Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2015

Prices fall as US manufacturing struggles in the slow lane

US manufacturing remained stuck in crawler gear in September, fighting an uphill battle against the stronger dollar, slumping demand in many export markets and reduced capital spending, especially in the energy sector.

The sluggish growth, weaker forward-looking indicators and downturn in price pressures all point to the Fed holding off with rate hikes until next year.

Here are five key charts from the flash PMI survey:

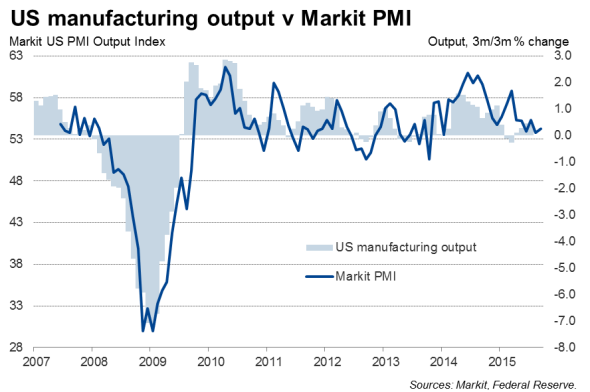

1.Growth worries as manufacturing struggles

At 53.0 and unchanged on August, the headline flash Markit Manufacturing PMI came in exactly in line with expectations. However, the survey is indicating the weakest manufacturing growth for almost two years, meaning the sector will have acted as a drag on the economy in the third quarter. As such, GDP growth is likely to have slowed from 3.7% in the second quarter to 2.5% at best in the three months to September.

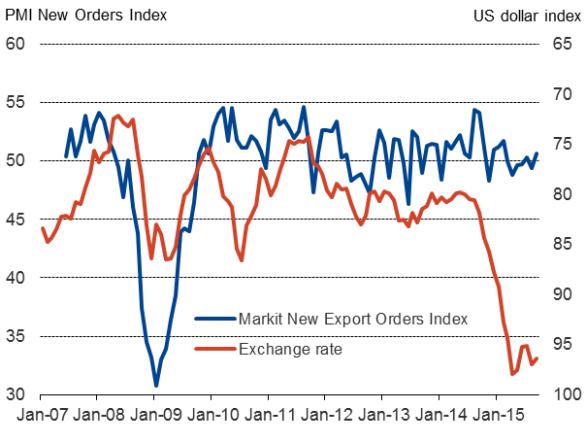

2.Exporters are fighting the strong dollar

Export orders barely grew in volume terms during the month, albeit rose at the fastest rate since February. Producers struggled again the stronger dollar and weak growth in key export markets, especially previously-fast growing emerging markets such as China.

The dollar has appreciated by 18% over the past year on a trade weighted basis. The higher exchange rate makes US producer goods more expensive abroad, though producers are often countering the currency appreciation with price discounting, which will hit profits margins.

Exports hit by dollar appreciation

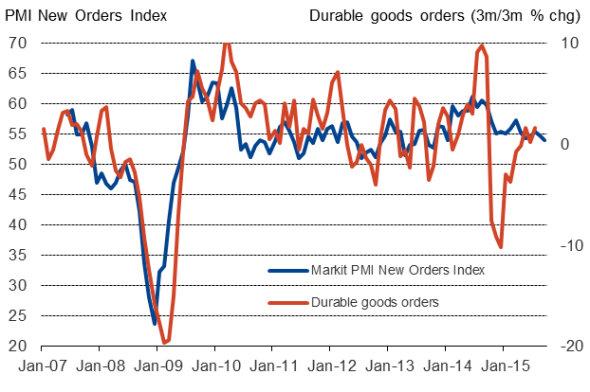

3.Smallest rise in orders since January 2014

Factory orders

Inflows of work rose at the slowest pace since the start of 2014 as weak domestic demand added to the lacklustre export performance. The PMI new orders series cuts through the noise of the official durable goods orders data, and points to a near-stagnation of order book growth.

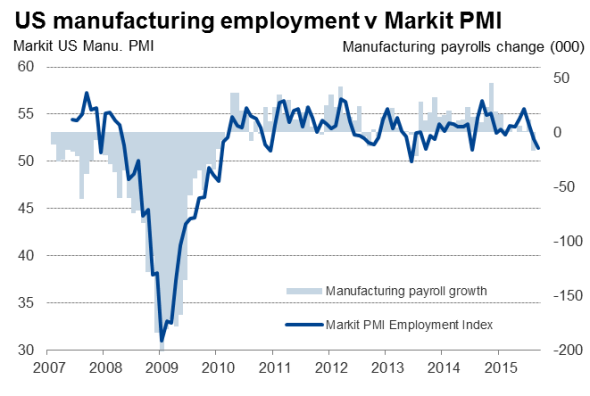

4.Job creation has waned

The survey also showed that job creation has slowed, with the PMI's sub-index consistent with the official measure of factory non-farm payrolls dropping by around 10,000 in September. The latest reading was one of the lowest seen since the financial crisis and reflected an increasingly cautious approach to hiring as companies focus on protecting profit margins in the face of the strong dollar and weak sales.

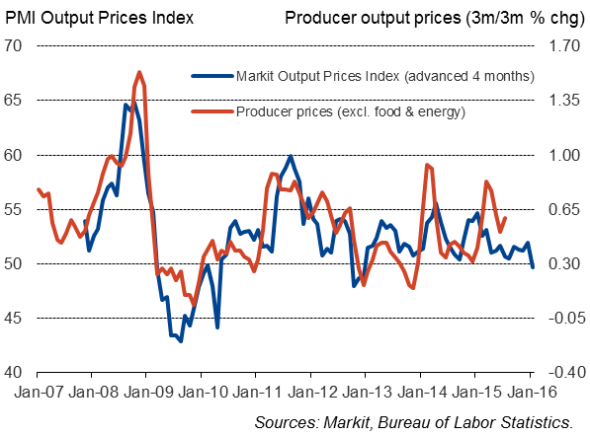

5.Selling prices fell for the first time in over three years

Average factory gate prices fell in September for the first time since August 2012, adding further to evidence that supports the Fed holding off with any rate hikes.

Price falls reflected intense competition amid weak demand, as well as the pass-through of lower commodity prices, especially oil. Average input prices fell for the first time in five months as producers benefitted from lower prices for a wide range of commodities.

Factory gate price inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-prices-fall-as-us-manufacturing-struggles-in-the-slow-lane.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-prices-fall-as-us-manufacturing-struggles-in-the-slow-lane.html&text=Prices+fall+as+US+manufacturing+struggles+in+the+slow+lane","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-prices-fall-as-us-manufacturing-struggles-in-the-slow-lane.html","enabled":true},{"name":"email","url":"?subject=Prices fall as US manufacturing struggles in the slow lane&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-prices-fall-as-us-manufacturing-struggles-in-the-slow-lane.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Prices+fall+as+US+manufacturing+struggles+in+the+slow+lane http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-prices-fall-as-us-manufacturing-struggles-in-the-slow-lane.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}