Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2015

Weak German manufacturing growth contrasts with solid expansion in service sector

October's flash PMI data for Germany present a somewhat mixed picture on the overall health of the German economy. While the service sector continued to expand at a solid pace, manufacturers reported slower growth.

Services sector growth ticks higher, manufacturing slows

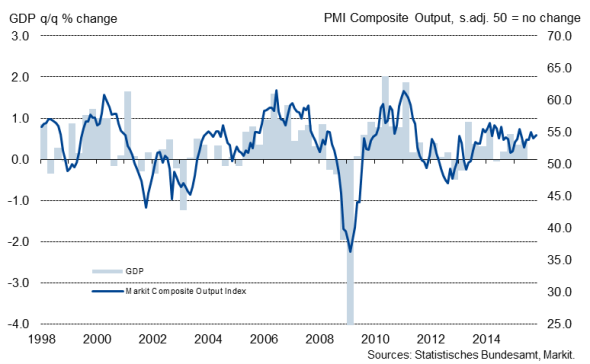

The German private sector economy as a whole started the fourth quarter on a solid footing, with the Markit flash Composite PMI Output Index rising from September's 54.1 to 54.5 in October. New business also continued to rise at a robust rate and companies raised their workforce numbers further.

The data are consistent with GDP rising at a quarterly rate of 0.4% in October, matching the expansion signalled for the third quarter.

German GDP and the PMI

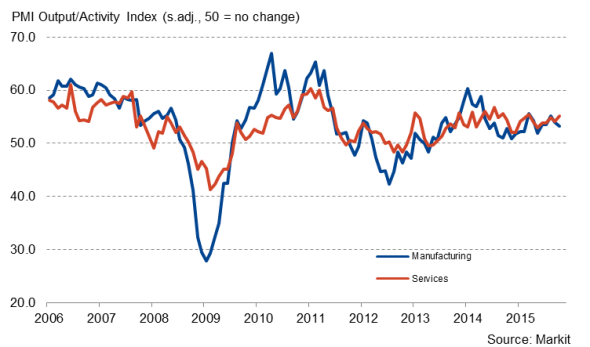

A closer look into the underlying data shows, however, that signs of a two-speed economy are building. Service sector activity increased at an accelerated pace, while manufacturers reported the weakest improvement in overall operating conditions since May.

Manufacturing and Services PMI Output Indices

Growth in Germany's goods-producing sector eased further during October, with the flash PMI dropping from 52.3 in September to a five-month low of 51.6. The data show that the slowdown was broad-based, with output, new orders and employment all increasing at weaker rates.

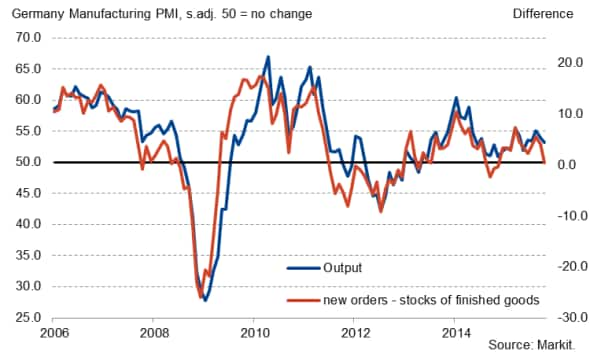

The numbers also raise questions about the sustainability of the manufacturing expansion. Firms accumulated stocks of finished goods for the first time in a year, and at the strongest rate since August 2011. With output being driven by changes in order books less changes in stock levels, the difference between the two sub-indices is historically a good lead indicator for changes in production. The drop in the new order to inventory ratio therefore suggests that a future rise in demand can be absorbed by using existing stock, rather than scaling up production. Consequently, there is a likelihood that output growth could slow further in coming months.

Further slowdown in output growth likely

The slowdown in new order growth was largely a result of softer demand from foreign markets. In particular, companies reported lower client demand from China and Russia, with the latter affected by ongoing uncertainties stemming from sanctions.

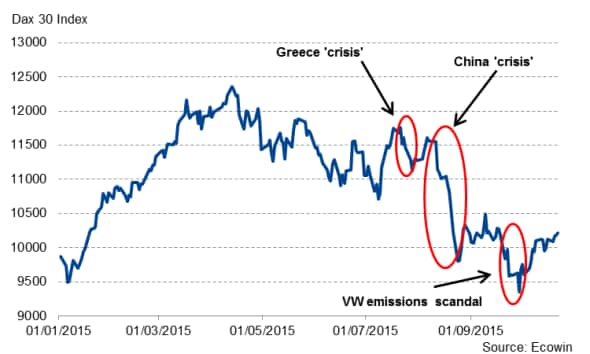

However, a renewed weakening of the euro following Mario Draghi's hints of more stimulus measures could lead to stronger growth of exports, at least in the short term. The EUR/USD rate fell from 1.1310 to 1.1185 on comments that "the degree of monetary policy accommodation will need to be re-examined at our December monetary policy meeting." Markets reacted positively on the news, with the Dax30 soaring 1.9%.

While the VW emissions scandal caused a dramatic drop in the firm's share prices and the Dax30 Index, it has not had any direct impact on the PMI data so far, according to anecdotal evidence provided by survey panel members. However, it is not impossible that companies may feel the effect in coming months.

Dax 30 Index

Overall, the survey data point to further economic growth at the start of the final quarter of 2015. The next months will show, however, whether or not the German economy is on track to meet the governments' growth target of 1.7% for the year. Some downside risks remain, including global economic uncertainties, a potential effect of the VW emissions scandal and the future of the euro. Another worry is that service sector optimism towards the 12-month outlook for activity was the lowest in a year amid reports of economic uncertainties, staff shortages and falling prices.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-economics-weak-german-manufacturing-growth-contrasts-with-solid-expansion-in-service-sector.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-economics-weak-german-manufacturing-growth-contrasts-with-solid-expansion-in-service-sector.html&text=Weak+German+manufacturing+growth+contrasts+with+solid+expansion+in+service+sector","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-economics-weak-german-manufacturing-growth-contrasts-with-solid-expansion-in-service-sector.html","enabled":true},{"name":"email","url":"?subject=Weak German manufacturing growth contrasts with solid expansion in service sector&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-economics-weak-german-manufacturing-growth-contrasts-with-solid-expansion-in-service-sector.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+German+manufacturing+growth+contrasts+with+solid+expansion+in+service+sector http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-economics-weak-german-manufacturing-growth-contrasts-with-solid-expansion-in-service-sector.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}