Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 22, 2016

ECB attempts to suppress European credit risk

The ECB's aggressive stimulus measures announced earlier this month have already seen risk in both corporate and financial bonds subside.

- Markit iBoxx " Non-Financials Senior index is 18bps tighter since ECB corporate bond buying announcement

- This is still 68bps wider than covered bonds, which the ECB have been purchasing since 2014

- Deutsche Banks's 6% coco bond saw its price rise to 85.6, from 81.4, the day ECB announced another round of cheap bank financing

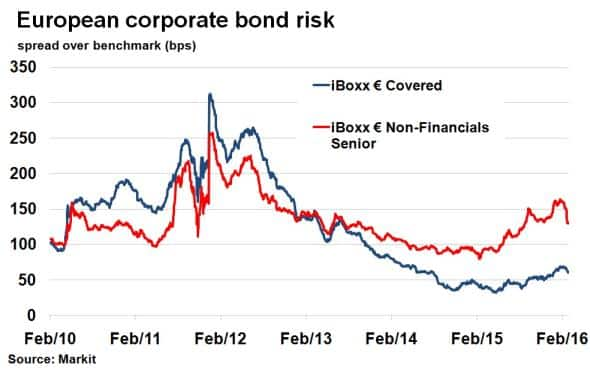

The European Central Bank's (ECB) decision to extend its current QE programme to non-bank corporate bonds has seen risk in the sector decline. But it still remains considerably higher than perceived risk around covered bonds - debt backed by public sector loans and residential mortgages - which have been acquired by the ECB since 2010.

The ECB entered its third covered bond programme (CBPP3) in October 2014, boosting demand in and compressing bond spreads further in the process. Likewise, the ECB's Corporate Sector Purchase Program (CSPP) has already seen bond spreads decline as investors anticipate a squeeze in demand and a boost in prices, but corporate bond spreads remain 68bps wider than covered bonds, according to Markit's iBoxx indices.

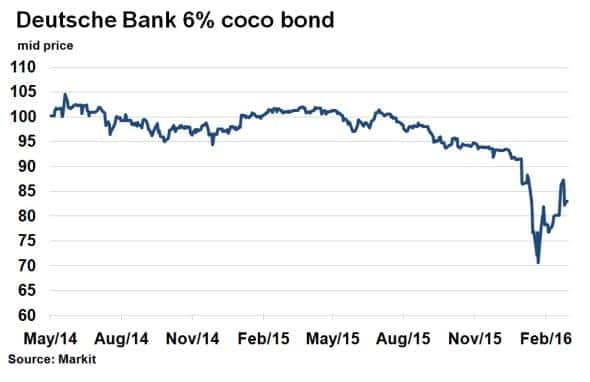

The ECB also introduced another round of targeted long term refinancing operations (TLTRO II) as part of this months announcement. This offers cheap credit to banks in order to stimulate lending, but also to address fears around Europe's banking system (potentially through debt buybacks) which sparked in February this year.

Corporates join covered bonds

Covered bond purchases started in 2010 as a method to revive the European economy, but with growth remaining languid, the ECB went a step further this month by adding corporate bonds to its shopping list.

Risk in the covered bond market has fallen substantially since the European sovereign debt crisis in 2011, owing partly to the implicit backing from the ECB through its asset purchases. The iBoxx " Covered index has seen its spread over benchmark, a measure of risk, tighten to 61bps from over 300bps in 2012.

The ECB's announcement of CSPP on March 11th has already had a similar effect on non-bank corporate bonds, with the spread on the iBoxx " Non-Financials Senior index 18bps moving tighter since. Spreads do however remain 49bps wider than post financial crisis tights of March 2015, and 68bps wider than covered bonds.

While covered bonds do indeed represent a higher quality asset (50% of the Markit " Non-Financials Senior index is BBB rated as opposed to just 5% for the iBoxx " Covered index), it was only back in April 2013 that the basis between these two indices was zero, illustrating their diverging paths since.

Easy credit

European banks came under sustained pressure in February with the Markit iTraxx Europe Senior Financials index seeing its 5-yr CDS spread nearly double in a matter of weeks. Fears have since subsided further by the ECB's latest stimulus package which included favourable financing for banks in the region through TLTROs.

One of the banks which came under scrutiny was Deutsche Bank, which saw the value of 6% coupon contingent convertible bond fall 20% from January 20th to February 11th. The ECB's announcement on March 11th saw the bond price leap from 81.4 (cash basis to par) to 85.6, according to Markit's bond pricing service.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Credit-ECB-attempts-to-suppress-European-credit-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Credit-ECB-attempts-to-suppress-European-credit-risk.html&text=ECB+attempts+to+suppress+European+credit+risk","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Credit-ECB-attempts-to-suppress-European-credit-risk.html","enabled":true},{"name":"email","url":"?subject=ECB attempts to suppress European credit risk&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Credit-ECB-attempts-to-suppress-European-credit-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+attempts+to+suppress+European+credit+risk http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Credit-ECB-attempts-to-suppress-European-credit-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}