Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 22, 2014

Investing in Europe without the euro

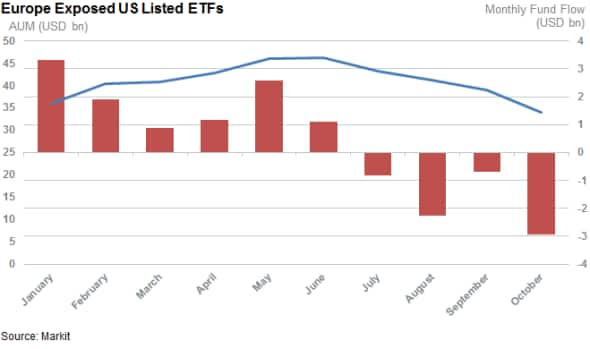

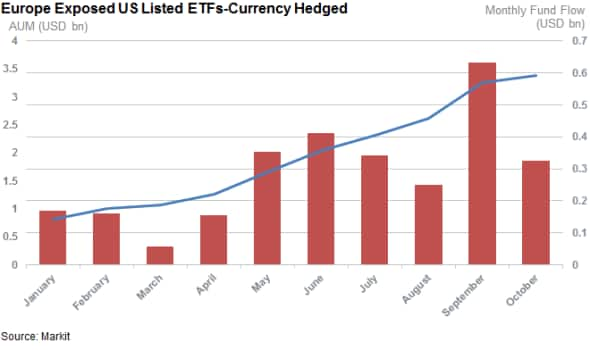

US ETF investors have continued to reduce their exposure to Europe in the last few weeks, compounding a trend that started over summer. The euro's recent slide looks to be behind some of these outflows as currency hedged funds have seen their AUM jump to record levels.

- US investors have withdrawn nearly $3bn from European focused equity ETFs in the last month

- The largest funds have led the outflows with the Vanguard Europe ETF taking the lion's share

- Investors are still keen to gain exposure to the eurozone, with currency hedged funds seeing large inflows

US investors have made an about turn in their European exposure in the last few months. We first highlighted this trend last August, but the European Central Bank's (ECB) recent monetary easing and the subsequent fall in the value of the euro looks to have exacerbated the trend in the recent few weeks.

ECB intervention recap

The ECB announced last month that it would begin to purchase asset backed securities and covered bonds in the hope of kick starting the region's anaemic growth. This follows similar quantitative easing programs used by the Federal Reserve and the Bank of Japan aimed at stimulating the economy by decreasing the cost of exports. The ECB is looking to increase the money supply in an effort to devalue the euro relative to the dollar. The target inflation rate, set by the ECB, is just below 2% but consumer prices in the eurozone were up only 0.3% from last year's levels in September.

On Monday, Mario Draghi, president of the ECB hinted that several options were on the table if the current asset purchasing program did not prove to be sufficient in raising the super low inflation rates, most significantly that the ECB would be prepared to add corporate bonds to its list of eligible repurchase assets.

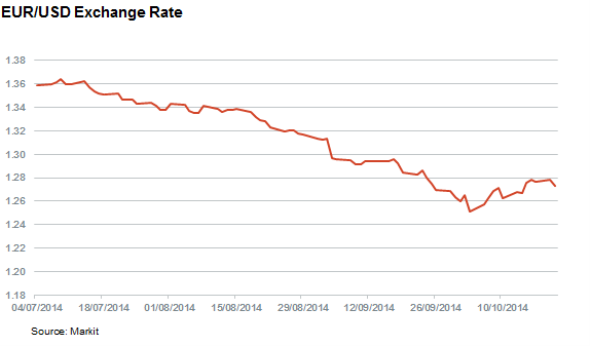

These announcements have come at a time when the Federal Reserve is nearing the end of its quantitative easing program, pushing the dollar up sharply against its trading partners. The diverging path taken by both central banks has seen the euro to fall to multi-year lows against the dollar. Since the start of 2014, the euro has dropped around 8% relative to the dollar with the majority of the depreciation taking place in the last month.

US investors continue to flee Europe

The weakening euro has added to an already bearish case for the region which has exacerbated outflows out of US listed European focused ETFs. US listed equity funds with European exposure have seen just under $3bn of outflows in the first three weeks of the month. This is by far the worst month for these funds for the year, and builds on three straight months of outflows during which investors withdrew an aggregate $3.7bn.

The biggest outflows were seen by the largest fund in the asset class. The Vanguard FTSE Europe ETF saw $2.1bn of net outflows after seeing its price fall by 5% in the opening three weeks of the month. This adds to the significant outflows seen since July which has seen the fund lose 35% of its AUM from its June peak.

iShares' flagship US European product, the MSCI EMU ETF, has fared the same as its AUM fell from $12bn to $7.6bn.

Though the funds are still net positive for the year in terms out outflows, the recent fall in the net asset value tracked by these funds, driven by both currency and asset price swings, has seen the AUM manage by the asset class fall by $1.8bn.

Currency hedged funds in favour

One bright spot in the recent trend has been currency hedged funds which, unlike their un-hedged peers, have continued to see strong inflows over the last few months. So far this month, the three US listed currency hedged funds saw inflows of $326m which has taken their AUM to an all-time high $3.3bn. These funds have seen their asset base triple after $2.8bn of inflows. This can be read as a positive sign for risk assets as a growing portion of investors have a bullish feeling for the value of European assets in local currencies.

The leader in the recent trend has been the WisdomTree Europe Hedged Equity Fund, whose assets have surged to $2.8bn. The euro's devaluation looks to have made this switch a canny investment as it has outperformed Vanguard Europe ETF by over 5% in the three last month.

James Hohorst

Simon Colvin

Analyst

Markit

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Equities-Investing-in-Europe-without-the-euro.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Equities-Investing-in-Europe-without-the-euro.html&text=Investing+in+Europe+without+the+euro","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Equities-Investing-in-Europe-without-the-euro.html","enabled":true},{"name":"email","url":"?subject=Investing in Europe without the euro&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Equities-Investing-in-Europe-without-the-euro.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investing+in+Europe+without+the+euro http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Equities-Investing-in-Europe-without-the-euro.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}