Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 21, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Surge in demand to borrow Sunedison as late 10-K filing accelerates short interest

- 30% of KB Home shares shorted as surge in shares and short positions seen in 2016

- China Coal most shorted in Apac as industry struggles with overcapacity

North America

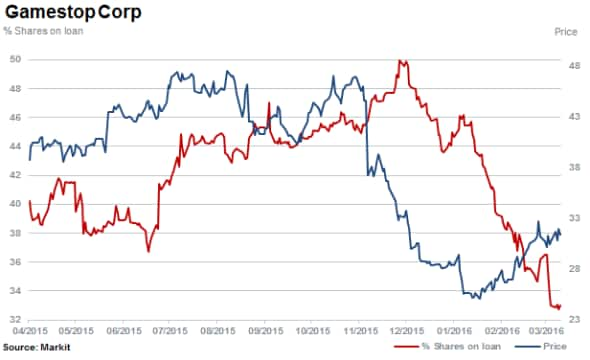

Most shorted ahead of earnings this week in North America is Gamestop with a third of shares sold short, despite short sellers substantially covering positions since 2015.

Short sellers who held their ground in Gamestop over the last 12 months or so had begun to take their profits, slowly covering 25% of positions, but this has accelerated in 2016 as the stock rallied.

Still among the most shorted stocks in North America ahead of earnings, short interest in KB Home has surged 120% so far in 2016 with almost 30% of the company's shares currently shorted.

Third most shorted is renewables firm Sunedison which delayed the release of its 10-k filing, citing material weaknesses in its internal controls. Demand to short the stock has subsequently increased, with a quarter of the firms shares currently sold short and the cost to borrow doubling to over 10% in the last month.

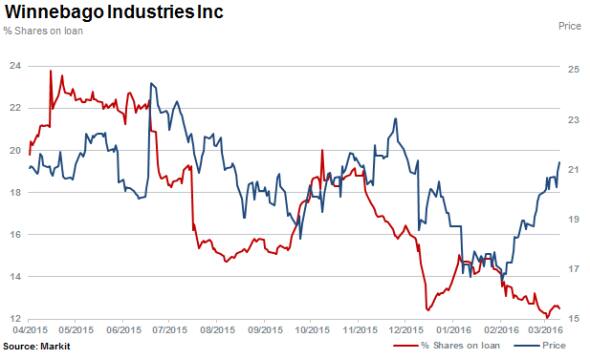

Short sellers have continued to cover positions in Winnebago Industries (WGO) with shares rising almost 30% in the last two months. WGO recently resumed generating positive free cash flows with improved growth in sales and profit margins.

Markit Dividend Forecasting expects WGO to declare a flat quarterly dividend of $0.11 per share, maintaining the current payout level at ~24% versus comparable peers at 28%. We expect dividends to grow in line with earnings.

Europe

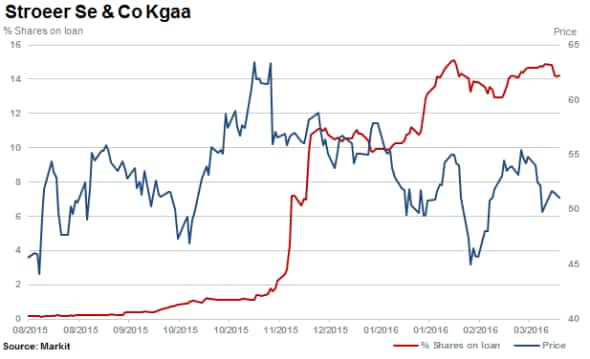

Most shorted ahead of earnings in Europe is the Stroeer Group with 14% of shares outstanding on loan. The advertising and communications company saw negligible levels of short interest prior to November 2015, but has seen short sellers gravitate in the opening months of this year.

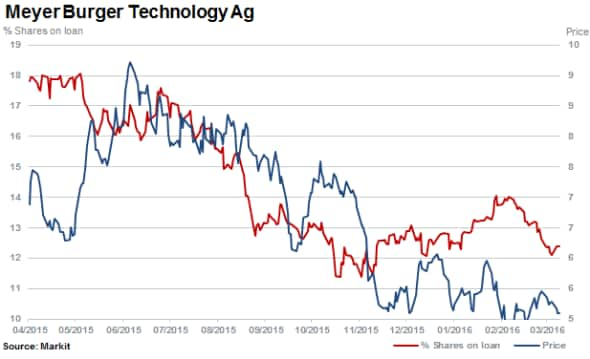

Despite short sellers covering a third of positions in photovoltaic equipment manufacturer Meyer Burger Technology over the last 12 months, it is still the second most shorted stock in Europe ahead of earnings.

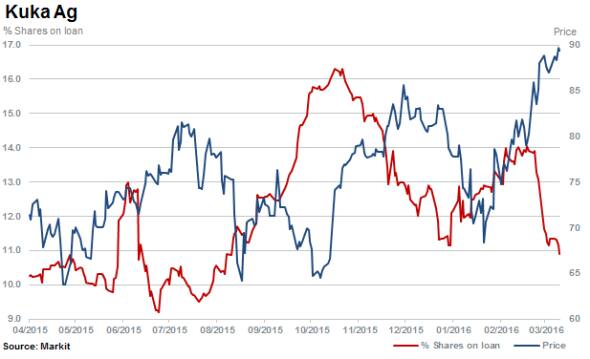

Third most shorted with 11% of shares outstanding on loan is industrial robotics firm Kuka whose recent rally in the last few weeks has seen short sellers cut positions by 20%.

