Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2015

Manufacturing shows broad-based global weakening in April

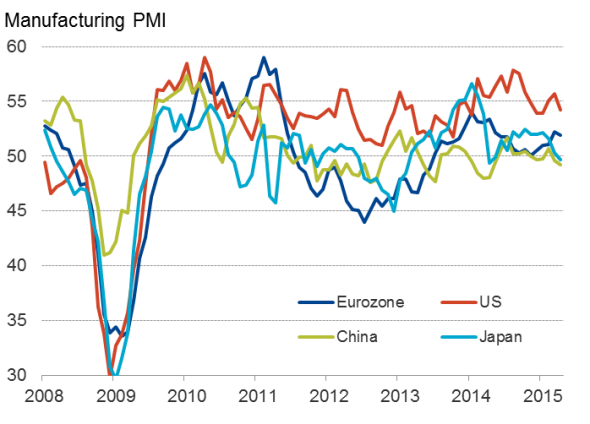

April's flash PMI survey data provide the first insight into economic trends at the start of the second quarter, and paint a disappointing picture of the health of the global economy.

Flash PMI surveys

Source: Markit.

Over in Asia, survey data show both China's and Japan's manufacturing sectors in contraction. Albeit only modest, the downturns are a particular worry given the huge stimulus programme currently underway in Japan and efforts made by the Chinese authorities in recent months to address the slowdown.

The Japanese PMI showed the first deterioration of business conditions for a year in April, with orders dropping for a second straight months. The concern is that goods producers are seeing order books deteriorate despite the steep depreciation of the yen, which should in theory be helping boost overseas sales. Export growth in fact slowed in April, while domestic demand fell.

The PMI for China likewise signalled the worst decline for a year, and has now registered declines for two second successive months. The downturn was led by weaker domestic demand, with exports rising (albeit only very slightly) for the first time in three months.

Perhaps the biggest disappointment of all, however, was a downturn in the eurozone PMI which, given increasingly aggressive stimulus from the ECB, was widely expected to have risen again in April, building on encouraging signs of renewed growth seen earlier in the year.

The eurozone slowdown was driven by weaker growth in Germany and a near-stagnation of business activity in France. However, it was not all bad news out of Europe, with business activity in the euro area excluding France and Germany growing at the fastest rate since August 2008. This upturn suggests that ECB stimulus is having a meaningful impact in reviving 'animal sprits' in the so-called 'periphery'.

The US rounded-off the flash PMI releases, and likewise saw a waning in the rate of manufacturing growth, down to the weakest since January. Key to the slowdown was a deterioration in export orders, in turn a symptom of the loss of competitiveness arising from the US dollar's strength. However, while exporters are suffering, domestic demand looks to have remained robust, helping to sustain a reasonably strong production trend.

While US growth has clearly slowed in 2015 compared to the impressive rate seen throughout much of last year, fears of a sharp US slowdown look overplayed, based on these data.

From a policy perspective, the PMI data therefore point to even more aggressive stimulus being required in both China and Japan. In the eurozone, recent analyst talk of the ECB possibly needing to 'taper' its asset purchase programme due to signs of stronger than anticipated economic growth look wholly premature.

In the US, however, the dip in the survey does little to dent the outperformance of the PMI relative to other countries and as such keeps the possibility of the Fed tightening policy later this year very much alive.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-manufacturing-shows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-manufacturing-shows.html&text=Manufacturing+shows+broad-based+global+weakening+in+April","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-manufacturing-shows.html","enabled":true},{"name":"email","url":"?subject=Manufacturing shows broad-based global weakening in April&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-manufacturing-shows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+shows+broad-based+global+weakening+in+April http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-manufacturing-shows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}