Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2014

French prices fall at fastest rate for five years amid renewed recession threat

The French economy started the fourth quarter on a poor footing, according to PMI survey data. Output is falling, pointing to a deepening recession in the private sector, job losses are mounting and prices are being slashed as companies seek to boost sales.

A private recession

The Markit flash PMI for France fell to 48.0 in October, its lowest since February and the fifth successive month in which the PMI has been below 50, thereby signalling a deterioration in business conditions.

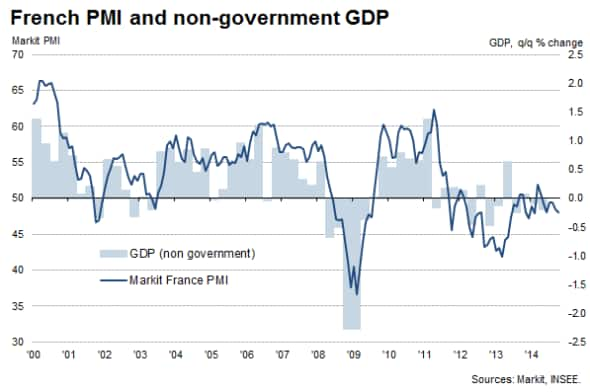

The data highlight how the French business sector is back in recession. The latest available official data are only published up to the second quarter, but showed that GDP stagnated in both the first and second quarters. As our chart shows, the PMI has been more downbeat than GDP data so far this year, signalling falling GDP, but that largely reflects the difference in coverage.

Importantly, the GDP data include government spend but the PMI only covers private sector activity. Strip out government spending and GDP fell 0.2% in the second quarter following a 0.1% decline in the first quarter, which is largely in line with the PMI readings (averages of 49.5 and 49.3 in the first and second quarters respectively).

The average PMI reading of 49.1 for the third quarter therefore points to another quarter in which private sector output fell marginally (though total GDP may well have stagnated again, due to rising government spending). The latest PMI reading of 48.0 suggests the rate of decline may have gathered momentum at the start of the fourth quarter.

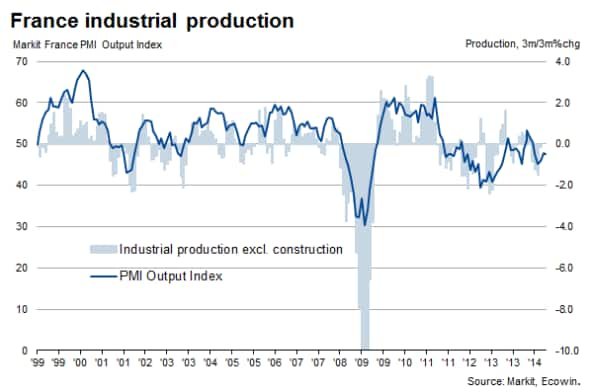

The manufacturing PMI reading points to a 0.5% quarterly rate of decline of factory output in October, while the services PMI points to a 0.2% quarterly rate of decline of service sector GDP.

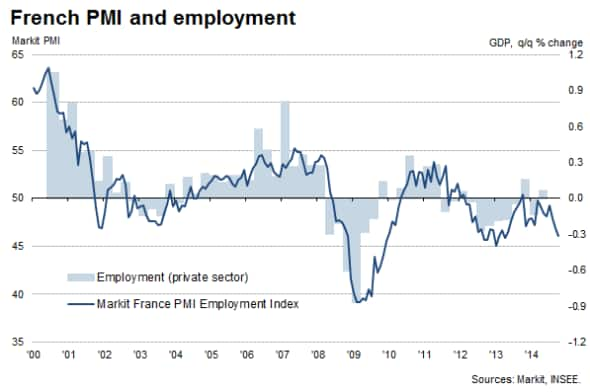

Employment falling

The mild recession in which French companies find themselves has resulted in an increased rate of job losses. The PMI's Employment Index dropped to its lowest since April 2013, which is broadly consistent with private sector employment falling at a quarterly rate of 0.3%. This suggests the return to growth of private sector employment in the second quarter (the latest official data available) will have proved to be short-lived.

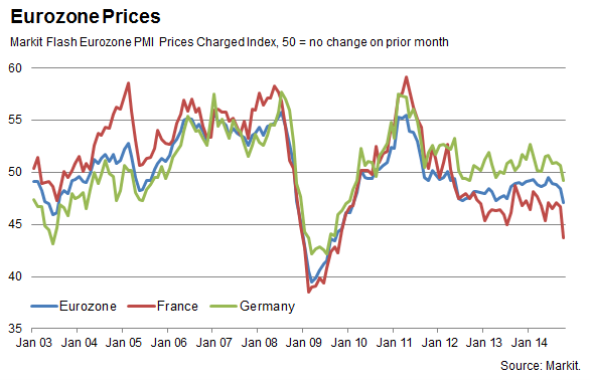

Prices slumping

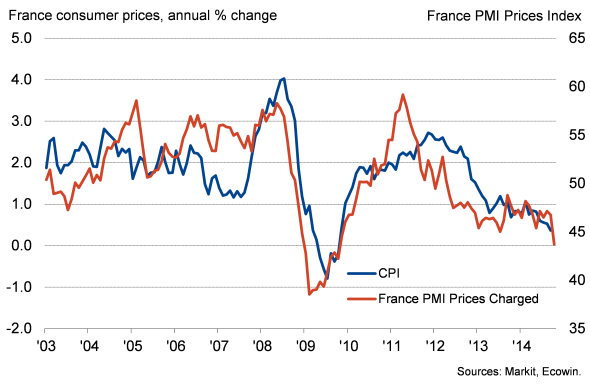

Policymakers concerned with the threat of deflation will meanwhile be worried by the fall in the PMI survey's Prices Charged Index, which signalled the steepest drop in charges for goods and services since October 2009, when France was caught up in the height of the global financial crisis. With consumer price inflation already down to 0.4% in September, its lowest since 2009, the PMI raises the risk of a further drop the headline inflation rate in coming months.

French inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-French-prices-fall-at-fastest-rate-for-five-years-amid-renewed-recession-threat.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-French-prices-fall-at-fastest-rate-for-five-years-amid-renewed-recession-threat.html&text=French+prices+fall+at+fastest+rate+for+five+years+amid+renewed+recession+threat","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-French-prices-fall-at-fastest-rate-for-five-years-amid-renewed-recession-threat.html","enabled":true},{"name":"email","url":"?subject=French prices fall at fastest rate for five years amid renewed recession threat&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-French-prices-fall-at-fastest-rate-for-five-years-amid-renewed-recession-threat.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=French+prices+fall+at+fastest+rate+for+five+years+amid+renewed+recession+threat http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-French-prices-fall-at-fastest-rate-for-five-years-amid-renewed-recession-threat.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}