Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 21, 2014

Markets brace for return to calm

The last few weeks have seen the market roar back to life. We review options implied volatility and ETF developments to discern the longevity of these trends.

- Implied options volatility has surged in both the US and Europe in the last few weeks in the wake of the recent market selloff

- ETP investors have added over $767m of exposure to volatility tracking products in the last three weeks taking volatility ETP AUM to all-time highs

- Most of the inflows are aimed at funds which benefit from a fall in volatility

The markets have seen more than their fair share of volatility in the last few weeks as the S&P 500 briefly gave up the entirety of this year's hard fought gains, in the month leading up to last Wednesday. Fast forward a week and things look slightly rosier after the market recovered some of the gains lost in previous weeks. This trend was mirrored on the other side of the Atlantic with the Stoxx 600 experiencing a similar price swing, though the pan European index still hasn't managed to break into positive figures for the year.

Volatility surges

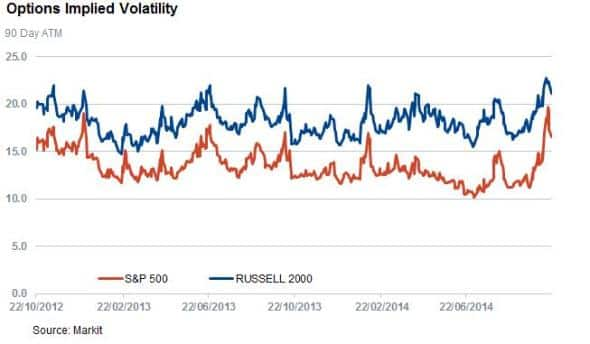

The selloff seen in the last couple of weeks has seen a surge in volatility on both sides of the Atlantic as measured by implied options volatility. 90 Day At The Money Implied Volatility for S&P 500 options jumped by two thirds last Thursday from the level seen four weeks prior. Annualised implied volatility topped out at just under 20% on Wednesday, which was the highest level on over two years according to Markit Daily Volatility.

Russell 2000 shares also saw a similar move over the same period of time, but the month on month change was less pronounced as these options had already seen a gradual rise in implied volatility over the previous few weeks. This seems to indicate that the recent bout of volatility caught large cap investors by surprise.

In Europe, Stoxx 600 options also saw a surge in implied volatility in the wake of similar price swings.

Note that all three indexes have seen their options implied volatility fall in the last couple of days, meaning the trend appears to be reverting back from its recent highs.

Investors rally to volatility

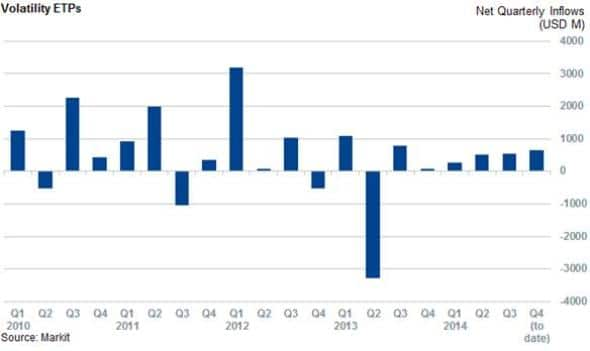

This surge of volatility has not gone unnoticed by ETP investors, as the 60 ETPs which track market volatility are on track to see their largest monthly inflows since August 2012 after investors added $767m of exposure in the last three weeks. These strong inflows, along with the recent volatility which has seen the value of the long exposed products surge, has taken the AUM managed by the asset class to a new all-time high.

Interestingly, the funds which have seen the largest inflows since the start of the latest market volatility are those that stand to benefit from a fall in market volatility.

This trend is led by the VelocityShares Daily Inverse VIX Short Term ETN, which has seen $756m of inflows in the last three weeks, and the Proshares Short VIX Short Term Futures ETN in second place with $319m of inflows.

The market's return to calm looks to have made these investments canny ones as both funds have seen strong returns in the last couple of days.

Funds which benefit see outflows

Removing the inverse and leveraged funds from the analysis, the 41 remaining funds have actually seen outflows over this period, as investors took advantage of the surge in volatility to take profit from their positions. In fact the VXX ETN mentioned above saw its largest net outflow on October 14th after returning over 43% in the previous four weeks.

This asset positioning indicated that ETF investors see this recent surge in volatility as a passing phase which will soon revert; a development which is already in the works in options market.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Equities-Markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Equities-Markets.html&text=Markets+brace+for+return+to+calm","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Equities-Markets.html","enabled":true},{"name":"email","url":"?subject=Markets brace for return to calm&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Equities-Markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markets+brace+for+return+to+calm http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Equities-Markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}