Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 23, 2014

Mixed bag in Italian luxury

A heavy exposure to a newly restrained China and a weak home market has seen short sellers circle Italian luxury firms. We quantify this growing trend.

- Short sellers have piled into the sector, which has seen average shares retreat by a quarter in the last 12 months

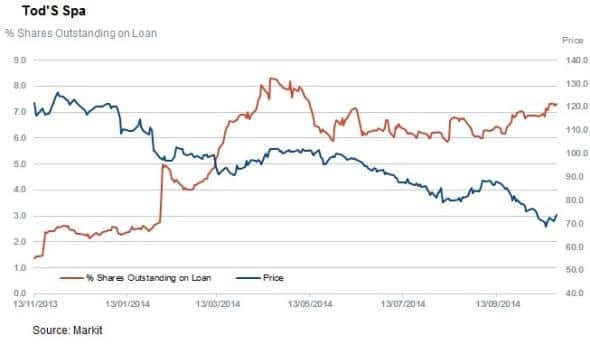

- Tod’s is the most shorted of the lot with 18.4% of free float out on loan

- Shorts have steered clear of Moncler, despite the company suffering the worst price decline of the sector

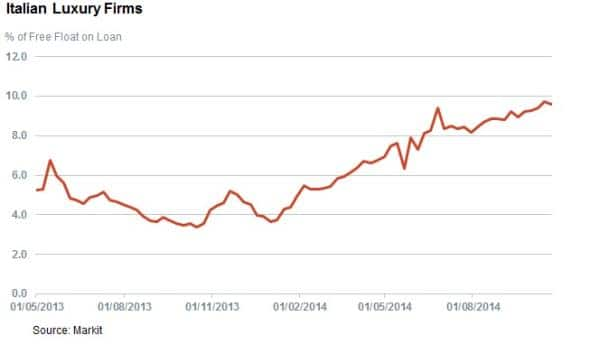

The short interest on the nine largest Italian domiciled luxury goods companies is the highest level since 2010. Over the past year the shorts seem to have been on the right side of the market, which has seen an average price decline of ~30% for the same basket of securities.

One of only two firms to post an annual share price rise from the entire group is Geox, a mid market fashion retailer, with an increase of 8% over the past year. Interestingly Geox currently has the second highest percentage of shares out on loan at 18%, second only to high end retailer Tod's, which has 18.4% of its free float on loan. Interestingly, while demand to borrow shares in Tod’s has stayed relatively flat, that of Geox has declined from 52 week highs reached in March when 24% of its free float was out loan.

Luxury in the crosshairs

While Tod’s leads the way in the space, its peers in the luxury shoes, garment and accessories firms are attracting short sellers as they have significant sales exposure to the high end Asian and the European tourism markets which have been weak of late. Several firms in that space have reported that they are expecting a similarly difficult winter trading period in the northern hemisphere for the remainder of the year and have set investor expectations relatively low.

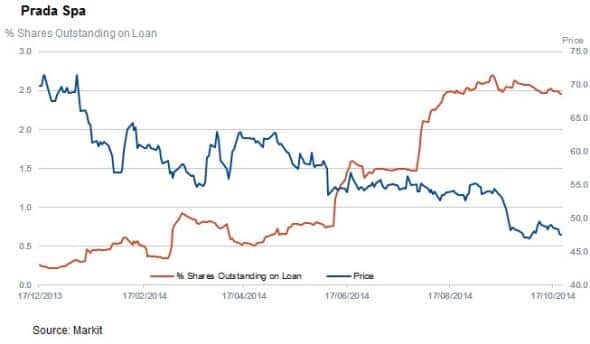

Standouts include, Prada with 12.9% of free float out on loan. The group's share price has declined by 40% over the past year. The company released disappointing half year results in September and the group stated that foreign exchange movements and weakening overall consumption in Europe and China impacted results. The group did report strong growth in Japan and the Middle East, but this was not enough to offset and prevent the worst growth levels reported since the company's listing on the Hong Kong Stock Exchange in June 2011.

Salvatore Ferragamo's recent results echo that of its Milanese peer and share price is currently down some 31% over the past twelve months, while the firm now sees 8.9% of its free float on loan.

Eyes on shorts

Eyewear firms have historically not seen as much short selling activity, but Luxotica’s Ceo’s student departure has seen shorts redouble their attention with 2.4% of the firm’s free float out on loan.

Safilo has also seen a surge in short interest in the last month and now has 5.1% of free float out on loan.

Companies in the clear

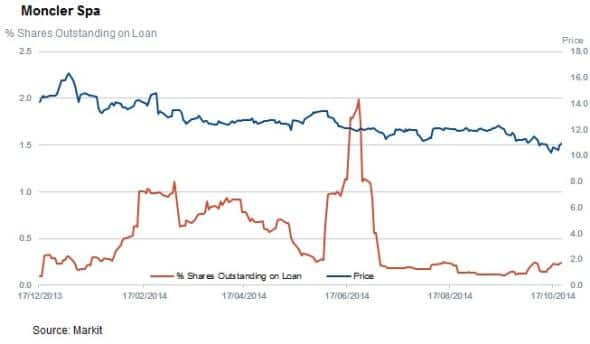

On the relatively less shorted end of scale, Moncler only has 0.3% of free float out on loan. This is interesting as the maker of luxury ski outfits has seen its shares slump by about a third to new lows since listing last year.

The other company to avoid the scrutiny of short sellers is Moschino owner Aeffe, which has about 4% of free float out on loan after a stellar year which has seen its shares advance by 148%.

Relte Stephen Schutte | Analyst, IHS Markit

Tel: +44 207 064 6447

relte.schutte@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-equities-mixed-bag-in-italian-luxury.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-equities-mixed-bag-in-italian-luxury.html&text=Mixed+bag+in+Italian+luxury","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-equities-mixed-bag-in-italian-luxury.html","enabled":true},{"name":"email","url":"?subject=Mixed bag in Italian luxury&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-equities-mixed-bag-in-italian-luxury.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mixed+bag+in+Italian+luxury http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-equities-mixed-bag-in-italian-luxury.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}