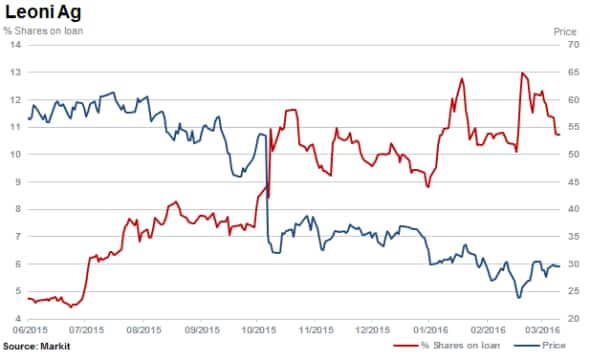

Wire and cabling system supplier Leoni has just over 10% of its shares sold short and its stock has declined some 50% over the past 12 months with short interest increasing two fold.

Markit Dividend Forecasting currently expects Leoni to cut its dividend by almost 40%. The firm issued a Q3 profit warning due to surprisingly heavy charges in its wiring systems division with Q3 EBIT significantly weaker than anticipated.

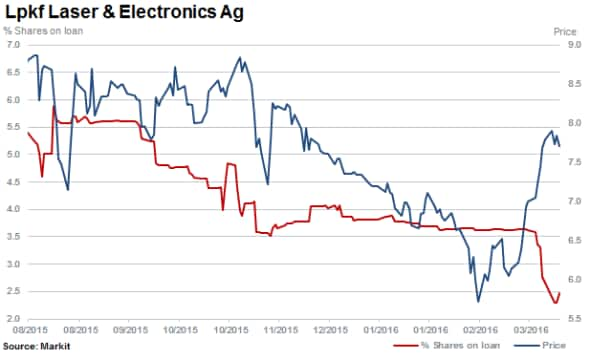

With a relatively low amount of outstanding on loan of 2.5% currently, a possible short squeeze appears to have occurred in German laser and 3D manufacturing firm LPKF. Shares have spiked 21% in the past two weeks with short interest declining by a third. Markit Dividend forecasting expects LPKF to suspend its dividend after cutting it by 50% last year, and consensus earnings show further deterioration is expected.

Apac

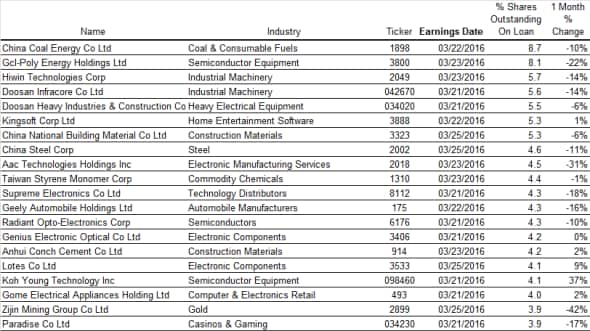

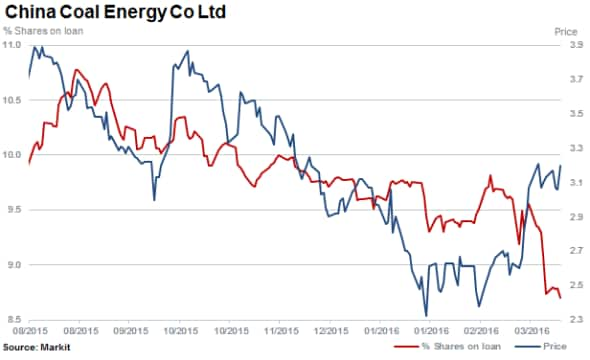

Most shorted ahead of earnings in Apac is China Coal Energy with 8.7% of shares outstanding on loan. China is battling with overcapacity in the industry and labour unrest due to the collapse in prices in oil and coal with companies adopting "wartime work atmospheres" - in order to cut the bloated workforce. Accordingly Markit Dividend Forecasting is expecting a suspension in the firm's dividend.

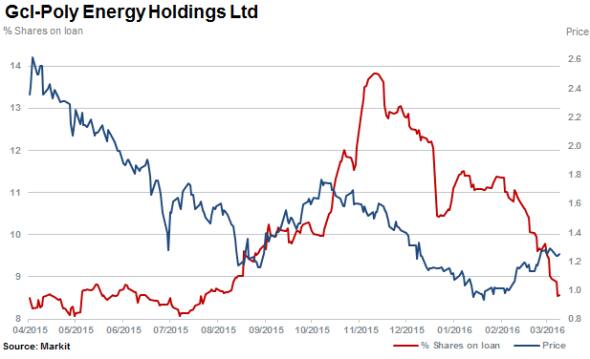

Gcl-Poly Energy Holdings is the second most shorted ahead of earnings in Apac with 8.1% of shares sold short. Shares in the photovoltaic materials supplier have declined by 41% in the last 12 months with short sellers covering 40% of positions in the last four months.

Short interest has increased almost two fold to 5.3% in China National Building Material. Full year earnings are projected to decrease by over 70%, attributed to a substantial slowdown in cement demand growth and severe overcapacity in the industry. Markit Dividend Forecasting is expecting the dividend to be cut by three quarters.

Markit Dividend forecasting also expects a substantial 60% cut to China Steel Corp's dividend with the company hurt by decreasing average selling prices, weak steel demand and regional oversupply. However shorts have recently covered, with shares rising by 24% in the past three months. 4.6% of shares are currently outstanding on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}