Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 23, 2016

US flash manufacturing PMI takes a step back from July's recent high

The August Markit Flash US Manufacturing PMI came in below market expectations but still signals an improved performance of factories in the third quarter compared to the first half of the year.

Although exports grew at the fastest rate for almost two years, subdued domestic demand acted as a drag on order book growth. The hiring trend also slowed as firms grew cautious about the outlook and inflationary pressures cooled.

Manufacturing upturn takes a backward step

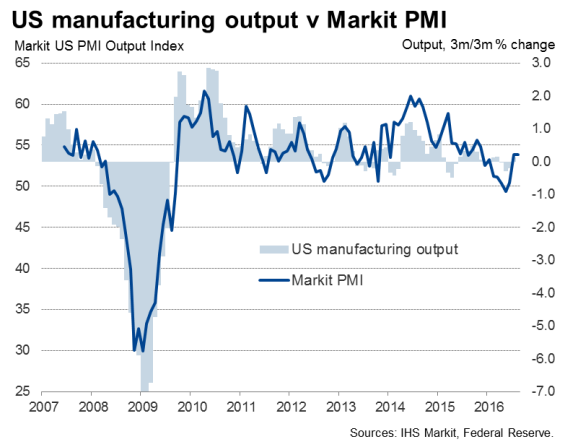

The seasonally adjusted Markit Flash US Manufacturing PMI" registered 52.1 in August, down from July's nine-month high of 52.9. However, while the drop in the PMI is a disappointment, it's less worrying when looked at in the context of July's better than expected reading. Taking the July and August readings together suggests that manufacturing is enjoying its best period of expansion so far this year in the third quarter.

The survey found manufacturers increasing their output for the third month running and enjoying the largest rise in exports since September 2014.

The improved production and trade performances should help drive faster economic growth in the third quarter. But that's where the good news stops. Despite the upturn in exports, subdued domestic demand meant total new orders expanded at a slower rate in August.

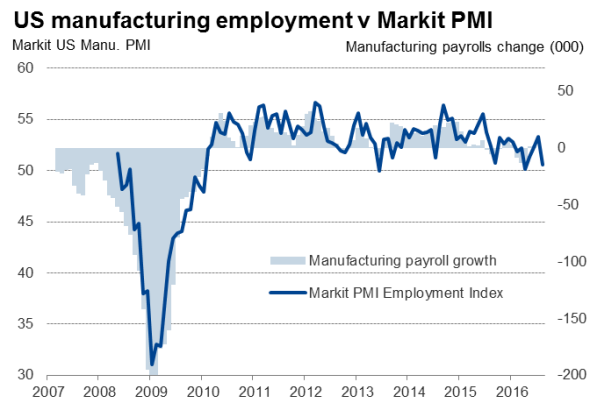

Manufacturing employment increased at the slowest rate for four months. Inventories of finished goods and raw materials both fell as companies generally adopted cautious inventory policies.

Sources: IHS Markit, BLS

Prices charged by manufacturers were meanwhile unchanged in August, thereby ending a three-month sequence of increase, as intense competition in some cases led to price discounting.

Policy on hold, for now

Policymakers will be pleased to see signs that the economy may have picked up speed in the third quarter compared to the disappointments seen in the first two quarters of the year, but the Fed looks unlikely to tighten policy again until the upturn has stronger foundations. Any interest rate rise therefore looks unlikely before December.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-US-flash-manufacturing-PMI-takes-a-step-back-from-July-s-recent-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-US-flash-manufacturing-PMI-takes-a-step-back-from-July-s-recent-high.html&text=US+flash+manufacturing+PMI+takes+a+step+back+from+July%27s+recent+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-US-flash-manufacturing-PMI-takes-a-step-back-from-July-s-recent-high.html","enabled":true},{"name":"email","url":"?subject=US flash manufacturing PMI takes a step back from July's recent high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-US-flash-manufacturing-PMI-takes-a-step-back-from-July-s-recent-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+manufacturing+PMI+takes+a+step+back+from+July%27s+recent+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-US-flash-manufacturing-PMI-takes-a-step-back-from-July-s-recent-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}