Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 24, 2015

Macau casinos to cut dividends

Macau casinos continue to suffer as high roller VIP clients reduce gambling spend while China's economy slows and short sellers take advantage of opportunities.

- Macau casinos attract double the amount of short interest compared to peers

- Wynn Macau remains the most shorted casino in the region

- Dramatic dividend cuts are forecast for at least four large operators

Chinese crackdowns shifting bets

The anti-graft campaign being carried out by Chinese president Xi Jinping, intended to eliminate corruption and ostentatious spending, is dramatically impacting the fortunes of Macau based casinos.

Operators and their share prices are feeling pain as analysts have cut forecasts and recommendations on the majority of major players. Short sellers' current negative sentiment towards Macau casinos is best represented by the average proportion of free float out on loan. The current figure stands at 5.3%, substantially higher compared to the average of 2.4% for other Hong Kong listed gaming and leisure firms.

Dividend cuts are now forecast for the industry as a record 49% decline in monthly gross revenue was recorded in February 2015. Macau casinos have posted nine consecutive months of accelerating decreases in monthly gross gaming revenues.

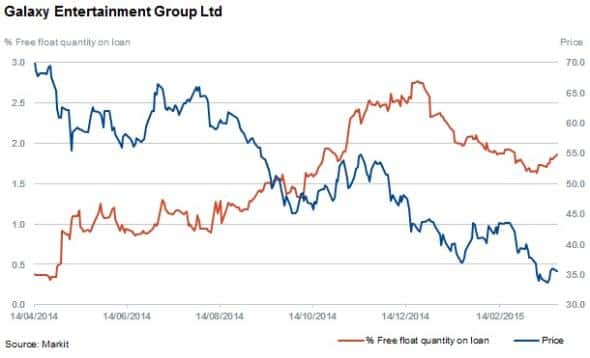

Strong first half results in 2014 saw Galaxy Entertainment post a 9% increase in full year revenue but second half revenues actually fell by 15%. Galaxy has acknowledged that the recent graft campaign impacted high roller VIP revenues which are responsible for a third of its gaming revenues. These declined by 16% in the fourth quarter alone.

Free float out on loan for Galaxy peaked at 2.8% in late December 2014 and short sellers have since covered a third of their positions. Shares in the company have continued to decline in 2015 and are now 16% lower than at the start of the year.

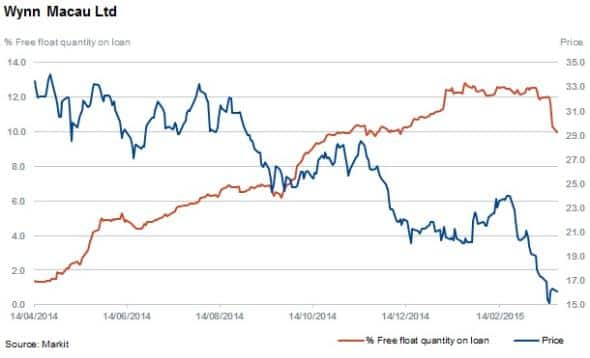

Wynn Macau continues to be the most shorted casino with 9.9% of free float out on loan. The company's share price has fallen by a third in just the last month as short sellers covered by 20%. Markit Dividend Forecasting is expecting the company's final dividend for the 2014 financial year to be revised down by a substantial 39% next week, although it did announce a special dividend in early March. This could explain the substantial movement in the company's stock in the last month.

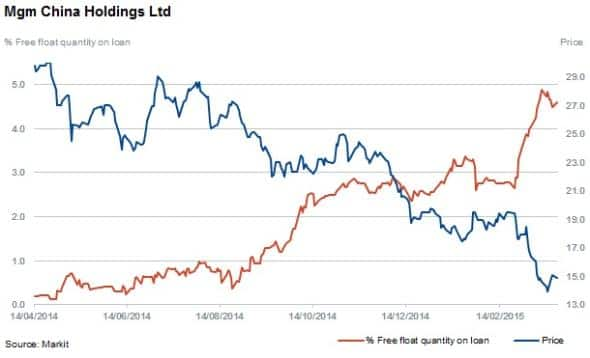

Sjm and MGM China are expected to cut their interim dividends for fiscal 2015 by 27% and 32%, respectively, when they are announced in the summer. This follows a second consecutive cut from MGM, having already reduced its 2014 final payment. Both names have seen a significant increase in short positions in the last few weeks.

Free float out on loan for Sjm has increased by 52% to reach 4.0% while the number for MGM China has increased by 33% to reach 4.6%. Both of these significant increases in shorting activity have been accompanied by double digit share price declines.

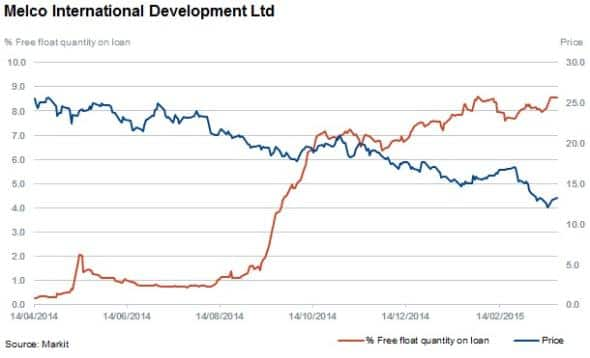

Melco International has seen a significant sell off in recent weeks as the stock declined by 27% in the last month. The company is expected to cut its final 2014 dividend by as much as 63%. Short sellers are holding their stations despite the recent share price collapse with the per cent of free float out on loan holding at record highs of 8.6%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-equities-macau-casinos-to-cut-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-equities-macau-casinos-to-cut-dividends.html&text=Macau+casinos+to+cut+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-equities-macau-casinos-to-cut-dividends.html","enabled":true},{"name":"email","url":"?subject=Macau casinos to cut dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-equities-macau-casinos-to-cut-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Macau+casinos+to+cut+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-equities-macau-casinos-to-cut-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}