Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2015

Boon to UK households as inflation falls to zero

UK inflation has fallen to zero for the first time on record. Consumer prices were unchanged on a year ago in February, having been 0.3% higher in January, according to the Office for National Statistics. (Note that current records only began in 1989. The ONS estimates that inflation may have been negative briefly in the 1960s.)

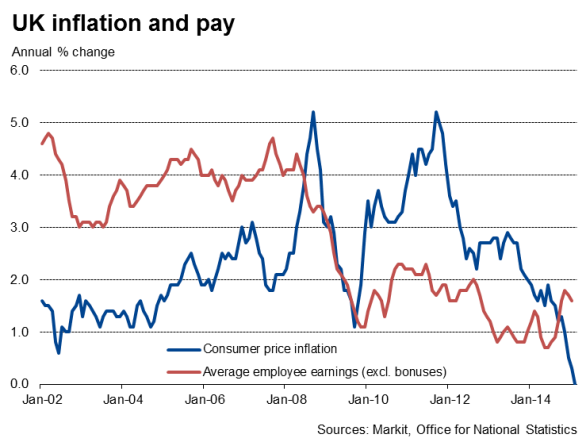

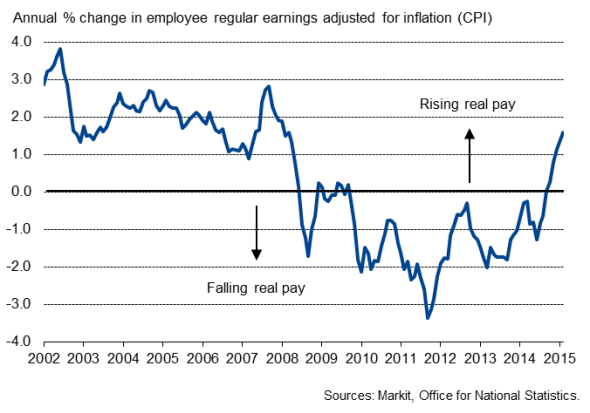

Rather than being a concern, the drop in inflation is a boon to the economy, providing households with greater spending power at a time when pay growth remains frustratingly weak. Real regular wages are currently rising at their fastest rate for seven years - increasing at an annual rate of 1.6% - but this is largely thanks to lower inflation rather than rising earnings. With pay growth currently running at just 1.6% once bonuses are excluded (and just 1.8% including bonuses), the weakness of employee earnings remains one of the major worries in relation to the sustainability of the economic upturn.

Real pay growth

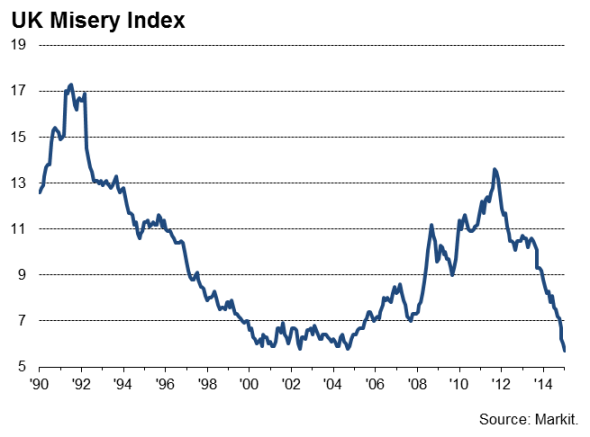

Household surveys clearly highlight how improved sentiment, which has risen to a post-recession high in recent months, is currently being driven by lower inflation. The 'misery index', derived from measures of unemployment and price pressures has hit its lowest since data were first available in 1989 on the back of falling joblessness and the lack of inflation.

Inflation looks set to fall further in coming months as lower oil and energy prices feed through to consumers, slipping into negative territory before starting to pick up again later in the year (as the effect of lower oil prices works its way out of the annual comparisons). Consumer spending therefore looks set to receive additional support from low prices as we move into the summer.

The concern is, of course, that consumer spending could wane as soon as inflation starts to pick up again unless we see stronger wage growth materialise soon.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Boon-to-UK-households-as-inflation-falls-to-zero.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Boon-to-UK-households-as-inflation-falls-to-zero.html&text=Boon+to+UK+households+as+inflation+falls+to+zero","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Boon-to-UK-households-as-inflation-falls-to-zero.html","enabled":true},{"name":"email","url":"?subject=Boon to UK households as inflation falls to zero&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Boon-to-UK-households-as-inflation-falls-to-zero.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Boon+to+UK+households+as+inflation+falls+to+zero http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Boon-to-UK-households-as-inflation-falls-to-zero.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}