Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 23, 2015

CDS implied and credit agency ratings diverge

There are currently 21 investment grade credits with CDS spreads implying junk status, while high yield North American consumer driven credits continue to improve.

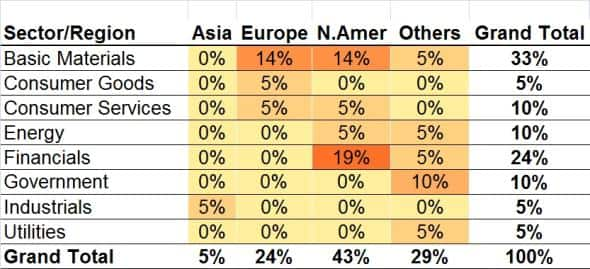

- North American Basic Materials and Financials make up the biggest chunk of investment grade names with CDS implying high yield status

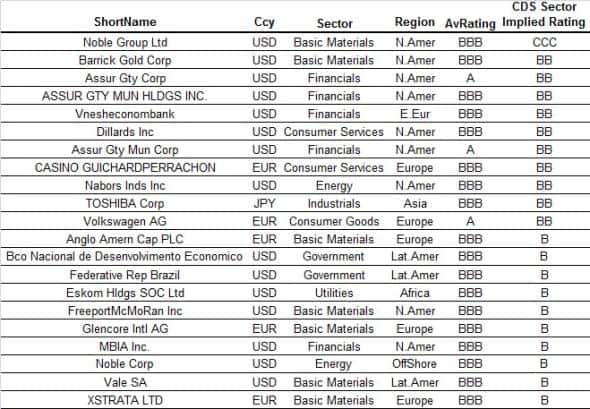

- Noble Group has the widest gap between average rating and implied rating; BBB and CCC

- High yield consumer-led credits lead names whose CDS implies an investment grade status

The second half of this year has seen fixed income markets blighted by bouts of idiosyncratic risk among single name credits. Names such as Volkswagen and Glencore have dominated headlines amid unexpected news and broader macro volatility.

The pace at which such risks have escalated has left traditional credit risk measures such as credit ratings lagging, with market participants increasingly looking for more rapidly reacting measures of risk. The use of CDS data has been one such method, providing liquidity amid volatility and transparency.

Using Markit's CDS pricing service, implied ratings can be derived based on single name 5-yr CDS spreads and associated CDS sector curve spreads. Discrepancies between actual credit ratings and implied credit ratings give an indication of gaps between market perception and rating agency perception of credit risk. While there are some limitations between the comparison, such as CDS liquidity and credit agency time horizons, the analysis provides useful insight.

Investment grade, implied high yield

Of the 1043 single name senior CDS credits, currently 21 investment grade issuers trade at CDS levels that imply high yield status.

Unsurprisingly, the basic materials sector makes up 33% of the 21 names. The second half of this year has seen commodity prices hit by slowing global trade, particularly in major importer China, straining credits in the sector.

Commodities supplier Noble Group's CDS spread currently implies a CCC rating, three notches below its average rating of BBB. While in Europe, miners Glencore and Anglo American CDS spread imply a single 'B' rating even though both are currently still hanging onto investment grade status.

On the sovereign front, Republic of Brazil CDS implies high yield status, although its average rating remains on the cusp, with only S&P having made the move to downgrade it to BB+.

Financials make up 24% of the names, with a large concentration in North America. These are dominated by US municipal bond insurers MBIA and Assur Gty Corp, which have seen CDS spreads widen during the contagion caused by US municipalities such as Puerto Rico.

High yield, implied investment grade

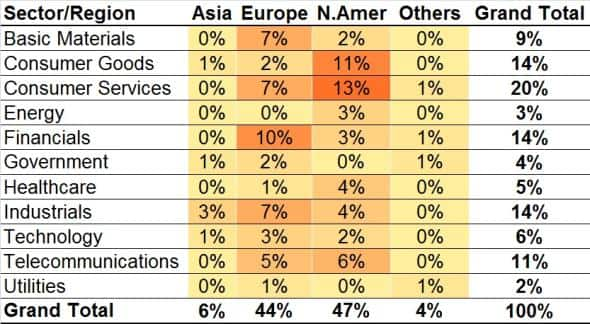

On the flip side of the trend, there are currently 103 credits that are currently rated as high yield by rating agencies, while their CDS spreads imply otherwise. These issuers are broadly equally split between Europe and North America, which could be a sign of the US' improving economic fundamentals and easy monetary policy in Europe.

The biggest sectors that stand out in North America are good and services consumer sectors. Owing to the US's economic recovery, names such as Saks, E W Scripps and TRW Automotive all see CDS spreads implying an 'A' rating, even though rating agencies have them below BBB.

Elsewhere, European financials continue see their credit risk tighten among an easy monetary backdrop and continued balance sheet improvement. Particularly among Europe's' periphery, Spanish banks such as Banco de Sabadell and Banco Pop Espanol and Banca Monte dei Paschi di Siena, Italy's oldest bank, all now see CDS levels implying a BBB rating.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112015-credit-cds-implied-and-credit-agency-ratings-diverge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112015-credit-cds-implied-and-credit-agency-ratings-diverge.html&text=CDS+implied+and+credit+agency+ratings+diverge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112015-credit-cds-implied-and-credit-agency-ratings-diverge.html","enabled":true},{"name":"email","url":"?subject=CDS implied and credit agency ratings diverge&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112015-credit-cds-implied-and-credit-agency-ratings-diverge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CDS+implied+and+credit+agency+ratings+diverge http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112015-credit-cds-implied-and-credit-agency-ratings-diverge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}