Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 24, 2015

Fed boosts Latam credit

The Fed's dovish tone last week has soothed negative sentiment surrounding Latin American credits.

- Latam CDS spreads are down sharply after last week's dovish FOMC meeting

- Petrobras has seen short term spreads compress, buoyed by US Treasury

- Brazilian corporate bonds now provide 1.24% of extra yield over US junk bonds

The bearish sentiment around Latin American credits was reversed last week as the US Federal Reserve signalled a more cautious economic outlook and subsequent slower path for monetary tightening. Vast quantities of emerging market debt, like that in Latin America, are denominated in US dollar. The dovish tone emanating from the Fed was welcomed by market participants' heightened expectations of a prolonged low borrowing environment.

Sovereign contagion

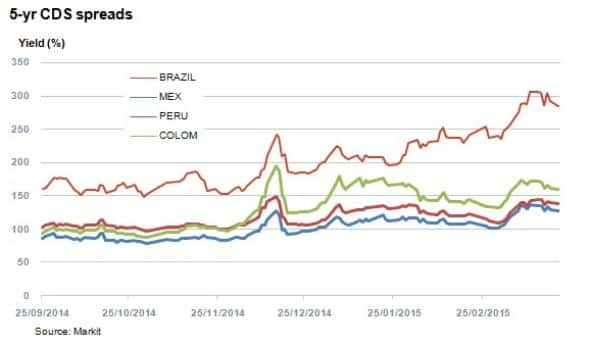

Credit markets were first to react positively to these developments, as evidenced by the falling cost of insuring Latam government bonds against default.

Over the last couple of months, Brazilian bonds CDSs were initially set apart from the rest of the Latam sovereign pack. This was the back on the increasingly negative fallout from the Petrobras corruption scandal. In fact Colombian and Mexican CDS spreads tightened 25bps and 15bps in February while Brazil traded 4bps wider. But the continuing weakness in oil prices and the strengthening of the US dollar saw the entire Latin American universe trade wider in early March.

Following the FOMC meeting, Brazilian 5-yr CDS spreads tightened 18bps to 286bps, accompanied by Mexican and Colombian sovereign spreads which tightened by 15bps and 7bps respectively.

The cash markets also reacted positively to the FOMC developments. Peru's recently issued 2050 bond, gained 3.75 points on the back of the Fed's comments, according to Markit bond pricing. It is worth noting that Peru's 5-Yr CDS spread remains near a 52 week high, and has triggered an alert from Leading Risk, a company providing credit research signals, indicating further expected credit deterioration.

Corporate bonds

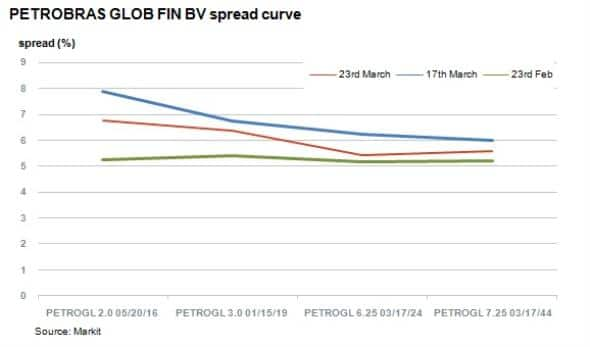

The improved credit outlook off the back of the FOMC meeting has also lifted the mood in corporate credit.

The Fed's actions allowed Petrobras to regain some lost ground following the recent corruption and as the company saw spreads on its US dollar denominated bonds recover. The short end of the yield curve tightened over 100bps; the long end, as gauged by the 7.25% 2044 bond, saw its spread over treasuries decrease by 40bps. However, the curve remains inverted - a sign of distress.

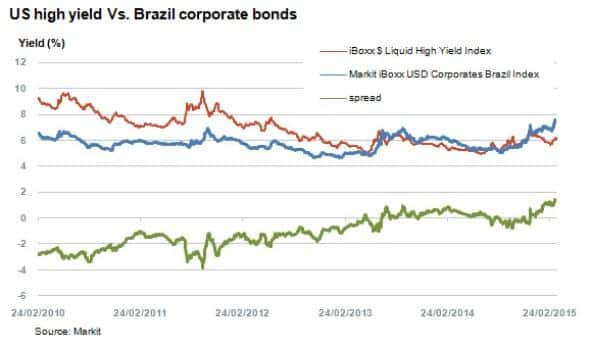

The Petrobras scandal also threatened to spill over into other credits with no association with the company. In the week before the Fed's comments The Markit iBoxx USD Corporates Brazil Index average yield rose sharply from 7.04% to 7.57%, representing a fresh five year high, before improving to 7.31% as buying set in.

This still leaves the spread between The Markit iBoxx USD Corporates Brazil Index and the iBoxx $ Liquid High Yield Index at 1.24%, which is close to all time high levels.

The iBoxx USD Corporates Brazil Index is made up of a mixture of investment and high yield names. Contrasting today's record high spreads against the historically negative spread over US high yield credit, explains why any positive macro news benefitting the region is met by strong investor demand.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Credit-Fed-boosts-Latam-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Credit-Fed-boosts-Latam-credit.html&text=Fed+boosts+Latam+credit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Credit-Fed-boosts-Latam-credit.html","enabled":true},{"name":"email","url":"?subject=Fed boosts Latam credit&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Credit-Fed-boosts-Latam-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+boosts+Latam+credit http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Credit-Fed-boosts-Latam-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}