Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 22, 2016

Eurozone flash PMI dips lower at start of second quarter

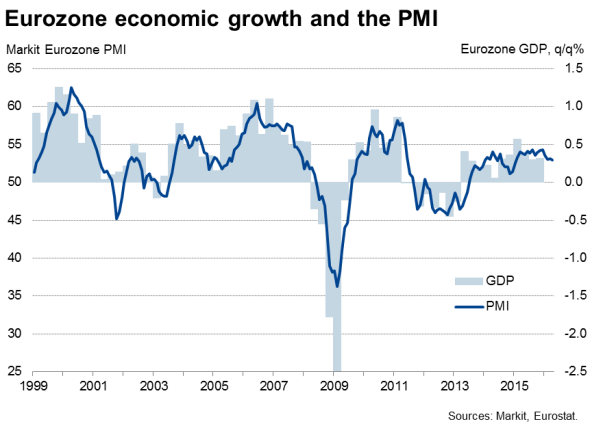

The eurozone economy remains stuck in a slow-growth rut in April, with the PMI once again signalling GDP growth of just 0.3% at the start of the second quarter, broadly in line with the meagre pace of expansion seen now for a full year.

The survey data point to an ongoing lack of 'animal spirits' and weak demand despite recent stimulus measures.

Markit's 'flash' Eurozone PMI dipped from 53.1 in March to 53.0 in April, indicating that the pace of economic growth at the start of the second quarter is marginally weaker than the average seen in the first quarter, and slightly slower than the average seen last year. Markets were expecting a reading of 53.2, according to a Thomson Reuters poll.

Only moderate growth was again seen in both manufacturing and services, in both cases just below average first quarter rates of increase.

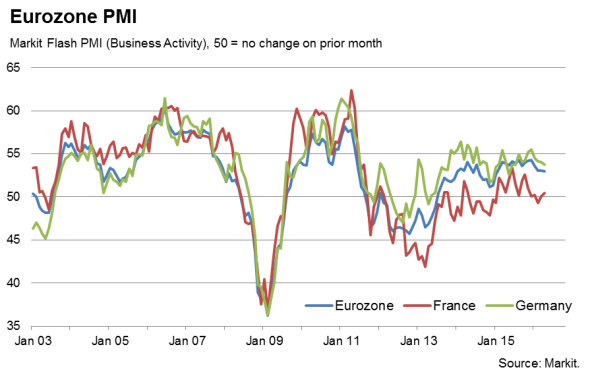

France continues to act as a major drag on the region, with goods exports slumping to the greatest extent for over three years. Germany and the rest of the region are enjoying more robust expansions by comparison, though growth rates slowed in April to suggest that even these pockets of growth might be fading.

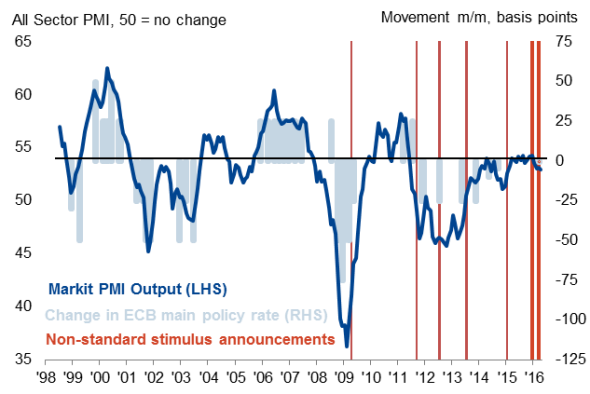

A failure of business expectations to revive following the ECB's announcement of more aggressive stimulus in March is a major disappointment and suggests that companies see few signs of the modest pace of growth accelerating in coming months.

Those looking for more positive signs will see that employment growth lifted higher and price gauges ticked upwards, but all are merely improving from low bases. Furthermore, with backlogs of work barely rising, continuing the near-stagnant trend seen over the past three months, current capacity levels and employment growth appear to be adequate to meet demand, suggesting firms are unlikely to expand capacity without a substantial improvement in demand.

ECB action

Even more aggressive policy action may therefore be required to drive a more robust and sustainable recovery and reignite inflationary pressures.

The ECB made no change to policy at its April meeting, as expected, but president Mario Draghi re-iterated the need for time before the impact of prior measures, such as negative interest rates and the upcoming corporate bond purchases, now scheduled to start in June, to take effect. The central bank also noted that credit and financing conditions appear to have improved so far this year, thanks to the policy initiatives. However, in contrast to the March press conference, April's meeting saw Draghi keeping the door open for more stimulus if necessary.

PMI and ECB policy

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Economics-Eurozone-flash-PMI-dips-lower-at-start-of-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Economics-Eurozone-flash-PMI-dips-lower-at-start-of-second-quarter.html&text=Eurozone+flash+PMI+dips+lower+at+start+of+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Economics-Eurozone-flash-PMI-dips-lower-at-start-of-second-quarter.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI dips lower at start of second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Economics-Eurozone-flash-PMI-dips-lower-at-start-of-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+dips+lower+at+start+of+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Economics-Eurozone-flash-PMI-dips-lower-at-start-of-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}