Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 17, 2015

Rolls-Royce caught in turbulence

Investors punished Rolls-Royce last week while short sellers banked profits, highlighting the uncertainty faced by the aerospace industry as weaker activity and order pipelines are expected.

- Shorts built up $1bn in positions ahead of Rolls-Royce's fall, catching out long investors

- Markit Dividend Forecasting expects Rolls-Royce to cut distributions by 54%

- Surge in short interest across European aerospace seen during the second half of 2015

Cabin pressure

The aerospace industry is reeling from a decline in commercial activity, digesting a slump in global demand as Asian markets cool off. Sustained lower oil prices have impacted jet fuel costs and have put downward pressure on the premiums charged for new aircraft. Planes already in service, although less efficient, can now be kept operating for much longer than previously anticipated.

Compounding pressures are aircraft that are expected to come off lease, adding to global supply at bargain prices. Aircraft makers have subsequently begun to come under increasing pressure and have been targeted by short sellers.

Boeing reported stronger third quarter results, lifted by its military business with shares rallying since August. Short sellers have not been convinced, doubling positions in the last three months to 2.3% of shares now out on loan. There is concern regarding Boeing's 777 sales at risk as planes come off lease.

Maker of the Learjet, Canadian based Bombardier, has seen shares fall 70% in the last 12 months and in October after selling a $1bn stake to the Quebec regional government.

Bombardier's efforts to break into the passenger market with its model C series, where Boeing and Airbus dominate, have had endless delays. Short sellers have covered positions as the stock has fallen but have held on to a significant 5.3% of shares outstanding on loan.

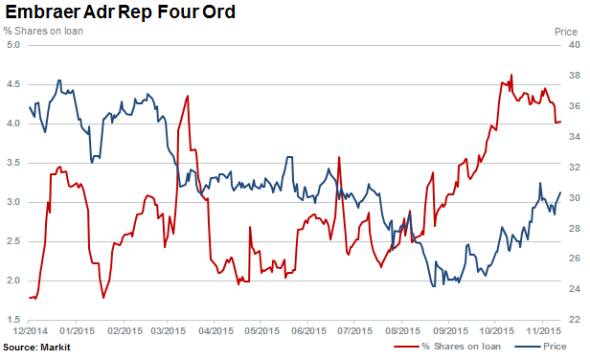

Short interest has increased in the ADR of Brazilian aircraft manufacturer Embraer. Shares outstanding on loan have risen to 4.0%, up 50% in the last three months while shares have increased by 50%.

The downturn in commercial and executive jet activity has also impacted firms who derive revenues from aircraft maintenance and supply of components, such as FTSE 100 constituent Rolls-Royce.

Shorts ahead of the curve

Rolls-Royce shares had already fallen 36.7% after peaking in April 2015. This was prior to the release last week, which indicated that earnings would take an almost $1bn hit in 2016. Disappointed investors sold the stock down over 20% in a day.

Short sellers were less surprised, however, and had increased positions by almost tenfold prior to the release. The company had posted disappointing results in February after two profit warnings in 2014. Short sellers had gathered $1bn in short positions, representing 5.5% of shares outstanding on loan, representing a paper profit of $200m after the fall. Positions have since been cut by a third.

Markit Dividend Forecasting is expecting Rolls-Royce to cut distributions to shareholders by 54% after the company said it plans to review its dividend plans and announce changes in due course. An operating review is expected to be announced on November 24th 2015.

Shorts target aerospace suppliers

Cobham PLC, a UK based supplier to the aerospace industry, has cited headwinds resulting from weaker Apac demand, which has seen shorts flock to the share in recent months.

Shares outstanding on loan have doubled in Cobham since August, rising to 3.9%.

FTSE 250 constituent Ultra Electronics has 5% of shares outstanding on loan, with shares up 6% over the last 12 months. A quarter of the group's sales is exposed to "aerospace & infrastructure".

Zodiac Aerospace is the most shorted European aerospace stock in the STOXX 600 with 6.8% of shares outstanding on loan. Shorts sellers have increased positions fivefold in the last 12 months while the stock has fallen 11%.

Zodiac is a major supplier to both Boeing and Airbus and manufactures aircraft internals, from cabin structures and seats to inflight entertainment systems.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Equities-Rolls-Royce-caught-in-turbulence.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Equities-Rolls-Royce-caught-in-turbulence.html&text=Rolls-Royce+caught+in+turbulence","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Equities-Rolls-Royce-caught-in-turbulence.html","enabled":true},{"name":"email","url":"?subject=Rolls-Royce caught in turbulence&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Equities-Rolls-Royce-caught-in-turbulence.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rolls-Royce+caught+in+turbulence http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Equities-Rolls-Royce-caught-in-turbulence.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}