Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 22, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Zoe's kitchen top short this week as 37% of its shares are on loan to shorts

- Marks and spencer leads a slew of UK retailers seeing high short interest before earnings

- Asian short sellers target Truly International heading into earnings

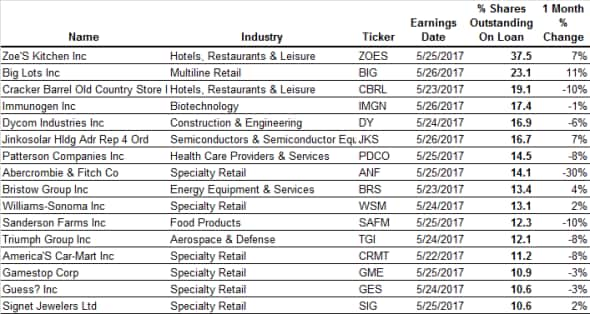

North America

The high conviction short among North American firms announcing earnings this week is fast casual dining chain Zoe's kitchen which has over 37% of its shares out on loan to short sellers. Short sellers will be hoping to repeat their recent success as the firm's last quarterly earnings, which disappointed on both the earnings and revenue side, started a selloff which took a quarter off the value of the firm's shares.

Shorting fast casual dining stores has proved to be a tricky game recently however as last week's high conviction dining chain, burger chain Red Robin, saw its shares surge by over a quarter after posting better than expected numbers. This will have no doubt cause some angst among Zoe short sellers as well as those currently shorting fellow casual dining firm Cracker Barrel. The latter's current borrow demand, 19% of shares outstanding, is enough to earn it the third place on the list of most shorted North American firms announcing earnings this week.

Retailers continue to be a main feature on the list of heavily shorted firms this earnings season and this week is no exception. The high conviction short play this week is bulk closeout firm Big Lots which has over 23% of its shares out on loan. This high short interest singles out the firm from the pack of discount and bulk retailers such as Costco and Tjx which have so far avoided scrutiny from short sellers. In fact that both Big Lots competitors now see have less than 1% their shares out on loan to short sellers.

Fashion retailers, who enriched shorts last week after disappointing results from heavily shorted American Eagle and Urban Outfitters, continue to feature prominently on this week's list of short targets. The high conviction fashion retail shorts this week are former industry heavyweight Abercrombie & Fitch and Guess which have 14 and 10.6% of their shares outstanding shorted respectively.

The most shorted non-retail firm announcing earnings next week is biotech firm Immunogen which has 17% of its shares shorted. This high short interest is skewed higher by the fact that the company has recently raised a large amount of capital through convertible bonds.

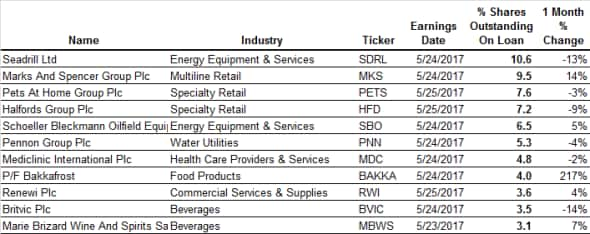

Europe

Offshore drilling rig operator Seadrill is the highest conviction short announcing earnings in Europe in the coming week as it has 10.6% of its shares on loan to short sellers. Persistent high short interest reflects the ongoing headwinds for offshore oil leasers, which have suffered from an industrywide cutback on exploration budgets as oil firms scale back new capital investments following the collapse in the price of oil. Seadrill's high short interest also reflects the firm's high debt load which has compounded its problems.

UK retailers are the other high conviction play this week as short sellers continue to single out the sector as a way to play a slowdown in consumer spending across the country following the brexit referendum. The anticipated slowdown has been some time coming however and last week's better than anticipated retail numbers indicate that short sellers may have to wait even longer coming. This has yet to dissuade shorts however as the demand to borrow shares of high street stalwart Marks and Spencer has remained steadfast near multi year highs.

The other UK retailers seeing high shorting activity heading into earnings this week are Halfords Group and Pets at Home which both have over 7% of theirs shares out on loan respectively.

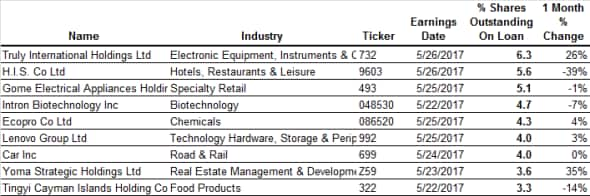

Asia

Asian short sellers are most focused on LCD display manufacturer Truly International heading into earnings this week as it is the only firm to see more than 6% of its shares out on loan heading into earnings. LCD manufacturers have made successful short targets for much of the last few years as the industry grappled with oversupply issues which have severely hampered pricing power. Short sellers aren't pricing in any recovery in supply/demand dynamics as Truly's short interest has tripled in the last nine months.

Firms further down the electronic supply chain are also attracting their fair share of short interest as computer maker Lenovo and electronics retailer Gome Electrical both find themselves on the list of heavily shorted Asian firms heading into earnings.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}