Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 23, 2016

Fallen angels and liquidity guide credit index rolls

Markit's US and European credit indices rolled this week with commodity-related fallen angels and heightened liquidity in credit markets driving the new index composition.

- Fallen angels caused four removals in CDX.NA.IG and three in iTraxx Europe Main

- Sector-related composition and liquidity-based inclusions drove CDX.NA.HY changes

- Liquidity among Financials meant none were removed from the iTraxx Europe Main

Fallen angels and heightened liquidity were the key themes emerging as Markit's US and European corporate credit indices rolled over this week, altering their compositions to best reflect rating, sector and liquidity changes over the past six months.

The Markit iTraxx Europe Main index, which compromises of 125 investment grade single CDS credits, saw four additions/removals. Among the credits removed were those downgraded from investment grade to high yield status ('fallen angels'); Anglo American and Repsol. The Markit iTraxx Europe Main index's high yield counterpart, the Markit iTraxx Europe Crossover index, saw twelve additions/removals, largely driven by heightened liquidity amid volatile global markets.

In the US, investment grade corporate credit, represented by the Markit CDX.NA.IG index saw five new additions/removals, again mainly driven by commodity-related fallen angels. Its high yield counterpart, the Markit CDX.NA.HY index, which rolls over next week, provisionally sees ten new additions/removals.

CDX

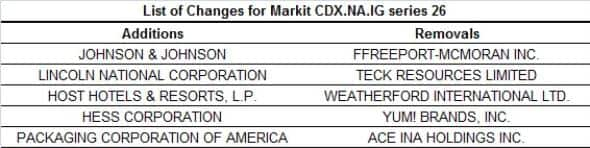

The Markit CDX.NA.IG index rolled over into its 26th series on March 21st with limited impact on the market as five credits were added/removed.

Four of the five names removed were those downgraded from investment grade to junk during the period since the previous roll last September. These included gold miners Freeport McMoran and Teck Resources, which both saw their 5-yr CDS spreads surpass 900bps over the period. American fast food company Yum Brands was also removed following a downgrade to high yield last December, as the company expects to take on more leverage.

Among the additions was one of the least risky US corporations, Johnson & Johnson (5-yr CDS spread currently 18bps) - reflecting its better CDS liquidity position.

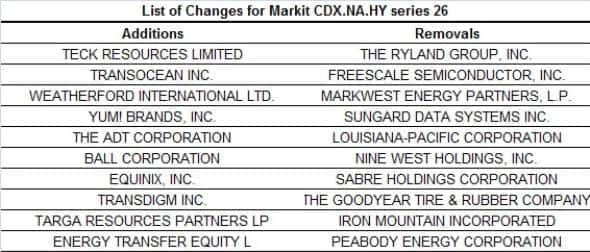

Three of the fallen angels made it to the list of additions to the CDX.NA.HY index, which rolls over on March 28th. Yum Brands, Teck Resources and Weatherfood International are all now constituents, as they remain favourable from a liquidity standpoint. Some new additions however, such as Ball Corporation, Targa Resources and Equinix were included because of their large position in the cash market, to induce additional liquidity in these names (Additional Liquidity Based Inclusion).

Among the removals from the CDX.NA.HY index were names upgraded to investment grade, such as SunGard Data Systems. Removals were also made to names in the Consumer Services and Consumer Goods sectors to better reflect HY cash indices.

iTraxx

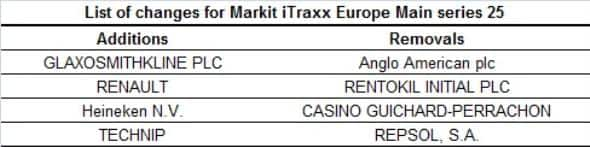

Europe's Markit iTraxx indices rolled over to series 25 on March 21st with the investment grade Markit iTraxx Europe Main index seeing four new additions/removals.

UK mining giant Anglo American and Spanish energy firm Repsol were removed as weak commodity prices impacted operations, leading to downgrades. Both were demoted to the Markit iTraxx Europe Crossover index.

Despite the turmoil in the European banking sector earlier this year, no financials were removed for series 25, with liquidity holding up. French car maker Renault was included after return to investment grade status.

The Markit iTraxx Europe Crossover index saw twelve additions/removals, driven by heightened liquidity amid volatile global markets.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-Credit-Fallen-angels-and-liquidity-guide-credit-index-rolls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-Credit-Fallen-angels-and-liquidity-guide-credit-index-rolls.html&text=Fallen+angels+and+liquidity+guide+credit+index+rolls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-Credit-Fallen-angels-and-liquidity-guide-credit-index-rolls.html","enabled":true},{"name":"email","url":"?subject=Fallen angels and liquidity guide credit index rolls&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-Credit-Fallen-angels-and-liquidity-guide-credit-index-rolls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fallen+angels+and+liquidity+guide+credit+index+rolls http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-Credit-Fallen-angels-and-liquidity-guide-credit-index-rolls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}