Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2015

Flash Germany PMI dips slightly as investor sentiment deteriorates

The German private sector economy expanded further at the start of the second quarter, but the pace of economic growth slowed slightly, according to Markit's Flash Germany PMI data. Moreover, exchange-traded funds (ETF) data signalled a deterioration in investor sentiment with ETFs exposed to Germany seeing net outflows for the first time in 2015 so far.

Further expansion in GDP expected

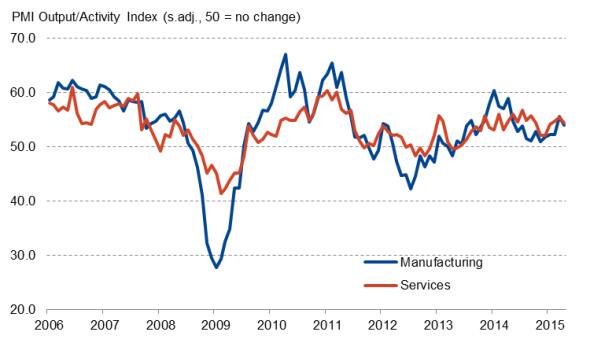

April data signalled further output growth in Germany's private sector economy, with the flash Germany Composite PMI posting 54.2, down from 55.4 in March.

PMI data highlighted that output increased at slower rates in both the manufacturing and service sectors. New orders also rose at a weaker rate, as manufacturers reported only a marginal increase in foreign new orders. While the weak euro helped secure new business in export markets, lower demand in some key markets dampened growth.

Manufacturing and Services PMI Output Indices

Source: Markit

Despite the slight dip in the headline PMI, the survey data are consistent with the German economy growing further at the start of the second quarter.

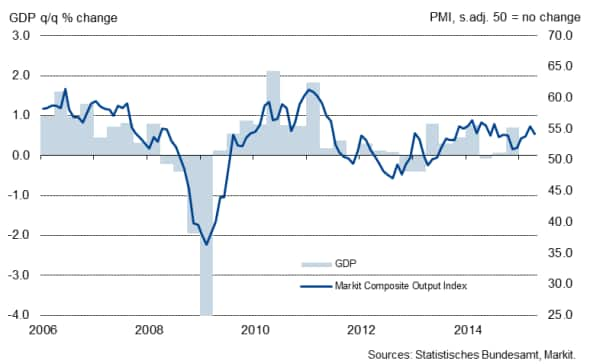

Official data for the final quarter of 2014 signalled GDP growth of 0.7% and survey data for the opening three months of the year suggest that the German economy is likely to have expanded at a slower pace, possibly down to 0.4% in the first quarter.

Meanwhile, as expected, the German government revised up their growth projections for 2015 and 2016 yesterday. The German economy is now forecast to grow by 1.8% both this year and next. Previously, the government had expected growth of 1.5% for 2015 and 1.6% for 2016. While Sigmar Gabriel, Germany's minister for economic affairs and vice chancellor said that "driven by a continued strong performance in the labour market with rising wages and increasing employment, Germany is on a solid growth path" he also reminded that the country has "to make efforts especially to improve our medium-term growth prospects." He also noted that "investment in education and research, in infrastructure, as well as a better environment for private investment, are important starting points."

Private sector economists are on average pencilling-in stronger growth of around 2% for this year, but the weakness in April's PMI data suggest the government's forecast is currently looking the most realistic.

German GDP and the PMI

Investor sentiment deteriorates

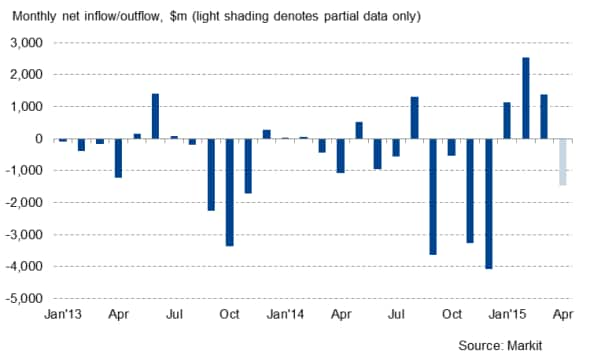

Exchange traded funds exposed to Germany meanwhile have seen net outflows of $1.48bn so far in April. These monthly outflows contrast with net inflows in each of the first three months of the year. Nevertheless, so far this year, German-exposed ETFs have seen a $3.60bn net inflow, with the ECB's announcement of quantitative easing and signs of stronger economic growth likely to have boosted investor sentiment.

Germany-exposed ETF flows (monthly)

However, April data are a reminder that there remain some uncertainties facing investors, including the ongoing debt crisis in Greece and the impact of a potential default or 'Grexit' on the eurozone, as well as concerns about economic conditions abroad that could affect German exports.

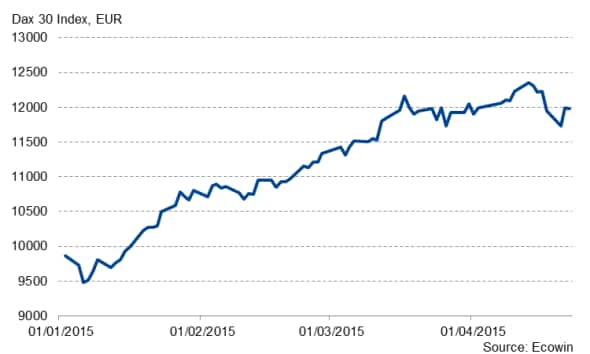

The deterioration in investor sentiment is also reflected by the first drop in the ZEW's Economic Sentiment Index in six months and a weakening of the German Dax 30. The Dax soared some 25% between the beginning of the year and the second week of April to reach an all-time high of nearly 12,400 points. The index has since then dropped 3%.

Dax 30 Index

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-flash-germany-pmi-dips-slightly-as-investor-sentiment-deteriorates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-flash-germany-pmi-dips-slightly-as-investor-sentiment-deteriorates.html&text=Flash+Germany+PMI+dips+slightly+as+investor+sentiment+deteriorates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-flash-germany-pmi-dips-slightly-as-investor-sentiment-deteriorates.html","enabled":true},{"name":"email","url":"?subject=Flash Germany PMI dips slightly as investor sentiment deteriorates&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-flash-germany-pmi-dips-slightly-as-investor-sentiment-deteriorates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Germany+PMI+dips+slightly+as+investor+sentiment+deteriorates http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-flash-germany-pmi-dips-slightly-as-investor-sentiment-deteriorates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}