as short sellers.

- Shorts profit on Shake Shack but company still one of the most successful IPOs of 2015

- As Twitter trades below its IPO price its cousin Square joins Godaddy as best performers

- Spark Therapeutics and Fitbit currently most shorted companies of the class of 2015

Based on IPO pricing levels, two thirds of firms are in negative territory but Shake Shack (down 65% from IPO highs) is still among top the performers.

Only a third of 150 North American firms that IPO’d during 2015 with market caps currently greater than $100m; are currently trading higher than their initial public offer pricing levels.

Sectors suffering the most include; alternative energy, medical equipment, biotechnology and pipelines. Companies listing in these sectors saw their stocks lose more than a fifth on average since coming to market. Short sellers, despite supply constraints have been very active in shorting newly public companies.

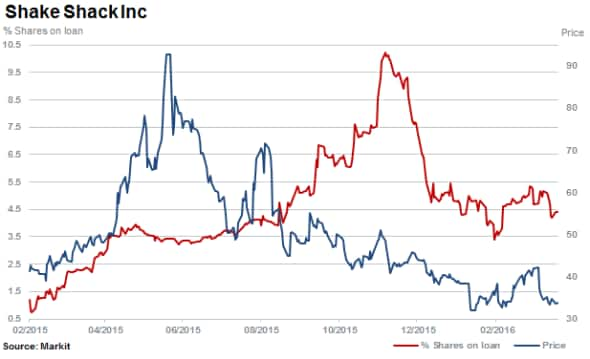

A feeding frenzy occurred on Shake Shack’s public debut, even after the company raised the price of its 5m share offering to $21. Shares doubled and touched highs of above $90 dollars in a few months, attracting significant interest from short sellers.

While early investors bidding up a limited amount of shares in hindsight may have wished they put in a different order, a year on the IPO has proved successful for the company and for patient short sellers.

Short sellers who were willing to pay significant costs at times to short were rewarded. Limited supply of lendable shares available combined with aggressive demand saw the cost to borrow Shake Shack soar above 100% in July 2015.

While Shake Shack’s stock has fallen to fresh lows since its IPO ‘pop’, down some 65%, the stock is still up 61% for investors who managed to catch the initial 5m plus shares offered. Additionally, the company’s secondary 4m share offering during August 2015 at $60 raised significant capital.

Joining Shake Shack among the top performing IPO’s in 2015 (based on initial pricing) is Godaddy whose shares have recently moved 60% higher. This has sent short sellers covering half of positions with 1.6% of shares outstanding on loan currently.

Just outside of the top ten performers is Square, which shares a CEO with Twitter. Twitter now trades below its IPO price, yet Square has surged 45%. Only listing in November 2015, significant demand to borrow the stock has its cost to borrow remain materially high with a relatively low amount of shares currently outstanding on loan at 2.7%

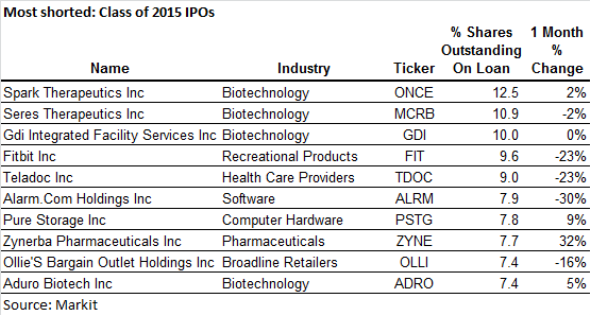

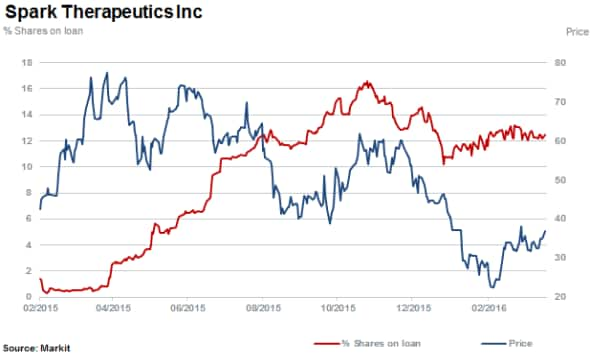

Also among the top ten IPO performers of 2015 but at the same time most shorted across the universe of 150+ stocks is Spark Therapeutics, with 12.5% of shares outstanding on loan.

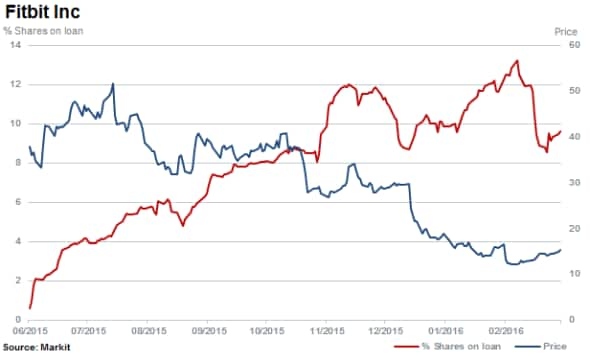

Joining the list of most shorted IPO’s of 2015 is Fitbit. The company has 9.6% of its shares outstanding on loan which have fallen a quarter since the firm went public.

Relte Stephen Schutte | Analyst, IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Equities-Shake-down-of-IPOs-Class-of-2015.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Equities-Shake-down-of-IPOs-Class-of-2015.html&text=Shake+down+of+IPOs%3a+Class+of+2015","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Equities-Shake-down-of-IPOs-Class-of-2015.html","enabled":true},{"name":"email","url":"?subject=Shake down of IPOs: Class of 2015&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Equities-Shake-down-of-IPOs-Class-of-2015.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shake+down+of+IPOs%3a+Class+of+2015 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Equities-Shake-down-of-IPOs-Class-of-2015.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}