Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 23, 2015

European legacy airlines clipped by competition

Established "legacy" airlines are facing a two pronged assault from domestic budget firms and international upstarts on long distance routes, leading short sellers to circle the once dominant group.

- Legacy airlines have seen short sellers double their positions

- Air France leads the three legacy carriers at the top of the most shorted list

- Discount airlines now have half the short interest compared to 12 months ago

Legacy European carriers have seen little relief from the recent collapse in oil prices and rebounding European economy. These carriers have seen masses of their customers flee to lower cost, no frills competitors while well capitalised foreign competitors have given them a run in the profitable long haul market. Their problems have been compounded by the legacy labour structure, which has seen these firms plagued by strikes as their management tries to enact the types of changes necessary to compete in the current marketplace.

Shares of the nine listed European legacy carriers have underperformed their no frills discount peers by over 20% since the start of the year. This trend has not gone unnoticed by short sellers.

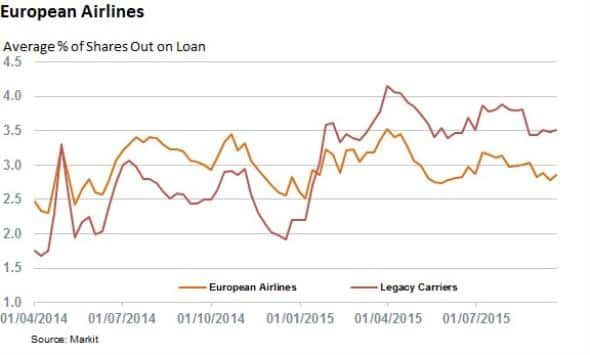

Short sellers circle

Current short interest in European legacy airlines stands at 3.5% of shares outstanding, 60% higher than at the start of the year. This means that these firms are now more shorted than both the overall European stock market and the airline field in general, which has 2.8% of shares shorted on average. The current shorting activity marks a turnaround from 18 months ago, when the same group of shares saw much less shorting than its peers.

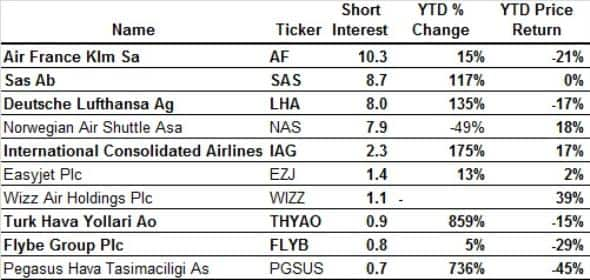

This trend is not led by any one firm as legacy carriers (Bold in table below) stand on all three steps of the most shorted European airlines podium.

Air France KLM holds the most shorted title with 10.3% of shares out on loan. While current short interest represents a 20% fall from the recent highs seen in March when 13.3% of the company's shares were shorted, the covering looks to have been driven by difficulties in sourcing shares to borrow. Over 90% of Air France shares in lending programs are now on loan, the same portion as during the year's high.

SAS-NAS market share battle

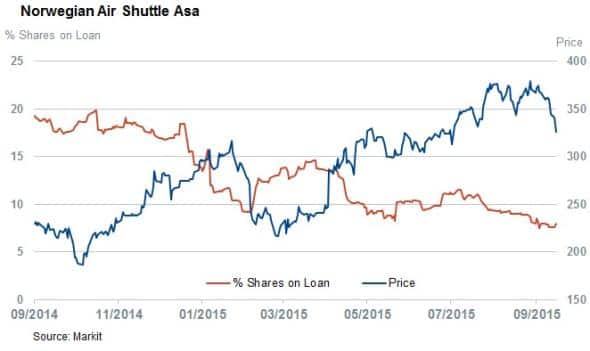

The struggle between low cost and legacy airlines is exemplified by the SAS-Norwegian Air Shuttle battle as both firms fight for market share in the Scandinavian region. Short sellers had originally been sceptical of the Norwegian's ability to grab market share away from its regional rival, but momentum seems to have reversed as seen by the recent short covering.

This success has largely come at the expense of SAS, which has seen analysts halve their profit forecast for the firm in the last six months. Short sellers have followed the news, with demand to borrow the company's shares climbing back over the 25% mark.

Discounters see covering

The short covering seen by NAS is representative of a bigger trend in the discount airlines sector as these firms have seen short interest fall by 40% year to date. Ryanair now sees its shares trade at an all-time high while short interest is non-existent with 0.1% of the Irish carrier's shares now out on loan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-Equities-European-legacy-airlines-clipped-by-competition.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-Equities-European-legacy-airlines-clipped-by-competition.html&text=European+legacy+airlines+clipped+by+competition","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-Equities-European-legacy-airlines-clipped-by-competition.html","enabled":true},{"name":"email","url":"?subject=European legacy airlines clipped by competition&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-Equities-European-legacy-airlines-clipped-by-competition.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+legacy+airlines+clipped+by+competition http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-Equities-European-legacy-airlines-clipped-by-competition.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}