Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 20, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week, plus names identified at risk of experiencing a short squeeze.

- Gamestop most shorted S&P500 name, bears and bulls hold steady after downgrade-drop

- Oprah squeeze begins to hurt as 100% shorts out-of-the-money in Weight Watchers

- Utility Warehouse (Telecom Plus) recently sent short sellers covering with previous results

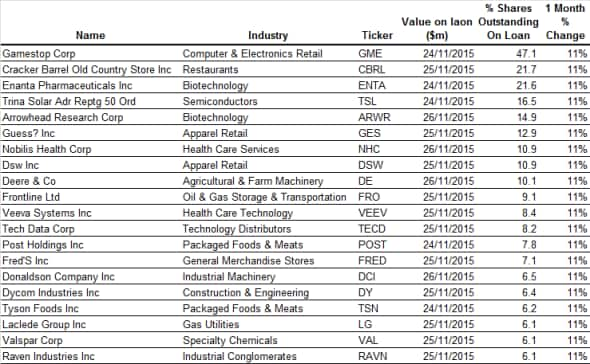

North America

Most shorted ahead of earnings this week and the most shorted in the S&P500 currently is Gamestop with 47% of shares outstanding on loan.

Persevering short sellers were rewarded last week with a 13% sell off after an analyst downgrade sent Gamestop shares diving. Last week has also seen the cost to borrow stock increase by 37%, indicating that bearish sentiment remains strong ahead of earnings due out on Monday.

Second most shorted for a consecutive quarter ahead of earnings is Cracker Barrel Old Country Store. The stock has been driven 11.4% lower since September while shares outstanding on loan have increased by 50%.

Third most shorted is Enanta Pharmaceuticals, a biotech firm researching and developing drugs for viral infections and liver disease. Shares outstanding on loan currently stand at 21.6%.

Shares in Enanta plummeted on October 22nd when the FDA issued a warning on AbbVie's hepatitis C drug Viekira Pak - components of which are supplied by Enanata Pharmaceuticals.

Short squeeze

Research Signal's Short Squeeze model* identifies companies highly likely to suffer a squeeze under current trading conditions.

One such company identified last week is Weight Watchers International. The company has been on the radar of short sellers since shares surged in October post a strategic investment by Oprah Winfrey of over "40m.

The company recently posted disappointing earnings with a lower active subscriber base and recruitment numbers during the quarter. Despite poor earnings, shares have risen 56% since, characteristic of where a stock has been highly shorted and the shorts are capital constrained. 100% of the shorts are out-of-the-money as of November 18th 2015.

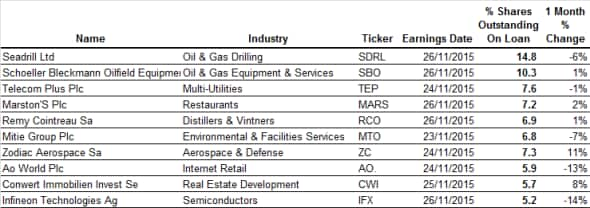

Europe

Most shorted ahead of earnings in Europe is offshore driller Seadrill, which has seen a dramatic 43% fall in its shares in the second half of 2015. Sustained lower oil prices have dampened exploration activities as oil firms reduce budgets. Shares outstanding on loan currently stand at 14.8%.

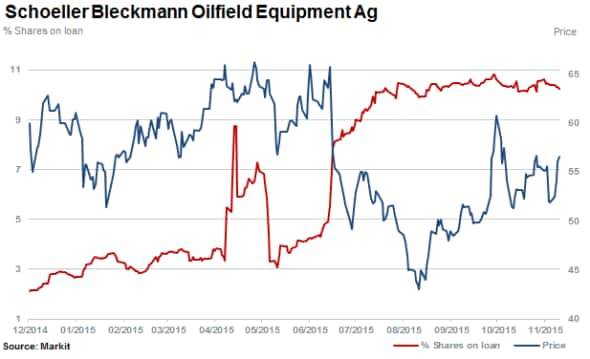

Austrian Shoeller-Bleckmann Oilfield Equipment is the second most shorted ahead of earnings in Europe with 10.3% of shares outstanding on loan. The firm supplies tools and equipment into the well drilling segment and is heavily exposed to the US oil producers.

Third most shorted in Europe ahead of earnings is low cost utility group Telecom Plus with 7.6% of shares outstanding on loan. Shares have turned a corner andreclaimed some 30% since June after the company released positive trading results for the year ending March 31, 2015.

Other notable European stocks shorted ahead of earnings include cognac maker Remy Cointreau with 6.9% of shares sold short and Zodiac Aerospace which has been targeted due weakness emanating in the weak demand for new aircraft.

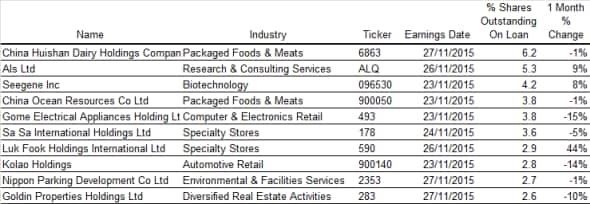

Apac

Most shorted ahead of earnings in Apac is one of the biggest dairy producers in China, Huishan Dairy. The company has seen short sellers cover positions by 20% since June, as the stock price has increased over 80% in the last six months.

Second most shorted is ALS, an International testing service business with a heavy exposure to geochemistry, metallurgy and mining industry. 5.3% of shares are currently outstanding on loan.

Among the most shorted in Apac is Asian cosmetics retailer Sa Sa International with 3.6% of shares outstanding on loan. Drops in both sales and gross profits have hit the Hong Kong listed firm which released a profit warning notice last month stating that H1 FY16 is expected to be down over 50% year-on-year. Markit Dividend Forecasting expects the company's dividends to be significantly lower than their prior corresponding periods.

Relte Stephen Schutte, Analyst at Markit

Posted 20 November 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}